HYCM Review 2024

|

|

HYCM is #68 in our rankings of CFD brokers. |

| HYCM Facts & Figures |

|---|

HYCM is an online broker with authorization from four international bodies including the FCA and CySEC. The broker offers short-term CFD trading on forex, shares, commodities, indices, ETFs and Bitcoin, and supports the MT4 and MT5 platforms, as well as Trading Central analysis. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs |

| Demo Account | Yes |

| Min. Deposit | $20 |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FCA, DFSA, CIMA, CySEC |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | HYCM traders can access CFDs on a range of stocks, indices, commodities and ETFs with floating spreads and maximum leverage varying by instrument. Clients also have a choice between two industry-leading platforms. |

| Leverage | 1:301:500 |

| FTSE Spread | 1.5 |

| GBPUSD Spread | 0.1 |

| Oil Spread | 2.0 |

| Stocks Spread | 2.2% |

| Forex | HYCM offers 40+ forex pairs, with most available to trade on either the MT4 or MT5 platform. The maximum leverage on offer is 1:30 in accordance with regulations, and tight spreads start from 0.2 on the Raw account and from 1.2 on the commission-free Classic account. |

| GBPUSD Spread | 0.4 |

| EURUSD Spread | 0.1 |

| GBPEUR Spread | 0.4 |

| Assets | 40+ |

| Stocks | HYCM offers 11 individual company shares to trade via the MT4 platform. There are also 20 ETFs to give a broader view of market movements. All trading is done through CFDs, meaning traders will not own the underlying equities. |

HYCM Capital Markets (UK) Limited offers CFD and forex trading to retail investors on the MT4 and MT5 platforms. This HYCM review will cover the new account registration process, how to download the platforms and mobile apps, regulation status, minimum deposits, plus spreads and fees. Find out if HYCM is a good broker for UK traders.

HYCM is an award-winning, FCA-regulated broker with multiple account types and good educational materials, making it a sensible pick for both beginners and experienced traders.

Company History & Overview

HYCM Capital Markets (UK) Ltd is a subsidiary of the Henyep Capital Markets Holdings Group, which offers trading services in over 140 countries worldwide. The UK entity has been regulated by the Financial Conduct Authority (FCA) since 1998.

HYCM is now an established brokerage firm, offering 100+ instruments across forex, indices, stocks, and commodity asset classes. The popular trading firm has also been recognised with multiple awards, including the Best Forex Broker.

Products & Instruments

HYCM offers decent market access via leveraged CFDs, especially in terms of forex. On the downside, there is a limited list of stocks and cryptocurrency is not available to UK clients.

- Trade 70 major and minor forex pairs including GBP/USD, EUR/GBP, and GBP/AUD

- Invest in 10 global company shares such as Meta Platforms Inc, Amazon, and Alibaba

- Speculate on the price of 20+ worldwide indices via spot or CFDs. This includes the FTSE100, NASDAQ100 and GER30

- Trade spot precious metals plus energies and soft commodities as CFDs. Assets include spot gold, Brent Oil CFD, and Coffee CFD

Note, access to instruments varies by platform. Stock trading, for example, is available on MT4 only.

Fees & Spreads

HYCM fees vary by account type. The pricing models are pretty standard for major brokers with the Raw Account following ECN pricing (tight spreads and a commission) and the Classic Account offering floating spreads with no commission. The Fixed Account offers set spreads though these are not competitive vs alternative brokers, such as Pepperstone or IG.

While using HYCM, our traders were offered the following spreads:

GBP/USD

- Fixed Account – 2 pips

- Classic Account – 1.3 pips

- Raw Account – 0.4 pips + £4 commission per round turn

FTSE 100 Index

- Fixed Account – 6 pips

- Classic Account – 2 pips

- Raw Account – 1.5 pips + £4 commission per round turn

Islamic accounts are liable for a £3.50 overnight charge. However, there is an initial 14-day swap-free no-charge period.

The broker also has a £10 inactivity fee per month for accounts that have been dormant for over 90 days.

Leverage

The broker can only offer a maximum 1:30 leverage to UK traders in line with regulatory requirements, though this varies by asset class:

- Indices – 1:20

- Commodities – 1:20

- Stocks – Margin from 20%

- Major Currency Pairs – 1:30

- Minor Currency Pairs – 1:20

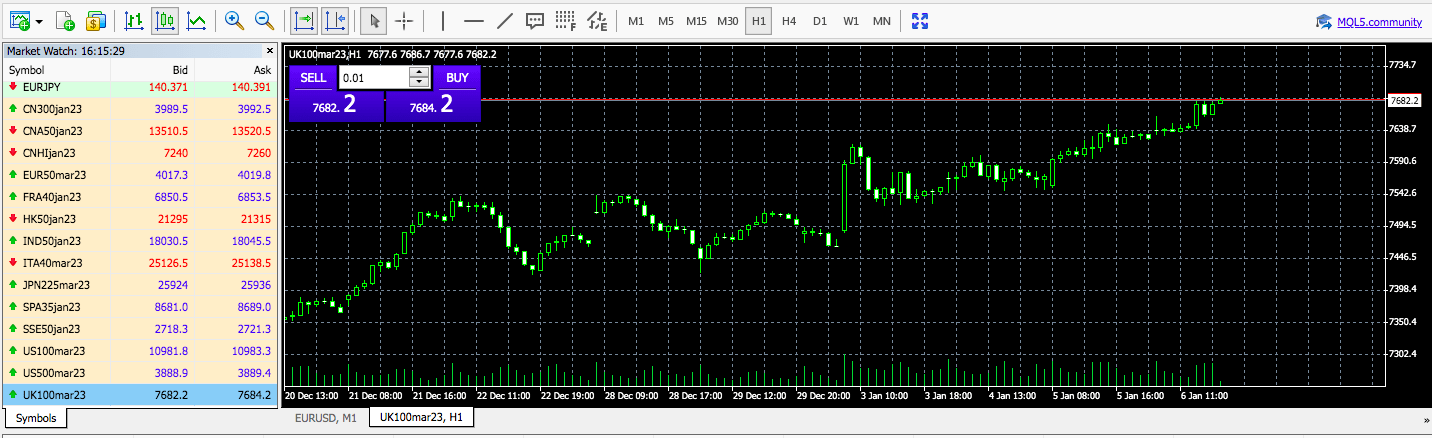

HYCM Platforms

UK investors can trade on the MetaTrader 4 and MetaTrader 5 platforms. These terminals are available for free download directly from the HYCM site or via MetaTrader’s official website. Alternatively, investments can be made on the web trader solution.

Both platforms provide a range of technical analysis tools, custom charting, and access to expert advisors (EAs). These are both industry-standard trading solutions offered by hundreds of brokers in the UK and will meet the needs of beginners and advanced traders.

MetaTrader 4

On the downside, HYCM does not offer copy trading. This is disappointing vs FXCM or eToro, for example, though the MetaTrader platforms do support auto trading of other investors using signals.

Download Instructions

It is quick and easy to download the MT4 and MT5 platforms.

- Visit the HYCM website

- Click on ‘Trading’ from the top menu

- Select either ‘MetaTrader 4’ or ‘MetaTrader 5’

- Choose ‘Download Desktop Version’

- Once the download is complete, select the folder within the computer’s respective downloads space

- Launch the installer programme

- Review the licensing and select ‘Next’

- The platform will open automatically once the installation is complete

- Select ‘File’ and sign in to the platform with your registered HYCM credentials

There is also a self-help guide available on the broker’s ‘Help Centre’ page for any queries.

Placing An Order

To place a trade, right-click on the preferred instrument in the MetaTrader Market Watch window. Select ‘New Order’. Amend the details of the position including risk-management parameters. Also adjust the volume to the size of the order required.

Review the order and click ‘Buy’ or ‘Sell’.

Mobile Trading

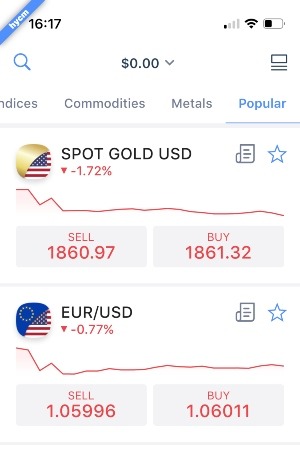

HYCM Mobile Trader

Our experts were pleased to see the broker offers the HYCM Trader mobile application which launched in 2022. The app is available to download on iOS and Android (APK) devices. Users can complete all standard account management activities including making deposits and withdrawals. Clients can also open and close positions with one click.

When we used the HYCM app, the interface was sleek and modern, with limited clutter making it user-friendly, even for beginner traders. All instruments are categorised into helpful themes such as ‘big tech’ or ‘popular’.

The application is also designed to indicate trading opportunities using highlights from the economic calendar and top daily market movers which can be accessed along the top of the client dashboard.

Mobile App

MT4 & MT5

Both MetaTrader platforms are also available as mobile-compatible apps. However, these are currently unavailable for download to iOS devices due to a suspension from Apple.

Users can trade and have complete management of an account on smartphone or tablet devices anytime and anywhere. All technical analysis features and custom charting tools are available on the app. The application syncs automatically to activities completed on desktop accounts.

HYCM Payments

Deposits

HYCM does not charge any fees to make a deposit to a live trading account. However, third-party bank charges may apply.

The broker accepts several payment methods (though PayPal is not accepted):

- Skrill

- Neteller

- Bank Wire Transfer

- Debit/Credit Card (Visa and MasterCard)

Bank wire transfers can take between one and seven working days to process, which is slower than competitors. Fortunately, card payments, Skrill, and Neteller are processed within one hour.

Importantly, only credit/debit card deposits are accepted in GBP. As a result, UK investors may be liable for currency conversion fees if using an alternative method.

There is a minimum deposit of £250 for bank wire transfers and £20 for all other methods.

Withdrawals

HYCM does not charge a commission fee for withdrawals over £300. A £30 handling fee applies for wire transfers less than this amount. A 1% withdrawal fee applies for payments via Skrill and Neteller over £5000.

The broker processes all withdrawal requests within one working day, however, the time taken for the money to clear does vary. Skrill and Neteller withdrawals have the quickest processing times, with money typically cleared within 48 hours. Bank wire transfers can take up to four working days, and credit/debit cards up to seven working days. Overall, withdrawal timelines are around the industry average.

Similar to deposits, credit/debit cards are the only methods that process GBP payments.

How To Make A Withdrawal

- Login to the HYCM client portal

- Select ‘Banking’

- Choose ‘Withdraw Funds’

- Complete the required information and press ‘Submit’

Traders can also transfer funds between HYCM accounts. To action, select ‘Trading Accounts’ within the client portal. Follow the ‘Inter Account Transfer’ request and select the two accounts to associate.

Bonuses & Promotions

Due to rules from the Financial Conduct Authority (FCA) and the European Securities and Markets Authority (ESMA), HYCM is not permitted to offer any bonuses or financial promotions. This includes a welcome no deposit bonus and other financial rewards based on trading volumes.

UK Regulation

Our experts were pleased to see that HYCM Capital Markets (UK) Limited is authorised and regulated by the Financial Conduct Authority, reference number 186171. With this licensing, the broker is permitted to offer contracts for difference (CFDs), rights to interests in investments, and rolling spot forex and contracts.

Importantly, the FCA has strict compliance rules and joining requirements. Funds are kept safe and held separately from HYCM money in a tier-one bank such as Barclays. HYCM also has a monitoring and risk-management system to protect customers against losses exceeding the amount of their original investment. The broker will close open positions when a client account falls below 55%. This is part of the negative balance protection scheme.

UK customers are also protected by the Financial Services Compensation Scheme (FSCS) with up to £85,000 reimbursement in the case of company failure. Additionally, HYCM is MiFID compliant.

Overall, HYCM is a highly-regulated broker, making it a relatively safe pick for UK traders. Our review did not find any concerns about the legitimacy of the company.

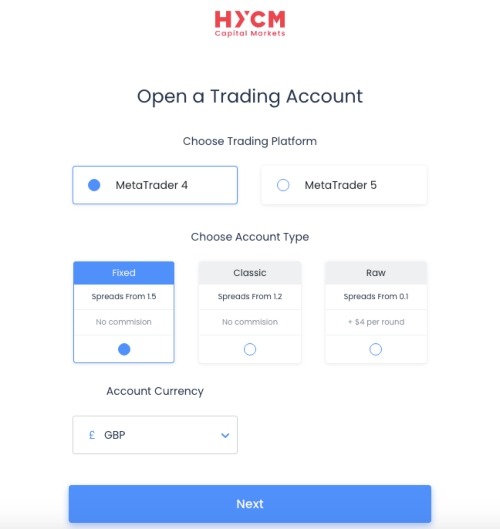

Live Accounts

HYCM offers three account types for retail investors; Fixed, Classic, and Raw.

Our experts were particularly impressed with the account type selection tool. It uses five basic questions to suggest the most suitable profile for traders based on trading patterns and typical investment styles, such as scalping.

UK investors can open accounts in seven base currencies including GBP, EUR, and USD.

Fixed Account

- No commission

- EAs not permitted

- £100 minimum deposit

- Fixed spreads from 1.5 pips

- Minimum trade volume 0.01 lots

Classic Account

- EAs permitted

- No commission

- £100 minimum deposit

- Floating spreads from 1.2 pips

- Minimum trade volume 0.01 lots

Raw Account

- EAs permitted

- £200 minimum deposit

- Raw spreads from 0.1 pips

- Minimum trade volume 0.01 lots

- £4 commission per round lot turn

There is also a VIP account available for clients trading in large volumes. VIP investors benefit from a dedicated account manager and detailed market analytics.

A swap-free Islamic version of all accounts is available.

How To Open A HYCM Account

There are some basic steps to register with HYCM:

- Enter your name, email, and contact number

- Add country of residence, e.g. UK, date of birth, and address

- Choose a trading platform (MT4 or MT5)

- Select the account type (Fixed, Classic or Raw)

- Choose the account currency from the dropdown menu, e.g. GBP

- Confirm non-US citizenship

- Set a password

Account Registration

As per FCA guidelines, HYCM complies with anti-money laundering (AML) and know-your-customer (KYC) requirements. This means all UK investors will need to upload documents with proof of residency and identification. This can be actioned via the ‘My Profile’ page within the client dashboard. Documents must be uploaded within seven days of opening a HYCM account.

Demo Account

HYCM offers a free demo account with $50,000 in virtual funds.

Although misleading on the broker’s website (suggesting MT4 and EUR or USD base currencies only), when we opened a demo profile, there was an option to open a paper trading profile on both the MT4 and MT5 platforms, and in all seven account denominations including GBP.

The demo account is active for 14 days, though there is no maximum number of accounts that can be opened.

How To Open A Demo Account

Potential traders are required to register for an account before being eligible for a demo profile.

Complete the HYCM online registration form and log in to the client portal. From here, select ‘Trading Account’ and then ‘Create Demo Account’.

No KYC documents are required.

HYCM Extra Tools

Education

The educational content offered by HYCM is good. There are two webinar sessions per week; a live market analysis discussion for the upcoming week and an online trading workshop.

The interactive workshop session is suitable for beginners. The meeting involves step-by-step trading in real-time. Practical exercise tasks are set, designed to be completed in demo mode alongside a detailed trading guide handout with tips and support. In-person events have also previously been run by the broker, however, there are no details of upcoming sessions.

The online help centre also has plenty of articles, organised by asset class. It could be worth spending some time reviewing the content, particularly for those looking to diversify portfolios.

There are three calculators available to HYCM traders; pip, margin, and a currency converter.

Trading Central

An advantage of trading with HYCM is the company’s partnership with Trading Central. The broker provides customers with free access to leading investment research and analytics so traders can make informed decisions. It allows users to find and authenticate opportunities, time trades with market precision, and learn how to manage risk.

The feature can be integrated directly into the MT4 terminal.

Opening Hours

Typical trading hours at HYCM are between 23: 01 (GMT) on Sunday and 21:00 (GMT) on Friday with daily trade breaks between 22:00 (GMT) and 22:05 (GMT) from Monday to Thursday. Specific market opening hours will vary within this time.

Winter and Summer trading hours are published on the broker’s website plus any upcoming public holiday dates.

Customer Service

HYCM customer support is available 24/5, similar vs FXTM.

Contact methods:

- Email – support@hycm.com

- Telephone – +442039067347

- Live Chat – Icon bottom right of each webpage

The broker’s online help centre is also particularly helpful. Here users can find various guides including how to download the MT4 terminal and articles on how to open a demo account and trading psychology. There is also a detailed FAQ section.

In addition, the HYCM group is present on Facebook and LinkedIn where clients can stay up to date with the latest company news.

Client Safety

The company provides top-tier customer safety and account security. The MetaTrader platforms meet strict security standards with full transaction encryption protocols and additional safety measures available at login.

The broker also has secure processes for data protection and network communication channels. All transmissions between clients and HYCM servers are secured with 128 keys. Additionally, account information and client personal details are encrypted using VeriSign 128-bit SSL certificates.

Should You Trade With HYCM?

Our HYCM review confirms that the broker offers competitive trading conditions and is suitable for investors of all experience levels. Although the number of instruments available isn’t as vast as some other leading UK brokers, the reliable customer support, proprietary mobile app, and free access to Trading Central make it a good pick.

FAQ

Is Your Money Safe With HYCM?

UK investors trading with HYCM are covered by the regulations and rules set out by the Financial Conduct Authority. This includes traders’ money being held separately from company funds. Additionally, all retail traders in the UK benefit from access to the FSCS compensation scheme and negative balance protection.

Does HYCM Offer High Leverage?

UK traders can only access leverage up to 1:30, though this varies between instruments. Although this is not as generous as the leverage offered by some offshore brokers, it will be the same across all FCA-regulated firms and helps limit risk for retail traders.

Is HYCM A Good Broker?

HYCM is a good broker offering trading opportunities on the MT4 and MT5 platforms. User reviews of HYCM are also generally positive, with ratings associated with responsive customer service, educational materials, and various trading tools, such as Trading Central.

Is HYCM Trustworthy?

HYCM Capital Markets (UK) Limited is authorised and regulated by the Financial Conduct Authority (FCA). This is a well-respected financial body, with stringent compliance requirements. HYCM has also held a license with the FCA since 1998, which is a promising sign that the brokerage is trustworthy.

Does HYCM Offer A Large Range Of Trading Instruments?

HYCM offers 100+ assets to UK investors. This includes leveraged CFDs on forex pairs, commodities, stocks, and indices. On the downside, crypto trading is not available and some alternative brokers offer thousands more instruments.

Compare HYCM with Other Brokers

These brokers are the most similar to HYCM:

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- Swissquote - Swissquote is a Switzerland-based bank and broker that offers online trading and investing. The company has a high safety score and is listed on the Swiss stock exchange. The firm offers a huge range of products, from stocks, ETFs, bonds and futures to 400+ forex and CFD assets. Hundreds of thousands of traders have opened an account with the multi-regulated brokerage. Clients can get started in three easy steps while 24/7 customer support is available to assist new users.

HYCM Feature Comparison

| HYCM | IG Index | Pepperstone | Swissquote | |

|---|---|---|---|---|

| Rating | 3.8 | 4.4 | 4.8 | 4 |

| Markets | Forex, Stocks, Commodities | Forex, Stocks, Commodities | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities |

| Minimum Deposit | $20 | $0 | $0 | $1000 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, DFSA, CIMA, CySEC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, FINMA, DFSA, SFC |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | No |

| Platforms | MT4, MT5 | MT4 | MT4, MT5, cTrader | MT4, MT5 |

| Leverage | 1:301:500 | 1:30 (Retail), 1:222 (Pro) | 1:30 (Retail), 1:500 (Pro) | 1:30 |

| Visit | ||||

| Review | HYCM Review |

IG Index Review |

Pepperstone Review |

Swissquote Review |

Trading Instruments Comparison

| HYCM | IG Index | Pepperstone | Swissquote | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | No |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | No |

| Futures | Yes | Yes | No | Yes |

| Options | No | Yes | No | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | Yes | Yes | No |

| Volatility Index | No | Yes | Yes | No |

HYCM vs Other Brokers

Compare HYCM with any other broker by selecting the other broker below.

Popular HYCM comparisons: