Key To Markets Review 2024

|

|

Key To Markets is #96 in our rankings of CFD brokers. |

| Key To Markets Facts & Figures |

|---|

Key To Markets is an ECN brokerage firm that was set up in London in 2010 for retail, professional and institutional investors to access a reliable and consistently-priced trading environment. The broker is regulated by the UK's FCA and the FSC in Mauritius. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Forex, CFDs, indices, shares, commodities, cryptocurrencies |

| Demo Account | Yes |

| Min. Deposit | $100 |

| Mobile Apps | Yes |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FCA, FSA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | Yes |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Islamic Account | No |

| Commodities |

|

| CFDs | The broker's selection of 180 CFD products is pretty small compared to competitors and I found it quite limiting that these only span forex, indices, commodities and stocks. |

| Leverage | 1:30 |

| FTSE Spread | 2 |

| GBPUSD Spread | 0.7 |

| Oil Spread | 0.46 |

| Stocks Spread | Variable |

| Forex | My evaluations uncovered a decent range of 65 forex instruments, comprising major, minor and exotic currency pairs, available with leverage rates of up to 1:30 and ECN execution. |

| GBPUSD Spread | 0.7 |

| EURUSD Spread | 0.4 |

| GBPEUR Spread | 0.7 |

| Assets | 65 |

| Stocks | I found more than 60 company stocks and shares CFDs from exchanges and markets within the US and across Europe, including Apple and Lufthansa. This is a disappointing selection compared to most brands I have reviewed. |

Key To Markets (KTM) is an online broker offering competitive ECN spreads. With a top-tier license from the FCA, Key To Markets accommodates UK clients looking to trade leveraged CFDs on forex, commodities, indices and shares. This review will detail the Key To Markets account types, typical fees, trading platforms, plus the firm’s safety rating.

Our Verdict

Key To Markets is worth considering if you are looking for reliable trading software and raw spreads.

However, compared to other UK brokers, the asset selection is not the most competitive and beginners may find the social trading features and educational resources lacking. We also found the absence of a GBP trading account a notable drawback for UK traders.

Market Access

Key To Markets offers over 180 assets across 4 classes. And whilst the range of forex, indices and commodities is ample, the broker falls short on the selection of shares with only 60+ available. As a result, traders looking for more comprehensive stock trading trading may prefer CMC Markets or IG Index.

Supported instruments include:

- Forex: 65 forex pairs, including exotics, available on the broker’s ECN platforms

- Indices: Speculate on 15 popular global indices such as the FTSE 100 and S&P 500

- Commodities: 12 CFDs on the most traded commodities such as gold, silver and natural gas

- Stocks: Trade over 60 shares from companies listed on US and European exchanges, including Apple and Lufthansa

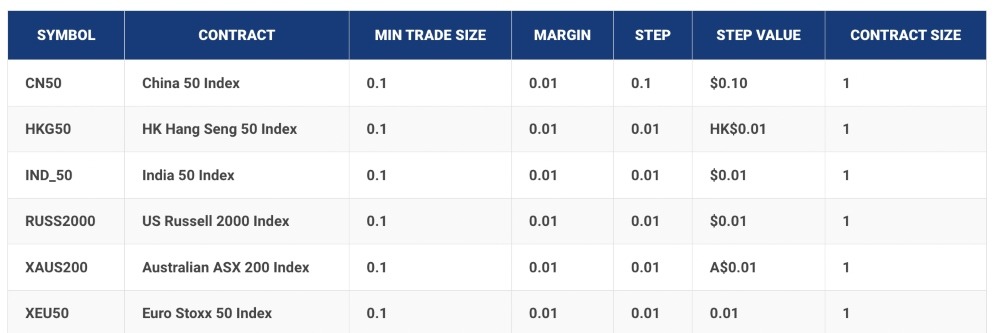

Popular Indices

Account Types

We were pleased to see that Key To Markets offers a choice of 2 true ECN accounts, through the MetaTrader 4 (MT4) or MetaTrader 5 (MT5) platform.

You get access to the same trading tools and features, including hedging and scalping capabilities. The only difference between the two is the fee structure. Our experts liked that prospective clients have control over which pricing model best suits their strategy.

With that said, we were disappointed to see that for UK clients, there is no option to use GBP as a base currency; only USD and EUR are permitted.

We have pulled out the key differences between the accounts:

Standard Account

- Spreads: ECN raw market spread + 1 pip

- Minimum deposit: $100

- Platforms: MT4 or MT5

- Minimum lot size: 0.01

- Commissions: Zero

Pro Account

- Spreads: ECN raw market spreads from 0.0 pips

- Commissions: USD 8/EUR 6 per lot round turn

- Minimum deposit: $100

- Platforms: MT4 or MT5

- Minimum lot size: 0.01

How To Open An Account

We found the registration process at Key To Markets fairly straightforward, allowing us to activate a profile and start trading within a couple of days.

- Fill out your key information in the application form

- Complete the trading questionnaire

- Send ID and proof of address documentation

- Wait for the documentation to be reviewed by the customer support team

- Once accepted, you can begin using your live trading account

Key To Markets Fees

In the Standard account, charges come in the form of 1 pip added to the raw market spread, which is taken directly from the ECN liquidity providers.

Whilst there is no percentage commission charged per lot, it does mean you see a wider spread. For instance, while using Key To Markets, we were offered a raw spread of 0.8 pips on the GBP/USD pair, making the total trading cost 1.8 pips with the Standard account. These aren’t the lowest spreads in the market but do compete well with the likes of XTB, for example.

In the Pro account, you get raw market spreads with commissions paid separately, at USD 8 or EUR 6 per lot round turn. I like that the broker scales this commission in line with trading volumes, so if I open and close a trade of 0.1 lots, my commission is only $0.8/€0.6.

Alongside the trading fees, other charges to take note of include overnight swaps and funding charges. Unfortunately, Key To Markets isn’t forthcoming about account inactivity fees.

Payment Methods

Deposits

We liked that Key To Markets offers numerous funding methods, with instant processing for e-wallets. However, it is unfortunate that GBP is not permitted, so UK clients may need to pay a currency conversion charge unless they make a deposit using USD or EUR.

The minimum initial deposit is USD 100/EUR 100, which is reasonable but not as low as some other brands, including CMC Markets which has no deposit requirement.

I was also disappointed to see that there are charges of 2.5% for deposits via bank cards and e-wallets. Compared to brokers such as IC Markets and Plus500, which offer free deposits, this is a major drawback.

Deposit fees are detailed below along with typical processing times.

- Debit/Credit Card – Instant processing, 2.5% fee for non-EU clients

- SEPA Transfer – Processed in 1 – 2 days, no fees

- Bank Wire – Processed in 2 – 4 days, no fees

- Neteller – Instant processing, 2.5% fee

- SticPay – Instant processing, 2.5% fee

- Skrill – Instant processing, 2.5% fee

How To Make A Deposit

Depositing funds into my account at Key To Markets was relatively straightforward:

- Log into your account

- Under the ‘Funds’ tab, click on ‘Deposit Funds’

- Select the account to deposit funds to and the desired method

- Input the transfer details such as the amount and the account information for transferring funds

- Confirm the deposit request and wait for the money to be transferred

Withdrawals

While there are fewer withdrawal methods available, we were happy to see that clients still have a few options, with fast processing times of 1 business day in most cases.

However, it was disappointing to see a 1% withdrawal fee via Skrill, Neteller and Sticpay.

Available payment methods along with respective fees and processing times are:

- Bank Wire – Processed in 1 business day, no fees

- Neteller – Processed in 1 business day, 1% fee

- SticPay – Processed in 1 business day, 1% fee

- Skrill – Processed in 1 business day, 1% fee

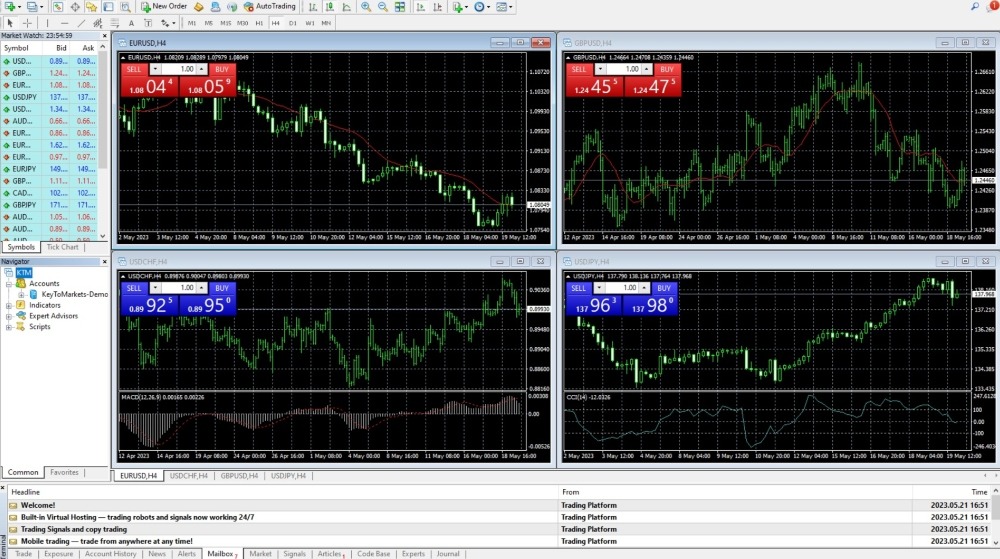

Trading Platforms

Our experts were impressed to see that both MetaTrader 4 and MetaTrader 5 are on offer at Key To Markets. These world-leading platforms support advanced technical analysis and automated trading capabilities through a range of high-quality tools and resources.

MetaTrader 4

MT4 is a multi-asset forex and CFD platform and a firm favourite among beginners and experienced traders. The platform’s interface can take a little while to get used to, but overall, I had no issues customising the charts and layouts.

I like that all trading strategies are supported, including scalping. Hedging orders are also allowed, so I can easily execute both long and short positions on MT4’s intuitive charts. For those who want to share strategies, the social PAMM system is a good addition.

You can download the platform to your Windows or Mac desktop for free and directly from the broker’s website.

My favourite features include:

- 30 pre-included technical indicators and 31 drawing tools

- EA backtesting through the MQL4 programming language

- 9 in-built time frames with the option to add more

- 4 pending order types alongside market execution

- One-click trading

MetaTrader 5

For those looking for a wider set of technical tools, the MT5 platform’s charting capabilities are even more impressive. We would recommend MT5 for more experienced traders, although beginners may also find some value in the additional features:

- 38 technical indicators and 44 graphical objects used for chart customisation

- Faster EA backtesting with the MQL5 programming language

- 2 extra pending order types compared to MT4

- 21 in-built timeframes

- An economic calendar

- Depth of Market

How To Place A Trade

Opening a trade is quick and easy on the MetaTrader platforms:

- Sign in to the MT4 or MT5 platform

- Click on the ‘New Order’ button on the menu bar

- Choose the asset you want to trade from the drop-down list

- Select either ‘Market Execution’ or ‘Pending Order’

- Specify the trade volume and strike prices for the stop loss and take profit orders if you are using them

- To open a market execution trade, you simply click ‘Buy’ for a long position or ‘Sell’ for a short position

- To open a pending order, select the type from a buy or sell limit or a buy or sell stop, input the strike price and, if necessary, an expiration time

- Click confirm to process the order

Mobile App

You can also trade on the go using the MT4 and MT5 mobile apps. You can find download links for the apps on Google Play and App Store via the Key To Markets website.

I found that the main benefit of the mobile app is that you can access your trading accounts simultaneously through multiple devices, offering a seamless trading experience wherever you are. You can also set convenient push notifications on your phone, so you never miss an opportunity.

We also like that all order types and execution modes are supported, plus you get access to real-time data, so you don’t have to compromise on quality when using the mobile apps.

Leverage

As Key To Markets holds a license with the Financial Conduct Authority (FCA), leverage limits are in line with UK regulations. Maximum levels are:

- 1:30: Major forex pairs

- 1:20: Non-major forex pairs, major indices and gold

- 1:10: Non-major indices, silver and energy and soft commodities

- 1:5: Share CFDs

Note that Key To Markets imposes a margin call at 120% and a stop-out level below 100%.

Demo Account

Key To Markets offers clients a free 30-day demo account. We thought it was a shame that the demo is not unlimited, as they often are with the top brokers.

With that said, we did like that you can practise in either the MT4 or MT5 platforms with flexible trading conditions. For example, we were able to choose the maximum leverage and adjust the initial balance between $100 to $100,000.

How To Open A Demo Account

- Click on the ‘Open a Demo Account’ button on the website

- Provide personal details such as your name, date of birth and contact information

- Complete the questionnaire on trading experience and source of funds

- On the secure client area, open the ‘Accounts’ drop-down list and click ‘Open Demo Account’

- Select the account type, leverage, base currency and initial balance

- You will be emailed your demo account login details

- Download the trading platform and sign in to begin practising

Regulation & Security

Key To Markets (UK) Limited is authorised by the Financial Conduct Authority with license number 527809.

As such, the broker must implement strict security measures to keep customers safe. For example, we were happy to see that client funds are segregated from those of the firm, so they can never be used for business operations.

In addition, clients are entitled to claim for up to £85,000 via the Financial Services Compensation Scheme, in the event of business insolvency.

Alongside the FCA, Key To Markets is also authorised by the Financial Services Commission of Mauritius. The broker is registered under the name Key To Markets International Ltd with license number GB19024503. On the downside, the FSC is not a top-tier regulator and therefore does not offer the same financial safeguarding measures as the FCA.

For added account security, we recommend that traders enable two-factor authentication which uses the Google Authenticator app.

Extra Tools

When we used Key To Markets, we were satisfied with the range of tools available. However, it is worth noting that the offering is not as comprehensive as some competitors, including AvaTrade and XM.

Among the most useful features are:

Expert Advisors

Key To Markets supports the use of expert advisors (EAs) to help execute trading strategies. These popular algorithmic robots are programmed to find suitable investment opportunities and then place trades according to a set of instructions.

EAs are essentially a useful way to access various markets simultaneously as they automate many stages of the trading process, including research and analysis.

Virtual Private Server

Key To Markets provides a virtual private server (VPS) via New York City Servers. A VPS can help clients reduce latency and therefore trade execution times, particularly when implementing an algo trading bot.

It was particularly nice to see that Key To Markets offers this server for free to clients that meet volume requirements.

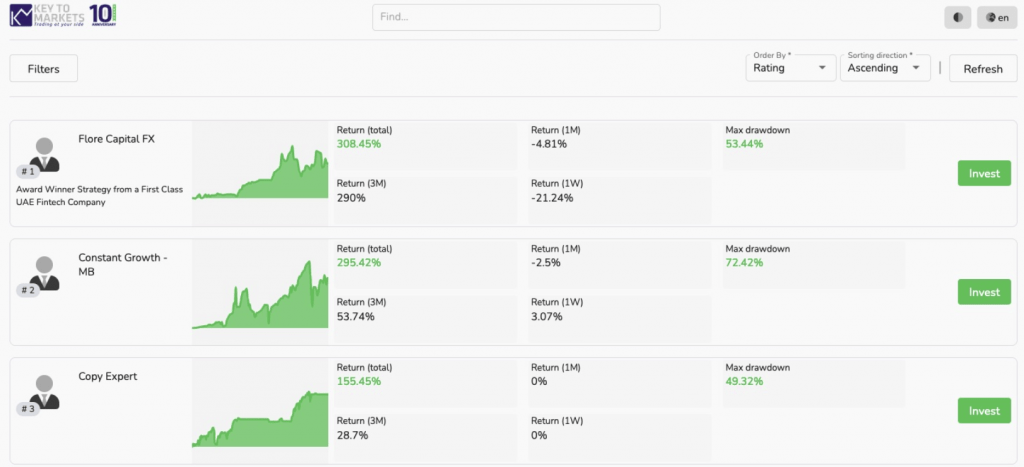

Social Trading

We were also impressed that social trading is supported via PAMM and copy trading services. Traders can choose to follow and replicate the trades of another experienced user on the broker’s leaderboard.

We also rated that each profile indicates the user’s returns over time, plus average gains per week and month.

Copy Trading Leaderboard

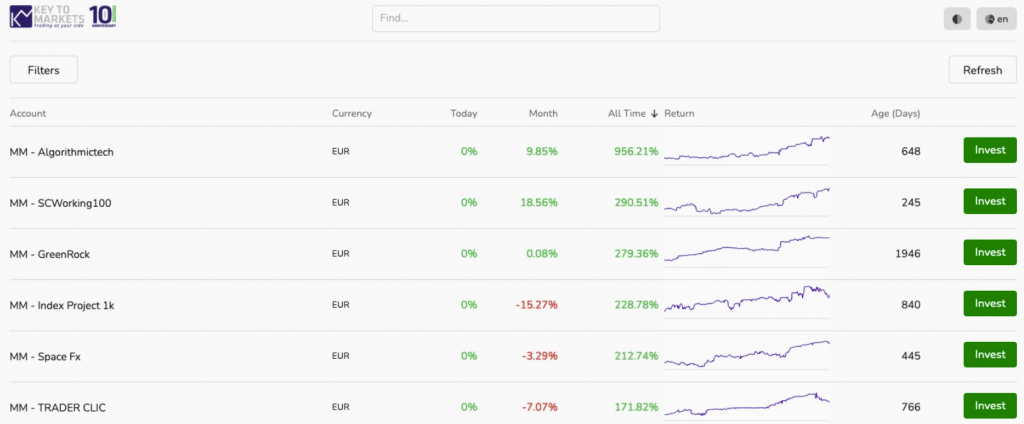

For the percentage allocation management module (PAMM) solution, Key To Markets supports both the client and fund managers. Clients can review the available money managers by seeing their profit and loss over different periods. The profiles also show the maximum profit from a single trade and the manager’s trading behaviour.

PAMM Top Money Managers

Overall, our team liked the social trading capabilities, making the broker a potentially good choice for new traders. With that said, we are not confident that beginners will prefer these features over market leaders such as eToro.

Education & Analysis

As for the broker’s education section, our team wasn’t thrilled with the standard of trading resources, although there is a modest selection.

The education page has a library of several guides with key information for novices and intermediate traders. It is easy to find resources covering topics such as what scalping is, how to start trading and the differences between manual and automated trading.

The analysis page offers a breakdown of recent news and announcements from in-house experts. We liked that there are weekly reviews whereby you can see discussions on recent and upcoming key events. Also, these reports come with asset picks derived from technical analysis of recent price action, which we thought was useful.

Overall, the offering is good but certainly doesn’t match up to the likes of IG Index or XM, where you will find vast libraries of trading topics, podcasts, webinars and courses suitable for all experience levels.

Bonuses & Promotions

As per FCA restrictions, promotional schemes that entice clients to sign up are not permitted, so welcome bonuses or ‘no deposit bonus’ deals are not available. This is standard practice at FCA-regulated brokers so we don’t consider this a major drawback.

Customer Support

The Key To Markets customer support desk is open between 9:00 am and 6:00 pm GMT during weekdays only. I was disappointed to see that customer support is not available 24 hours a day and there is no live chat option. This is a notable drawback for me given that the best brokers offer 24/5 customer support with excellent response times via live chat.

To contact the support team, the following methods are available:

- Email: info@keytomarkets.com

- Telephone: +44 20 3384 6738

- Contact form on the website

Company Overview

Key To Markets was launched in 2010, supporting both individual and institutional investors. The brokerage operates via an electronic communication network (ECN) to find counterparties to trades, providing an arguably more transparent execution model.

The broker is based in the UK with its headquarters in London. There are additional Key To Markets offices in Port Louis in Mauritius and Mexico City in Mexico.

Since its inception, Key To Markets has won several awards as a demonstration of its quality and reliability. For instance, it won the Best Global Forex ECN Broker at the Global Forex Awards in 2022, and the Best Forex Trade Execution award at the 2021 Global Forex Awards.

Trading Hours

Trading hours at Key To Markets depend on the asset and relevant global market exchange.

For example, opening hours for precious metals are between 1:00 am and 11:59 pm (GMT+2), Monday to Friday. CFDs on shares from US exchanges can be traded between 4:30 pm and 11:00 pm (GMT+2), Monday to Friday.

Full details on the Key To Markets trading hours can be found in the contract specifications on the broker’s website.

Should You Trade With Key To Markets?

Key To Markets is a decent option for traders looking for ECN pricing and access to the powerful MetaTrader platforms. We liked that the broker aims to accommodate both beginners and advanced traders alike through the Standard and Pro accounts.

However, Key To Markets falls short on additional trading tools, educational resources and social trading capabilities compared to the best UK brokers. The lack of a GBP-based account and deposit fees are also notable drawbacks.

FAQ

Is Key To Markets Trustworthy?

Key To Markets holds licenses with two regulatory bodies. The UK subsidiary, Key To Markets Limited, is regulated by the Financial Conduct Authority. As such we are confident that clients signing up with this branch will receive the highest standards of financial protection.

Is Key To Markets A Good Broker?

Key To Markets is a decent broker that offers reliable trading platforms and raw market spreads. We liked that beginners can also access social trading features and educational tools, although these are not as comprehensive as other brokers. UK traders may also be deterred by the lack of a GBP trading account.

How Can I Fund My Key To Markets Account?

Key To Markets supports numerous reputable deposit methods including bank transfers, Neteller, Skrill, Sticpay and credit/debit cards. We recommend depositing via e-wallets where possible, as these are processed immediately.

However, the broker does charge a 2.5% fee on several payment methods, which our team found disappointing.

Does Key To Markets Offer Low Fees?

For standard accounts, a fixed 1-pip is added to the raw market spread of the asset. We were offered a raw spread of 0.8 pips for the GBP/USD pair, contributing to a total fee of 1.8 pips with the Standard account. This is reasonable but not the lowest around.

With the Pro account, fees are charged as a commission at a rate of $8/€6 per lot round turn, alongside tighter spreads. These fees are better but still don’t compete with the cheapest brokers.

Does Key To Markets Offer A Good Range Of Instruments?

Through the MetaTrader 4 and MetaTrader 5 platforms, you can trade on 65 currency pairs, 12 commodities such as Brent and WTI crude oil and 15 indices such as the FTSE 100. Additionally, Key To Markets supports trading CFDs on shares from over 60 US, German, French and Spanish companies.

On the downside, the list of instruments does not match the thousands of assets available at the best UK brokers, such as CMC Markets.

Article Sources

Key To Markets FSC of Mauritius License

Compare Key To Markets with Other Brokers

These brokers are the most similar to Key To Markets:

- Admiral Markets - Admirals is an FCA- and ASIC-regulated broker with an excellent range of leveraged instruments, including forex, stocks, indices, ETFs, commodities, cryptos and more. The broker supports the MetaTrader 4, MetaTrader 5 and TradingCentral platforms. With both spread betting and CFDs available and thousands of instruments, this broker provides more flexibility than most rivals.

- Swissquote - Swissquote is a Switzerland-based bank and broker that offers online trading and investing. The company has a high safety score and is listed on the Swiss stock exchange. The firm offers a huge range of products, from stocks, ETFs, bonds and futures to 400+ forex and CFD assets. Hundreds of thousands of traders have opened an account with the multi-regulated brokerage. Clients can get started in three easy steps while 24/7 customer support is available to assist new users.

- FP Markets - FP Markets is an ASIC- and CySEC-regulated broker that offers forex and CFD trading on a broad range of assets through the MT4, MT5 and IRESS platforms. With trading available through standard and raw spread accounts on thousands of international stocks, forex, indices, commodities, cryptocurrencies, bonds and ETFs, this broker has some of the most comprehensive market coverage available. FP Markets also offers a full range of additional features, including educational resources and access to powerful software such as Autochartist.

Key To Markets Feature Comparison

| Key To Markets | Admiral Markets | Swissquote | FP Markets | |

|---|---|---|---|---|

| Rating | 2.8 | 3.5 | 4 | 4 |

| Markets | Forex, Stocks, Commodities | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities | Forex, Stocks, Commodities, Crypto |

| Minimum Deposit | $100 | $100 | $1000 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, FSA | FCA, CySEC, ASIC, JSC | FCA, FINMA, DFSA, SFC | ASIC, CySEC, ESMA |

| Bonus | - | - | - | - |

| Education | No | Yes | No | Yes |

| Platforms | MT4 | MT4, MT5 | MT4, MT5 | MT4, MT5, cTrader |

| Leverage | 1:30 | 1:30 (EU), 1:500 (Global) | 1:30 | 1:30 (UK), 1:500 (Global) |

| Visit | ||||

| Review | Key To Markets Review |

Admiral Markets Review |

Swissquote Review |

FP Markets Review |

Trading Instruments Comparison

| Key To Markets | Admiral Markets | Swissquote | FP Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | Yes | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | No | Yes |

| Futures | No | No | Yes | Yes |

| Options | No | No | Yes | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | Yes |

Key To Markets vs Other Brokers

Compare Key To Markets with any other broker by selecting the other broker below.

Popular Key To Markets comparisons: