Huobi Review 2024

|

|

Huobi is #83 in our rankings of crypto brokers. |

| Huobi Facts & Figures |

|---|

Huobi is one of the world's largest cryptocurrency exchanges, offering the top tokens by market cap on their proprietary trading platform. |

| Instruments | Cryptocurrency |

|---|---|

| Demo Account | Yes |

| Min. Deposit | $100 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | $0 |

| Regulated By | FCA, FSAS |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | Yes |

| Auto Trading | In-house trading bot available 24/7 |

| Signals Service | Yes |

| Islamic Account | Yes |

| Cryptocurrency | Huboi is a leading cryptocurrency trading exchange offering access to major and emerging tokens. |

| Coins |

|

| Spreads | Variable |

| Crypto Lending | Yes |

| Crypto Mining | Yes |

| Crypto Staking | No |

| Auto Market Maker | No |

Huobi is a crypto exchange and decentralised finance (DeFi) platform that supports trading in more than 400 digital assets with a competitive fee structure. But is it safe or are there better alternatives?

This review will assess the ways to trade with Huobi and all the services it offers, with detailed information on its fees, payment methods and anything else a UK-based investor should know.

Our Take

- Alongside exchange services, Huobi offers crypto derivatives via futures contracts, as well as copy trading and staking

- The exchange operates an onramp system, directly matching fiat-to-crypto transactions, with competitive 0.2% maker/taker fees

- The proprietary platform offers over 30 crypto ecosystems, including NFTs and the native HECO chain, plus access to trading bots like 3Commas

- The lack of regulatory oversight is a serious drawback – many traders will prefer the security of established crypto brokers

How To Trade On Huobi

I rated the variety of crypto-supported trading methods at Huobi. The exchange gives clients many options when deciding how they want to invest in the cryptocurrency market, including spot trading on a decentralised exchange, staking crypto, and leveraged trading on crypto futures.

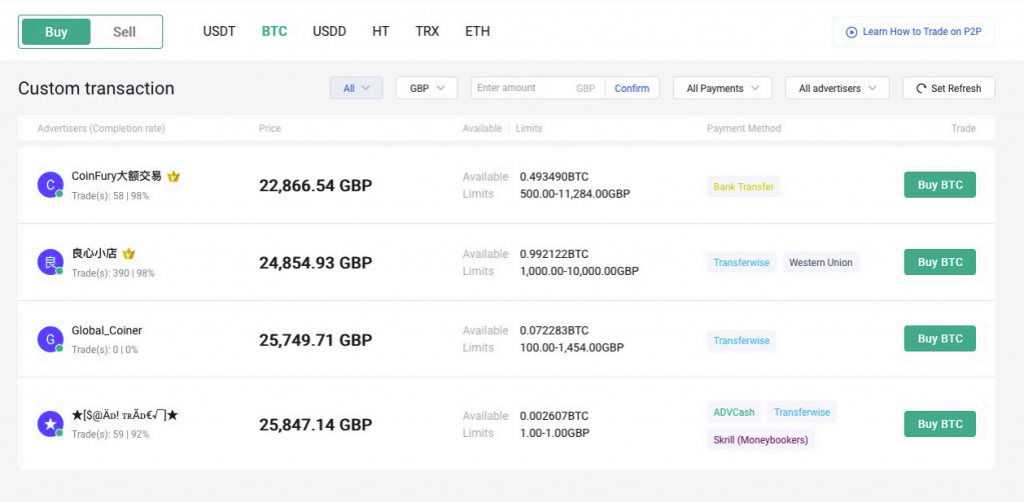

Buy Crypto

Huobi acts as a crypto onramp, matching users who want to buy crypto using fiat currency with sellers through a P2P system. After selecting a fiat currency used to open a buy order, you can choose the crypto token you wish to purchase and Huobi will show the best current sell orders for that pair. This allows you to connect directly with cryptocurrency sellers.

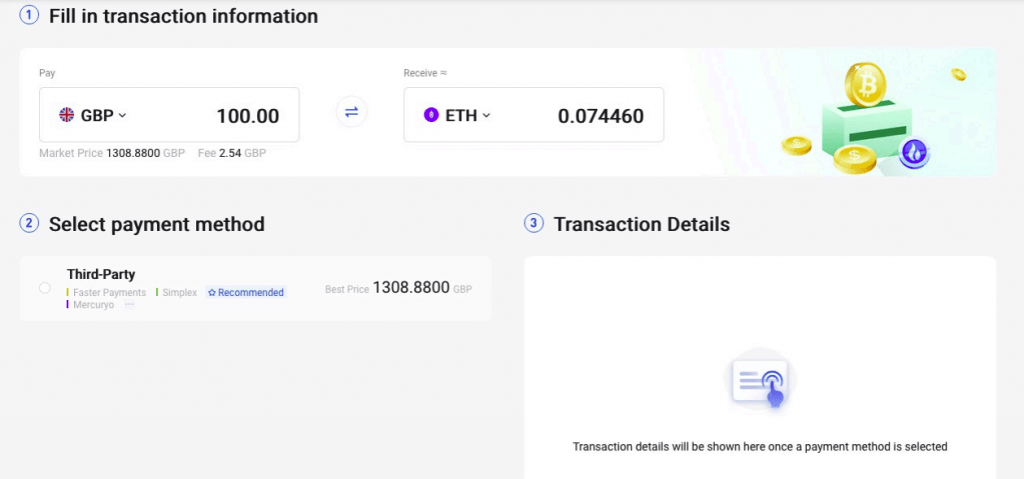

The GBP/ETH in the image below provides an example of how these trades work. For each transaction, the platform shows you the current GBP to ETH rate, the price you will pay and the supported transfer methods.

How To Complete A Fiat To Crypto Trade

I also found it straightforward to find and buy digital currency on the platform:

- Click ‘Quick Buy/Sell’ under the ‘Buy Crypto’ tab on the Huobi.com menu bar

- Select GBP (or another fiat currency) and the crypto you wish to purchase

- Input the amount of GBP you want to pay or the amount of crypto you want to buy

- Select the available payment option

- Complete the transaction request using the specified payment method

- Wait for the order to complete

Spot Trade

Similar to the fiat-to-crypto transactions, Huobi also supports transfers between two cryptocurrencies. This is a simple process though the trading pairs on offer are limited compared to alternatives.

Spot trading pairs must include one of USDT, TRX, BTC, ETH, HT, USDD, USDC or TUSD. Each of these base currencies is matched with a different list of tokens, and USDT is the most flexible with around 180 crypto you can trade. In contrast, TRX can only be traded with STRX.

How To Make A Crypto Spot Trade

- Select the two cryptos you want to trade using the menu on the left-hand side of the Huobi trading platform

- Input the order volume information using the spot tab at the bottom of the screen

- Ensure the amount is greater than the minimum order size

- Click either ‘Buy’ or ‘Sell’ to submit the order

- Wait for the order to complete

Crypto Farming

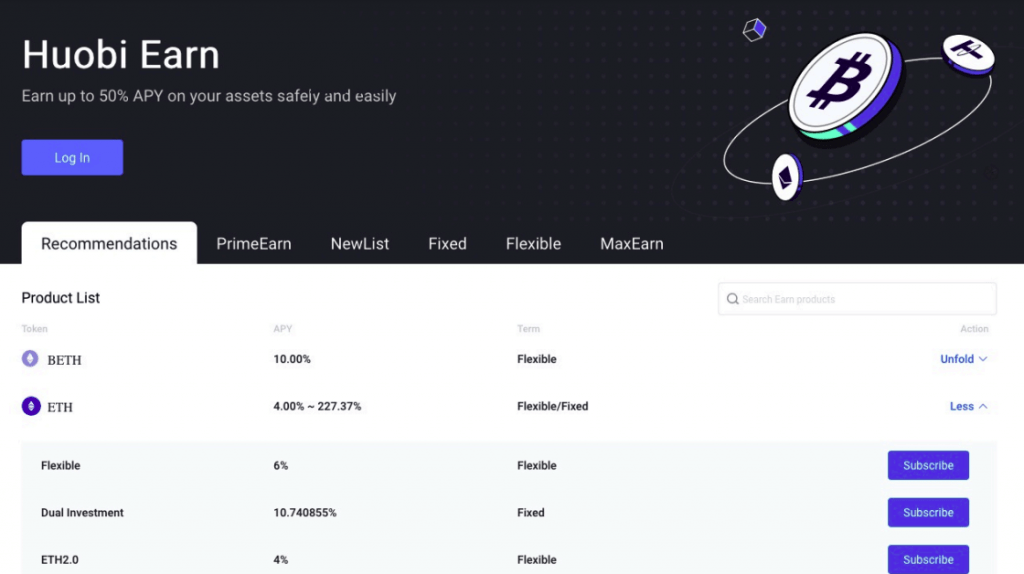

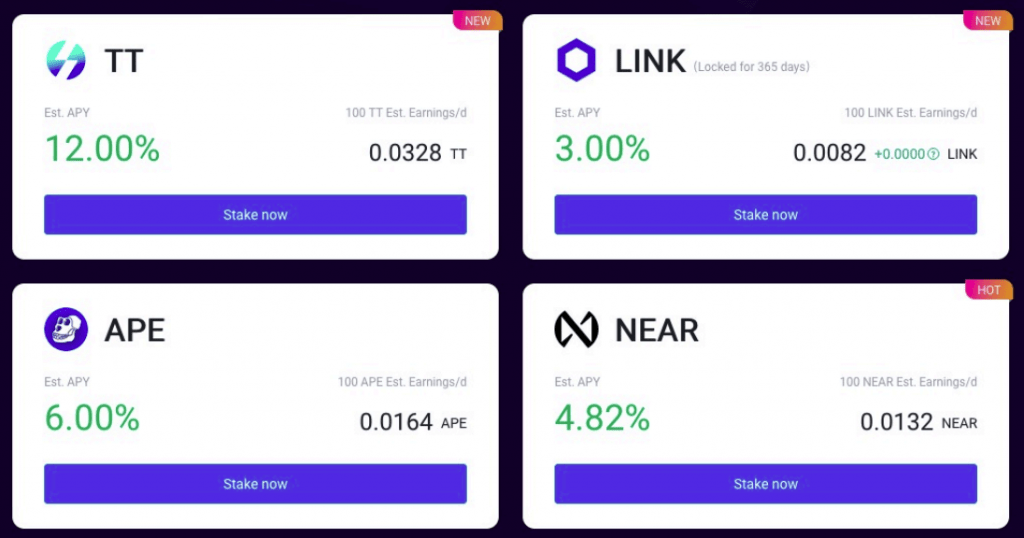

Through Huobi Earn, you can generate impressive returns of up to 50% APY (annual percentage yield) through a staking service.

This involves investing in cryptocurrency to provide liquidity to Huobi’s markets and earn a return from maker fees – a process also known as DeFi yield farming.

You can also generate passive revenue by staking crypto into wallets to help with the mining of new blocks on blockchains. This is mostly relevant for cryptocurrencies that use a proof-of-stake model to generate new tokens.

This is akin to yield farming in liquidity pools but there are much lower fees and returns come in the form of validator rewards. Typically, yield farming through a Proof-of-Stake protocol is unattainable due to the high barriers to entry, such as requirements for large amounts of liquidity and strong computing power. Huobi overcomes these by pooling together users’ funds from numerous clients to make a collective investment.

The image below shows some of the available stakes with Huobi, providing information such as the APY.

How To Start Crypto Farming

- Sign in to your account on the official Huobi website

- Click the ‘Huobi Earn’ icon

- Select the yield farming product you wish to invest in

- Click ‘Unfold’ and then ‘Subscribe’ on your chosen pool

- Complete the investment order by specifying information such as the deposit amount

- Click the ‘Subscribe’ button in the pop-up to submit the order

Derivative Trading

One of the best features of Huobi is the derivative crypto trading, with both futures and options available.

Futures are contracts whereby you agree to complete a trade at a later date and a predetermined price. With a futures contract, there is an obligation to complete the transaction when the contract expires, but Huobi also offers perpetual futures, which do not have a set expiration date.

Options are similar to futures but do not confer any obligation to complete the purchase or sale of the crypto at expiration. Since traders will not need to pay the difference if their option ends out of the money, their losses will be limited to the premium paid for the contract.

Derivatives traded on Huobi are settled using the stablecoin Tether (USDT).

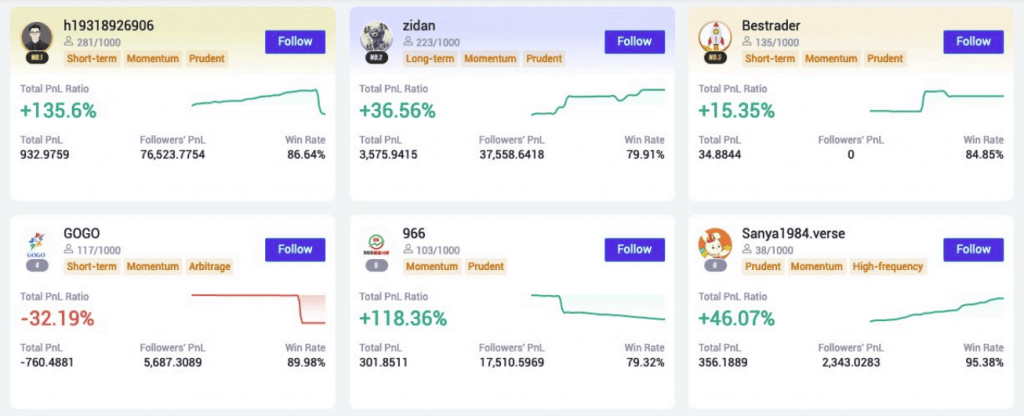

Copy Trading

Huobi also supports copy trading with derivatives. This service means you can follow and mirror investments made by top traders, replicating their orders as they send them.

This is ideal for beginners who do not yet feel confident enough to execute their own strategy, or for those who want to try and earn a more passive income through experts’ guidance.

We liked that Huobi copy traders can compare potential active candidates through a leaderboard showing the top traders and information on their styles, such as whether they trade with a short-term or long-term strategy. You can then view more detailed information by clicking on a trader’s profile, which will bring up info such as the 30-day profit and loss, win rate, average holding time and typical weekly trading frequency.

Huobi Fees

Our experts were happy to see that the Huobi exchange fee structure is competitive within the DeFi industry. Whether you are a maker or taker, you are charged a fee of 0.2%, which is better than other exchanges such as HODL HODL, which charges 0.3%.

However, Huobi’s fees are not the lowest with Kucoin, charging 0.1% for both makers and takers, for example. Additionally, Coinbase has a lower minimum taker fee of 0.05%, though this platform’s fees vary and can be as high as 0.6%, which is double the maximum of Huobi.

For futures, Huobi is similarly competitive as maker fees are 0.02% and taker fees are 0.04%. This is comparable with Kraken, which charges 0.02% and 0.05% for makers and takers, respectively.

You should also be aware that there is a margin interest rate of 0.098%.

Accounts

All Huobi clients have the opportunity to access the same range of trading features and tools, with no account types to differentiate what is on offer. While a range of account types can be useful, we appreciated Huobi’s simple approach towards crypto trading.

Note, however, that crypto staking and derivative trading will remain locked until you complete the ‘Know Your Customer’ (KYC) verification process. This involves submitting personal information and then providing documents showing proof of identity.

Full verification with Huobi also allows you to increase the withdrawal limit to more than 5 BTC over a 24-hour period. Once you have completed all four verification steps, the limit is increased to 3,000 BTC.

How To Register For A Huobi Account

I didn’t have any issues signing up for an account – it took several minutes which is similar to other crypto brands. To register:

- Click the ‘Sign Up’ button on the Huobi website’s top menu bar

- Provide your email address or phone number and a referral or invitation code if you have one

- Enter the verification code you are sent

- Create a password

- After login, complete the verification process by entering personal information and submitting proof of ID and address documents

- Once you have completed all four steps, you will have unrestricted access to the platform’s tools and features

Funding Methods

Deposits

There are no deposit fees for transfers to Huobi using cryptocurrency, which we appreciated, though we were sorry to see fees charged for fiat deposits.

For deposits made using GBP, clients can expect to pay 0.15% + £1 for the Faster Payments method, which takes between three and five working days. Our team was let down by the fact that this is the only GBP deposit method supported. We would have liked Huobi to also permit deposits made using bank wire transfers and credit/debit cards.

Alternative fiat currencies such as USD and EUR are available and support additional methods such as Skrill, but this comes with a higher charge and you will need to convert your currency, which may incur a fee. The benefit of doing so is that Skrill transfers funds instantly, meaning you can begin trading immediately after registration.

In the past, Huobi operated its own wallet service, which allowed clients to review their funds and provided easy integration with the platform, however, this was discontinued in May 2023.

How To Deposit Funds To Huobi

- Log into your Huobi account

- Click ‘Deposit’ on the assets tab

- Specify the currency (fiat or crypto) and amount you wish to deposit

- Choose the deposit method. For crypto deposits, this will be the network

- You will then be directed to a page showing details on where to send the money; for example, a wallet address for cryptocurrency

- Confirm the order and wait for funds to appear in your account

Withdrawals

Huobi allows clients to make both fiat and crypto withdrawals. Withdrawal fees vary according to market conditions as they relate to the network, or ‘gas’, fee, which is impacted by network traffic. This fee is paid to the crypto miners and trade validators who keep the blockchain working by processing transactions.

Different networks incur different fees, with Huobi’s native HECO chain generally being the most economical. For example, if you use a crypto on the ERC20 chain, you will pay a fee of around £4, whereas if you use a crypto on the Huobi ECO (HECO) chain, the fee is much lower at around £0.02. The minimum withdrawal limit differs according to cryptocurrency but is generally around 2 USDT or the equivalent.

Trading Platforms

Our experts were satisfied with the trading platform offered by Huobi. While we would have liked to see third-party platforms supported, big names like MetaTrader 4 are not really compatible with crypto exchange trading.

Our review found the proprietary software, Huobi Pro, to be more than adequate with access to charts and detailed historical data, competing well with the likes of Coinbase.

Some of our favourite features in the Huobi platform are:

- Depth of market chart showing the number of market orders at differing price levels

- 31 crypto ecosystems such as NFT, Metaverse, HECO and Hong Kong Zone

- Order book information showing current buy and sell orders

- Nine timeframes ranging from one minute to one month

- Recent trades for the chosen crypto-crypto pair

- Support for trading bots such as 3Commas

- Market execution and limit orders

- Take-profit and stop-loss triggers

Huobi Pro

Mobile App

We were pleased to find a dedicated Huobi mobile app available for iOS and Android devices, which can be downloaded by scanning the QR code on the official website or directly from the relevant app stores.

This app has the same functionality as the desktop web browser version, providing access to the OTC trading desk, derivative contracts, copy trading and staking. We thought the mobile account management process was particularly slick.

Huobi Leverage

I appreciated that Huobi supports leveraged trading for derivatives. With a maximum limit of 1:200, clients can open a trade with an overall exposure of £1,000 using just a £5 stake. In doing so, you have the opportunity to greatly boost your returns without increasing your stake size.

Note, however, that leveraged trading comes with greater risk, and should be handled with great care – particularly for very volatile assets like cryptocurrencies.

Regulation

Huobi is not regulated by any regulatory body, including the Financial Conduct Authority. Crypto exchanges and crypto trading generally exists in a regulatory grey area, and while some large exchanges have taken on a degree of regulatory oversight, these are not overseen in the same way as traditional brokers.

As a result, clients cannot expect safety measures such as negative balance protection to be implemented. This means, if the sum of your losing positions exceeds your account balance, you may be indebted to Huobi.

Traders who wish to dip into crypto trading in a more secure trading environment can look at crypto brokers, some of which are overseen by reputable bodies.

Security

Huobi does implement some strong security measures, however, including two-factor authentication (2FA) through either the Google Authenticator app or with SMS one-time passcodes. When you sign into your account, you will be asked to provide verification codes to help ensure users without permission cannot access your account and funds.

If you need to reset your 2FA, contact the Huobi customer support team. You may need to provide personal information such as a recovery email and your UID.

Bonus Deals

Huobi offers numerous promotional schemes that provide benefits to clients. In total, customers can be rewarded with up to 5,670 USDT from all the bonus schemes.

One example is the cashback voucher whereby completing the ID verification process rewards you with a 2 USDT cashback.

Additionally, Huobi offers two bonuses, each of 5 USDT, when you make your first derivative trades.

One of the more popular promos is the Huobi Point Card service. These cards accrue points which can be used to discount trading fees, with 1 point equal to 1 USDT. You can receive points either as gifts from other users or by taking part in promo events.

Finally, there is a welcome gift in the form of a 4% deposit rebate up to a maximum of 3,000 USDT.

Extra Tools & Features

Our team was pleased with the added tools and features Huobi offers, which include a good range of educational content to support strategy development and crypto trading. We especially liked the inclusion of user-generated content, which we found to be useful as it addressed common issues faced by traders.

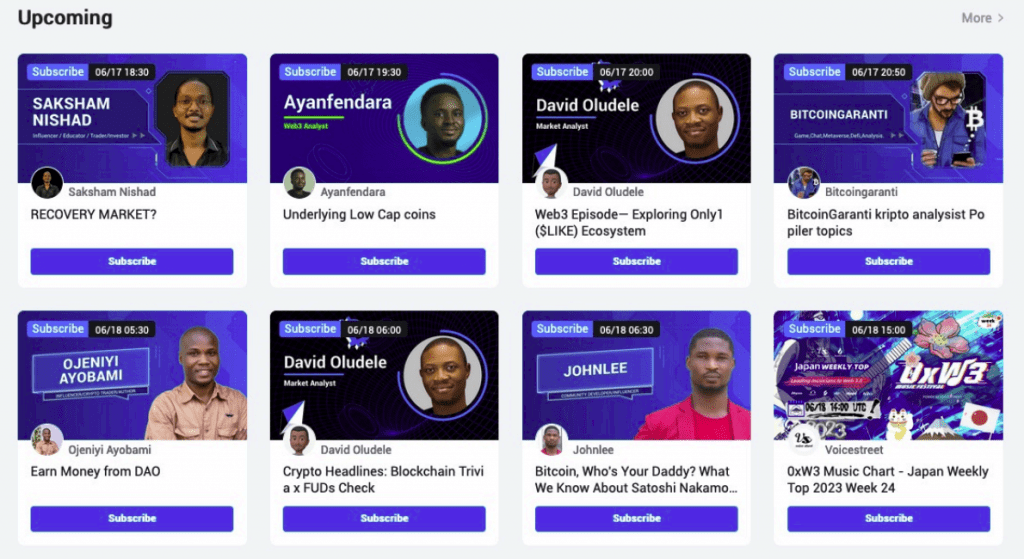

Huobi Live

Huobi Live is a streaming platform for video tutorials and guides made by experts and other traders. As well as a large catalogue of previous videos, users can also access regular streams covering a range of topics such as market analysis, the crypto trading basics, general DeFi chat and introductions to NFTs.

Huobi Community

Huobi hosts a large community of traders and a vibrant discussion forum, with frequent discussions on crypto forecasts, news events, trading strategy tips and many other crypto-related topics.

Note that while it is not necessary to have an account to read the forum, you will need one to post comments.

Website Wiki

The Huobi wiki is an excellent place to improve your knowledge of crypto trading and the DeFi industry which also doubles as a help centre. You will find a range of tutorials, which we found useful for beginners looking to kick-start their live cryptocurrency trading.

We think the spot and margin user guide is an especially thorough resource that covers all the fundamental information needed on how to get started and set up a strategy.

Customer Service

I felt that the Huobi customer service options were sufficient, but there is room for improvement.

For example, the only 24/7 help available on the website is a chatbot that provides relevant links to pages on Huobi’s site in response to users’ questions. This is fine for the basics but it couldn’t help with sophisticated questions upon testing.

Additionally, with no phone hotline, the only way to reach a member of the team directly is to download a messaging app such as Telegram or Discord and join the Huobi group.

Huobi’s customer service team offers clients the following contact options:

- Email support@huobi.com

- FAQs and tutorials on the website

- Speak to a member of the team on Telegram, Instagram, Discord, Twitter or Facebook

- Zendesk-style live chat but you will only speak to a bot that links pages from the help centre

- You can follow Huobi on TikTok, YouTube and Medium to hear announcements for upcoming events and news

Company Details & History

Launched in 2013 by founder and current owner Leon Li, Huobi was one of the first crypto-dedicated trading platforms, and it has retained its place as a popular cryptocurrency exchange.

The exchange was originally based in China, but the headquarters has since moved to Seychelles. This is in addition to offices elsewhere in the world in the UK, Hong Kong, Japan and South Korea. Huobi formerly had an office in the United States, but this has ceased operations.

As Huobi is now a global brand, it has subsidiaries in operation around the world. UK clients will register with Huobi Technology Europe Ltd, which has a headquarters in Luxembourg. Another subsidiary is Huobi Ventures, which is a global investment branch that has funded over 200 projects since 2018.

In the same year, Huobi was listed on the Hong Kong stock exchange under the name New Huo Technology Holdings Limited.

Should You Trade Crypto With Huobi?

Huobi is an interesting cryptocurrency trading platform offering a variety of ways to invest, making it a popular choice for all experience levels. The exchange supports novices with numerous guides and a copy trading service, while more experienced crypto traders will appreciate the opportunity to trade with high leverage.

While it is unfortunate that Huobi is not regulated by the FCA, this is typical for DeFi platforms and a common risk involved in crypto trading. Still, we recommend considering crypto brokers with a good track record and strong security features.

FAQ

Is Huobi Good For Beginners?

Our team were pleased to see some beginner-friendly features at Huobi, including competitive fees, copy-trading and educational content, including live webinars. However, the lack of a demo account is a major drawback for novices looking to browse the platform and practice their crypto trading strategies.

Is The Huobi Pro Platform Easy To Use?

We found the Huobi Pro platform was generally well-executed and user-friendly. The design is sleek and easy to navigate, suitable for beginners and more seasoned traders. There are also customisable charting options, including multiple time frames facilitating clear analysis of crypto pairs. One of the more helpful features is access to order information so you can see the current open buy and sell orders.

Can I Trust Huobi?

Huobi is a popular global platform with an average daily trading volume of around $280 million. It has implemented several account protection measures, including two-factor authentication through the Google Authenticator App or with OTPs.

With that said, the firm does not have glowing user reviews and the lack of regulation does make the brand less reliable than reputable crypto brokers like IC Markets or XTB.

Does Huobi Offer Competitive Pricing?

Yes, Huobi’s fees are generally competitive compared to some other big names, such as HODL HODL and Kraken, with 0.2% maker/taker fees. We also liked that there are no deposit fees when using cryptocurrencies, although you will be charged for fiat deposits. Withdrawals come with industry-standard gas fees, although withdrawing via the broker’s HECO chain is competitive, at £0.02 per transaction.

How Do I Close My Huobi Account?

You will need to submit a cancellation request form to delete your Huobi account. This can be found by opening up the live chat with the robot on the website and requesting an account deletion. The bot will then send you links to forms relating to the level of verification you have completed. Submit the relevant form and wait for the customer service team to respond.

Article Sources

Compare Huobi with Other Brokers

These brokers are the most similar to Huobi:

- Swissquote - Swissquote is a Switzerland-based bank and broker that offers online trading and investing. The company has a high safety score and is listed on the Swiss stock exchange. The firm offers a huge range of products, from stocks, ETFs, bonds and futures to 400+ forex and CFD assets. Hundreds of thousands of traders have opened an account with the multi-regulated brokerage. Clients can get started in three easy steps while 24/7 customer support is available to assist new users.

- FP Markets - FP Markets is an ASIC- and CySEC-regulated broker that offers forex and CFD trading on a broad range of assets through the MT4, MT5 and IRESS platforms. With trading available through standard and raw spread accounts on thousands of international stocks, forex, indices, commodities, cryptocurrencies, bonds and ETFs, this broker has some of the most comprehensive market coverage available. FP Markets also offers a full range of additional features, including educational resources and access to powerful software such as Autochartist.

- KuCoin - Kucoin is a crypto exchange that offers trading on 1000+ tokens as well as leveraged trading opportunities via futures and perpetual swaps. This exchange has a slick trading platform that supports robots, allowing traders to implement automated strategies. Other attractive features include a demo account, flexible funding methods and DeFi features like staking and mining.

Huobi Feature Comparison

| Huobi | Swissquote | FP Markets | KuCoin | |

|---|---|---|---|---|

| Rating | - | 4 | 4 | 3.6 |

| Markets | Crypto | Forex, Stocks, Commodities | Forex, Stocks, Commodities, Crypto | Crypto |

| Minimum Deposit | $100 | $1000 | $100 | $0 |

| Minimum Trade | $0 | 0.01 Lots | 0.01 Lots | 0.0001 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, FSAS | FCA, FINMA, DFSA, SFC | ASIC, CySEC, ESMA | - |

| Bonus | - | - | - | - |

| Education | No | No | Yes | No |

| Platforms | - | MT4, MT5 | MT4, MT5, cTrader | - |

| Leverage | - | 1:30 | 1:30 (UK), 1:500 (Global) | - |

| Visit | ||||

| Review | Huobi Review |

Swissquote Review |

FP Markets Review |

KuCoin Review |

Trading Instruments Comparison

| Huobi | Swissquote | FP Markets | KuCoin | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | No |

| Forex | No | Yes | Yes | No |

| Stocks | No | Yes | Yes | No |

| Crypto | Yes | No | Yes | Yes |

| Commodities | No | Yes | Yes | No |

| Oil | No | Yes | Yes | No |

| Gold | No | Yes | Yes | No |

| Copper | No | No | Yes | No |

| Silver | No | Yes | Yes | No |

| Corn | No | No | Yes | No |

| Futures | Yes | Yes | Yes | Yes |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | Yes | No |

Huobi vs Other Brokers

Compare Huobi with any other broker by selecting the other broker below.

Popular Huobi comparisons: