Intertrader Review 2024

|

|

Intertrader is #97 in our rankings of CFD brokers. |

| Intertrader Facts & Figures |

|---|

Choose from a multitude of trading platforms and instruments at Intertrader. |

| Awards |

|

|---|---|

| Instruments | Forex, CFDs, indices, shares, commodities, futures |

| Demo Account | Yes |

| Min. Deposit | $500 |

| Mobile Apps | Yes |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | Gibraltar Financial Services Commission & Limited Regulation under the FCA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | Yes |

| Copy Trading | No |

| Auto Trading | Yes |

| Signals Service | Yes |

| Islamic Account | No |

| Commodities |

|

| CFDs | Intertrader offers leveraged CFDs in multiple financial markets. |

| Leverage | 1:30 (Retail), 1:200 (Pro) |

| FTSE Spread | N/A |

| GBPUSD Spread | 1.2 |

| Oil Spread | 3 |

| Stocks Spread | Variable |

| Forex | Buy and sell major, minor and exotic currency pairs at Intertrader. |

| GBPUSD Spread | 1.2 |

| EURUSD Spread | 0.6 |

| GBPEUR Spread | 0.9 |

| Assets | 45 |

| Stocks | Trader on 250 UK stocks, plus US & global shares. |

| Spreadbetting | Spread betting is offered to UK traders only. |

Intertrader is an online broker with over ten years of experience in the global financial markets that offers forex, CFD and spread betting services. This 2024 review covers the most crucial elements of the company to help you decide if this brokerage can meet your needs. Learn about the supported trading platforms, commissions and fees, minimum deposit amounts and demo account availability. Read on to discover whether Intertrader is right for you.

About Intertrader

Founded in 2009, Intertrader has won numerous awards for its spread betting and CFD brokerage services during its tenure. Owned by FTSE 100 listed Entain, formerly known as GVC holdings, the broker is based on the island of Gibraltar. However, the firm operates several global offices, including one London office address.

The company caters to retail traders and high-volume pro clients through its prime brokerage, Intertrader Black, service. The firm’s regulation is from the Gibraltar Financial Services Commission, though the broker is registered with the FCA as well.

Markets

Intertrader offers speculation through contracts for difference (CFDs) and spread betting. This is advantageous to those in the UK, as most UK-based investors can take advantage of spread betting taxation rules to deliver tax-free profits on winning bets.

The broker provides several asset classes for derivatives trading, including forex, commodities and bonds.

Forex

Thirty-nine currency pairs are available for CFD and spread betting speculation through Intertrader, spanning a solid selection of major, minor and exotic pairs. EUR/USD spreads start from 0.3 pips via MT4 and 0.6 pips on the Intertrader web and desktop platforms.

Indices

Intertrader provides clients with a good range of global exchange markets with thirteen cash indices and nine futures and exotic indices. Investors can trade major indices like the UK FTSE 100, US S&P 500 and AUS 200 of Australia or more specialised markets like the VIX 70 and US Dollar futures index.

Spreads on cash indices start from 0.3 pips on the Russell 2000 and 0.08 pips on futures instruments for the US Dollar index.

Commodities

The number of commodities markets available varies significantly from platform to platform. For example, while Meta Trader 4 users are restricted to only four markets, users of the Intertrader proprietary platform can choose from up to thirteen commodities instruments.

Precious metals markets like gold and silver are provided in both spot and futures form, as well as four oil and four soft commodities offerings. Gold spot spread betting spreads start at 5.0 pips, based on a minimum bet size of 0.1 lots, while Brent crude oil spreads are upwards of 3.0 pips.

Shares

Top shares from the UK, the US and Germany are provided for CFD and spread betting speculation. However, equities are not available through the MT4 platform – clients must use the Intertrader platform to access these instruments.

UK and German stocks are subject to a 0.1% commission per side on top of the market spreads, while US shares are charged a 2.95 cent additional spread on top of market values.

Bonds

As with the Intertrader shares markets, bonds are unavailable through the MT4 platform. This said, traders are not missing out on much, as the broker only offers two bond markets: UK Long Gilt futures and Euro-Bund futures. Spreads start from 0.02 pips on these instruments.

Leverage

While the broker’s primary regulator is the Gibraltar Financial Services Commission, Intertrader leverage is limited to levels approved by the FCA. As a result, while pro clients have far higher margin limits, retail clients can utilise leverage up to:

- 1:30 on major and commodity currency pairs

- 1:20 on exotic forex pairs, gold and major indices

- 1:10 on all other commodities, non-major indices and bond markets

- 1:5 on UK, US and German shares

Account Types

Intertrader clients can either open a web trading or MT4 compatible account, restricting users to a singular platform per account. The broker operates a no dealing desk (NDD) model on its CFD trades and uses a hybrid STP/ECN execution style to provide zero commission trading on most markets. A £500 minimum initial deposit is required to open an account, which is significantly higher than most modern brokers.

Information on the specifications of each account is fairly limited, such as whether scalping and hedging are allowed or the margin call level for a trade. This is disappointing as most FCA-registered brokers are highly transparent about their trading conditions.

Unfortunately for traders who cannot pay interest due to their religious beliefs, the firm does not offer a swap-free Islamic account.

Demo Account

For those who prefer to give a new broker a test run before committing to a live account, Intertrader provides an MT4 demo account. However, there is no demo account for testing the proprietary platform offered by the company, which will likely be less familiar than the popular MetaTrader 4.

Trading Platforms

Intertrader clients can either use the globally popular MT4 system or the broker’s proprietary trading platform, depending on their account type. MT4 traders cannot access shares and bond markets and many of the offered commodity instruments. However, they benefit from expert advisor integration and FIX API market access.

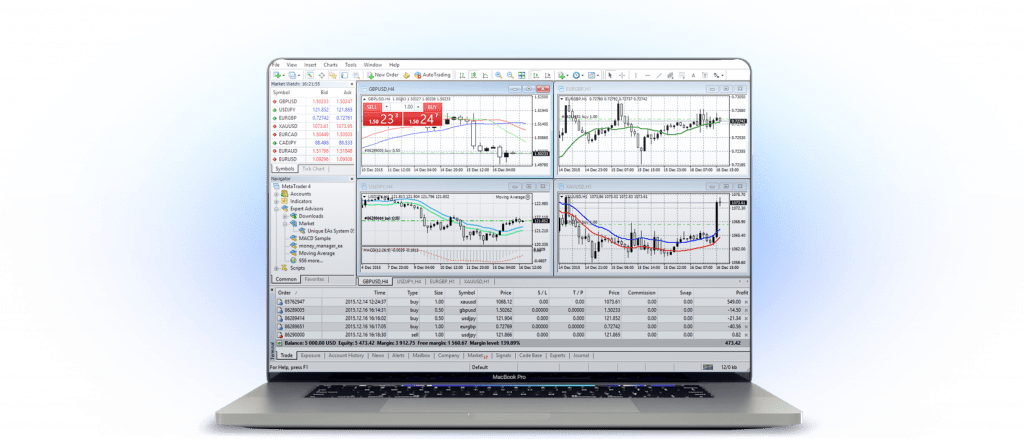

MetaTrader 4

MetaTrader 4, or MT4, has been the choice of many seasoned forex traders since its release in 2005. The platform boasts significant user customisation, nine timeframes and 30 technical indicators as standard. In addition, experienced coders can create expert advisor software using the MQL4 language, while those less technical can purchase community-made EAs from the active user marketplace.

MetaTrader 4 Platform

The MT4 demo account allows clients to try the platform risk-free. The platform is available as a free download on Windows, Mac and Linux devices or in mobile app form for Android and iOS devices.

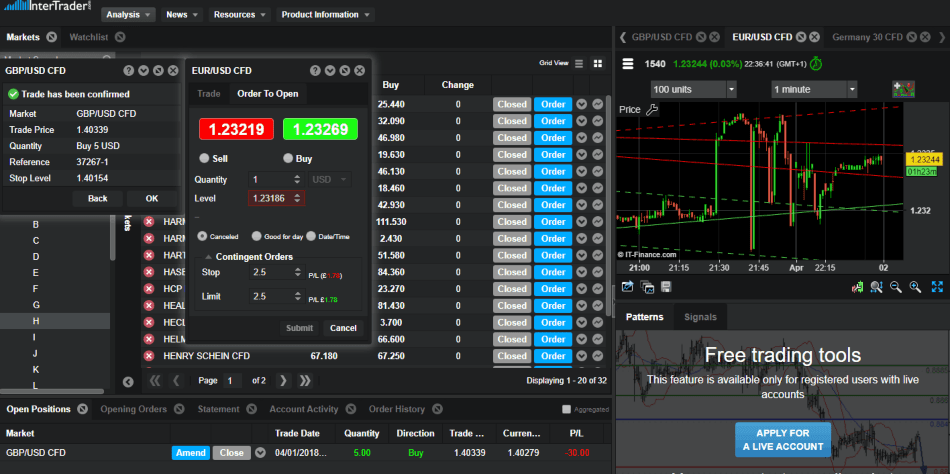

Intertrader Platform

The broker has also created bespoke web and desktop-based platforms to facilitate stock and bond trading. With a focus on simplicity and an easy user experience, the Intertrader platforms support both market and limit orders to help clients execute different strategies efficiently.

Each market features a research panel packed with the latest news and predictions for the underlying asset. Additionally, automated technical analysis from Autochartist and over 70 preset indicators ensure investors can make informed price predictions.

InterTrader Web Platform

Clients can also deposit and withdraw funds directly from this platform, offering a distinct advantage over MT4. The Intertrader platform is available as a web-based service, a desktop program for Windows and Mac and a mobile app on Android and iOS.

Payment Methods

Intertrader supports three methods to fund or withdraw from a trading account: credit or debit card, bank transfer and the Skrill e-wallet. Funding is available in GBP, EUR or USD and client money is held in segregated bank accounts per FCA regulations. Unfortunately, there are no options for crypto payments in Bitcoin, Ethereum or other altcoins.

Intertrader requires an initial minimum deposit amount of £500 and subsequent deposits must exceed £50. The minimum withdrawal amount is £100 unless you are withdrawing the entire balance from an account.

Deposit & Withdrawal Fees

There is no information regarding deposit or withdrawal fees on the broker’s website. However, this review understands that, while bank transfers and card deposits and withdrawals are fee-free, Skrill wallet transfers are subject to a processing fee of 3%. Additionally, Clients who wish to withdraw funds more than once in 24 hours are charged a £5 fee on amounts under £1,000 or equivalent.

Trading Fees

Intertrader operates a complex fee structure, levying commissions on forex markets traded through MT4 and share markets on the web trader platform.

MT4 currency pairs are subject to a £3 per lot per side commission but priced at direct market rates. UK and German stocks are subject to a 0.1% commission per side and US shares are charged a 2.95 cents additional fee per equity. All other markets are commission-free, with the broker’s fees contained within the spread.

Swap rates for holding positions overnight can be found through either trading platform and vary from asset to asset. The broker does not charge an inactivity fee on unused accounts.

Security & Regulation

The safety of sensitive data and funds is paramount to any investor. One of the best security indicators is oversight from a reputable regulator. While the broker holds limited licencing from the UK FCA, full supervision is provided by the Gibraltar Financial Services Commission.

Intertrader holds client funds in segregated bank accounts to protect against insolvency and traders receive additional protection of up to €20,000 from the Gibraltar Investor Compensation Scheme. However, the client portal login and proprietary platform are missing the two-factor authentication (2FA) that provides investors with the highest levels of account security.

Customer Support

Whether you are encountering sign-in issues, a withdrawal problem or have a more general enquiry, a knowledgeable and responsive customer support team is a significant benefit for any investor. Intertrader provides several contact methods for complaints and support, including a web form with a callback option, a phone number linked directly to the London office, 24/5 live chat and a dedicated help email address.

- UK Phone Number – +44 203 364 5189

- Support Email Address – support@intertrader.com

The broker also has a dedicated support site, where traders can find answers to common questions concerning account management, the different trading platforms and charges and costs.

Educational Content

Intertrader provides guides to forex, CFDs and spread betting basics, though these pieces will be of far greater use to a beginner than a pro. These guides cover fundamental topics such as spreads, profits and the difference between short and long positions. For more in-depth education on areas like technical analysis or market determinants, plenty of free guides on YouTube or beginner-friendly trading courses are available.

Additionally, the broker posts weekly market previews and systematic analyses of significant market events to help traders spot upcoming speculation opportunities.

Advantages Of Intertrader

- Regulated

- MT4 access

- Demo trading

- UK-based support

- Competitive spreads

- CFDs & spread betting

Disadvantages Of Intertrader

- No crypto trading

- No Islamic account

- Complex fee structure

- Limited leverage rates

- Limited online information

- Large minimum transaction limits

- Limited deposit & withdrawal methods

Promotions

Many brokers use promotions such as welcome bonuses or commission rebates to encourage new traders to join their platforms. As an FCA licenced broker, Intertrader does not offer any such incentives. While this may be disappointing to some, bonus programs often have high wagering requirements and restrictive terms and conditions.

Additional Features

To help clients make the most informed decisions in the markets, Intertrader provides a free economic calendar with major upcoming market events and news releases.

Additionally, advanced charting software from IT-Finance is integrated into the broker’s proprietary trading platform. This service allows users to create custom indicators and run backtesting on strategies using historical market data.

Trading Hours

Intertrader trading hours vary depending on the specific markets. Forex instruments are available 24/5, while major commodities take daily breaks of up to several hours. Indices and stocks follow the hours of their local exchanges. Investors can find specific hours for each asset on the MT4 and proprietary trading platforms.

Clients can access their accounts and make deposits and withdrawals at any time through the Intertrader platform or online client hub.

Intertrader Verdict

This Intertrader review has explored all the key aspects of the firm’s services and the round-up is a mixed bag. Positive features include its UK-based support options, IT-Finance advanced charting features and MT4 access for live and demo accounts. The choice of both spread betting and CFD speculation is also valuable. However, the £500 minimum initial deposit and complicated fee structure may dissuade some potential clients. Additionally, the limited regulation provided by the FCA in this case does little to offset the heavily restricted leverage on offer.

FAQ

Is Intertrader Regulated And Trustworthy?

Intertrader is subject to limited regulation from the FCA, with its primary regulator, the Gibraltar Financial Services Commission, handling complaints and fund protection.

Does Intertrader Support API Trading?

Professional Intertrader MT4 account users can utilise the available FIX API to streamline their trading experience.

What Is The Intertrader Minimum Bet Size?

The Intertrader minimum bet size or stake on spread betting markets stands at £1 per pip. Micro lots remain the minimum position size for CFD trades.

Is Intertrader A Good Broker?

Intertrader is a solid broker, offering spread betting and CFD markets on several asset classes. However, some may be put off by the £500 minimum initial deposit and restrictive leverage capabilities.

Does Intertrader Allow Scalping?

While Intertrader does not mention whether it supports scalping and hedging, users report that these investing styles are allowed.

Compare Intertrader with Other Brokers

These brokers are the most similar to Intertrader:

- Admiral Markets - Admirals is an FCA- and ASIC-regulated broker with an excellent range of leveraged instruments, including forex, stocks, indices, ETFs, commodities, cryptos and more. The broker supports the MetaTrader 4, MetaTrader 5 and TradingCentral platforms. With both spread betting and CFDs available and thousands of instruments, this broker provides more flexibility than most rivals.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Swissquote - Swissquote is a Switzerland-based bank and broker that offers online trading and investing. The company has a high safety score and is listed on the Swiss stock exchange. The firm offers a huge range of products, from stocks, ETFs, bonds and futures to 400+ forex and CFD assets. Hundreds of thousands of traders have opened an account with the multi-regulated brokerage. Clients can get started in three easy steps while 24/7 customer support is available to assist new users.

Intertrader Feature Comparison

| Intertrader | Admiral Markets | IG Index | Swissquote | |

|---|---|---|---|---|

| Rating | - | 3.5 | 4.4 | 4 |

| Markets | Forex, Stocks, Commodities | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities | Forex, Stocks, Commodities |

| Minimum Deposit | $500 | $100 | $0 | $1000 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | Gibraltar Financial Services Commission & Limited Regulation under the FCA | FCA, CySEC, ASIC, JSC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA | FCA, FINMA, DFSA, SFC |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | No |

| Platforms | MT4 | MT4, MT5 | MT4 | MT4, MT5 |

| Leverage | 1:30 (Retail), 1:200 (Pro) | 1:30 (EU), 1:500 (Global) | 1:30 (Retail), 1:222 (Pro) | 1:30 |

| Visit | ||||

| Review | Intertrader Review |

Admiral Markets Review |

IG Index Review |

Swissquote Review |

Trading Instruments Comparison

| Intertrader | Admiral Markets | IG Index | Swissquote | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | Yes | No | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | No |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | No | No |

| Futures | Yes | No | Yes | Yes |

| Options | No | No | Yes | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | No | Yes | No |

| Spreadbetting | Yes | Yes | Yes | No |

| Volatility Index | No | Yes | Yes | No |

Intertrader vs Other Brokers

Compare Intertrader with any other broker by selecting the other broker below.

Popular Intertrader comparisons: