Hugo’s Way Review 2024

|

|

Hugo's Way is #97 in our rankings of CFD brokers. |

| Hugo's Way Facts & Figures |

|---|

Hugo's Way is a true ECN brokerage, offering 160+ assets on the MT4 platform. Traders benefit from a low $10 minimum deposit requirement, 24/7 customer support and generous leverage up to 1:500. Hugo's Way is an unregulated broker based offshore in St. Vincent and the Grenadines. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Stocks, Cryptos, Futures, Commodities |

| Demo Account | Yes |

| Min. Deposit | $10 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | No |

| Islamic Account | No |

| Commodities |

|

| CFDs | My tests found 200+ CFDs across six asset classes such as forex, crypto and stocks with leverage up to 1:500. The broker has a low minimum deposit requirement of $10 so new and budget-conscious CFD traders can get started easily. |

| Leverage | 1:500 |

| FTSE Spread | 0.77 |

| GBPUSD Spread | 1.2 |

| Oil Spread | 0.87 |

| Forex | Hugo's Way offers a good selection of 50+ major, minor and crosses with leverage up to 1:500 on the MT4 terminal. I was glad to see micro lot (0.01) trading available, as well as hedging, scalping and news trading strategies. |

| GBPUSD Spread | 1.2 |

| EURUSD Spread | 0.5 |

| GBPEUR Spread | 0.4 |

| Assets | 55 |

| Stocks | I thought the range of 100+ European and US shares was a little light compared to alternatives. I was happy to find some popular stocks like JPMorgan Chase and Coca Cola, but I think dedicated stock traders will not have enough here to diversify. |

| Cryptocurrency | I was impressed with the 35 crypto pairs on offer 24/7 on the MT4 terminal. Some of my favorites are available including BCH/BTC, ETH/BTC and BTC/USD with leverage up to 1:100. Traders also benefit from Bitcoin deposit options, though this might feel restricting for some. |

| Coins |

|

| Spreads | Variable |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Hugo’s Way offers UK clients the opportunity to trade stocks, forex, indices, crypto, and more with STP/ECN connectivity. Hugo’s Way has its headquarters offshore and is not licensed, so your funds may not be safe if you choose to trade with this brand. In this broker review, we will cover the pros and cons of signing up with Hugo’s Way. We also outline how to create a Hugo’s Way account, how to make a deposit, typical live spreads, available instruments and more.

Our Take

- Hugo’s Way could be suitable for scalpers, hedgers or algo traders looking to invest in forex or cryptocurrencies via the MetaTrader 4 platform

- The broker offers free deposits and withdrawals, though payment options are limited to crypto methods

- The lack of educational resources and additional trading tools is disappointing and doesn’t match up with competitors

- The broker’s lack of investor security and unregulated status is a major drawback

Market Access

Our team were not particularly impressed with the broker’s small selection of 100+ CFD instruments, with just 70+ shares.

With that said, the forex and cryptocurrency selection is decent, so traders looking to buy and sell traditional currencies and crypto-assets may be well suited to Hugo’s Way.

- Energies – UK and US oil

- Metals – Three precious metals; gold, silver and platinum

- Indices – 10 global stock indexes such as FTSE100, US30, NAS100 and ESP35

- Forex – 55+ major, minor, and exotic currency pairs including GBP/USD, EUR/USD, AUD/CAD, and GBP/JPY

- Shares – 70+ global company stocks such as Apple, BNP Paribus, Goldman Sachs, Johnson & Johnson, and McDonald’s

- Cryptocurrency – 35+ crypto/crypto and crypto/fiat digital currency pairs including BITCOIN/USD, DOGECOIN/USD, NEO/BITCOIN, and ETHEREUM/BITCOIN

Fees

Hugo’s Way is transparent when it comes to its trading fees, though it is a shame that these are fairly high across the board.

All customers will be liable for a $5 commission fee per lot traded, alongside rather uncompetitive variable spreads. For example, I was offered live spreads of 2 pips on the GBP/USD and 2.4 pips on the EUR/GBP. This is quite poor considering ECN brokers such as CMC Markets offer spreads on the same pairs for 1.9 pips and 1.1 pips, respectively, with no commissions.

The good news is that the broker does not charge any deposit or withdrawal fees. Swap fees will apply for positions held overnight, which is standard.

We did not find any indication of an inactivity charge, but traders should bear this in mind.

Account Types

Hugo’s Way offers just one live account type, providing you with STP/ECN connectivity.

You can open positions with a minimum trade size of 0.01 lots.

I thought it was a shame that high-volume investors or those with a higher budget won’t be able to benefit from perks via an advanced account option, such as competitive fees or more generous leverage.

However, we did like that there are no trading restrictions. This means scalping, hedging and news trading are permitted.

We were disappointed that Hugo’s Way does not offer an Islamic account, a disadvantage vs OspreyFX and FXChoice.

How To Open A Hugo’s Way Account

- Add your name, email address, date of birth, and gender in the sign-up form

- Create and confirm a password

- Review and agree to the T&Cs and select ‘Sign Up’

- Confirm your application by verifying your account via the link in your inbox. You will be redirected to the login screen

- Sign in using your registered email address and password. Select ‘Login’

- Select ‘Trading Accounts’ from the side menu and make a deposit

- Download the MetaTrader terminal and start trading

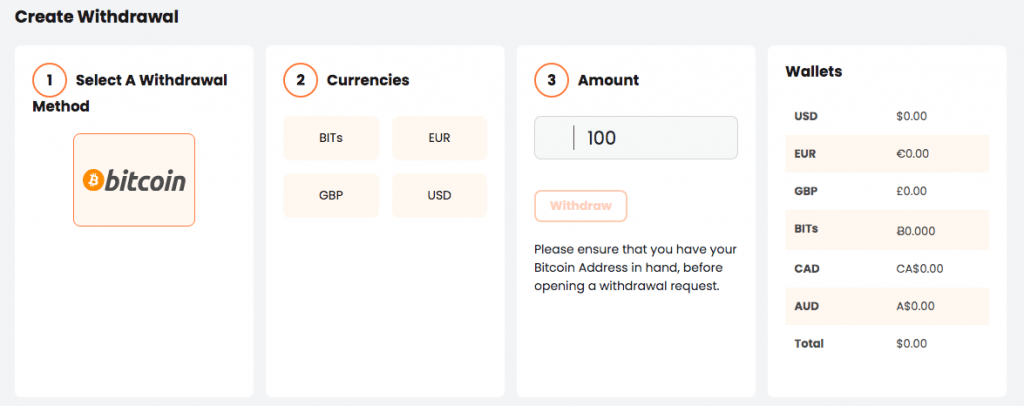

Funding Methods

Deposits

Hugo’s Way deposit options are very limited. You can add funds to a live trading account using direct Bitcoin deposits or Bitcoin via Instacoins. Instacoins is a third-party terminal that allows customers to purchase Bitcoin using a bank wire transfer or credit/debit card.

We were disappointed to find that you cannot add fiat money to your account. The broker’s minimum deposit requirement varies by the payment method used. This is £10 for Bitcoin or £50 if using Instacoins services, which I did find reasonable.

We were satisfied with the average funding time of between one and six hours, though blockchain confirmation times can cause delays. We were also pleased to see a GBP account base currency. There are also no fees for either method.

How To Make A Deposit

I thought the account funding process was fairly straightforward:

- Sign in to your Hugo’s Way account dashboard

- Select ‘Deposit Funds’ from the side menu

- Choose either ‘Bitcoin’ or ‘Fast Deposit via Instacoins’

- Choose a wallet address to add the money and input the value to fund. Click ‘Deposit’

- Select ‘Proceed to Instacoins’ from the following window pop out

- Follow the on-screen instructions to use your payment method of choice

Withdrawals

Hugo’s Way has a minimum withdrawal limit of £10 (equivalent in BTC), which I found competitive. There is no maximum limit.

The brand aims to process all withdrawal requests within 24 hours which is industry standard, however, you will then need to wait for the relevant blockchain confirmations before your money is available.

Similar to deposits, there is no withdrawal fee which we were pleased with. Note, though, that you will need to complete fund requests in Bitcoin so you may be liable for currency conversion fees to GBP after the withdrawal.

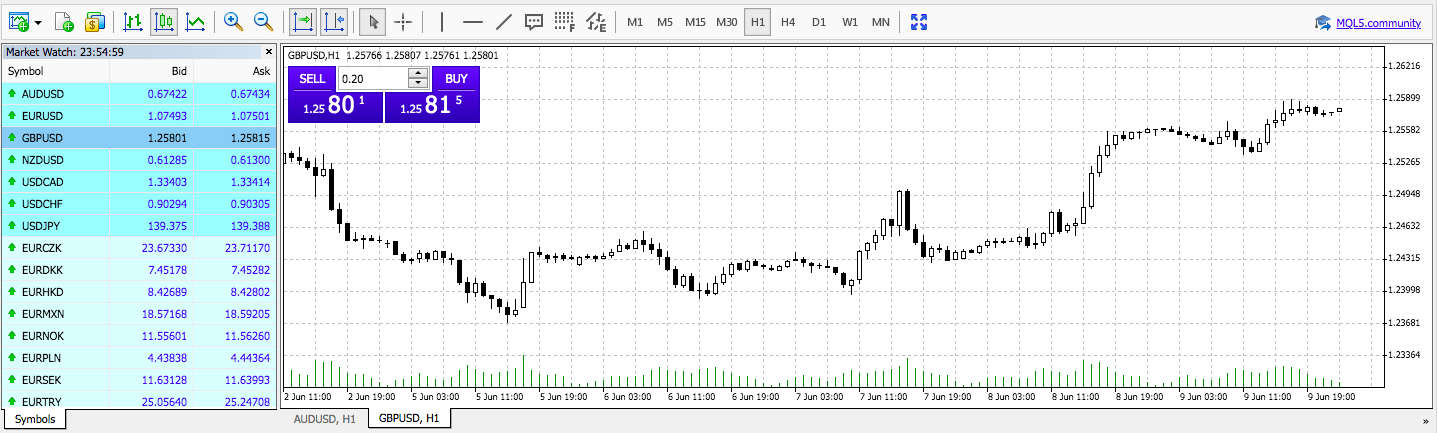

Hugo’s Way Platform

Hugo’s Way only offers MetaTrader 4 (MT4). It is a shame that the broker does not offer any additional options or a proprietary terminal. Nonetheless, MT4 is a top choice among beginners and experienced investors alike, thanks to its impressive customisation capabilities and charting tools.

One of the best features of the third-party trading platform is its automated trading function. You can set up expert advisors (EAs) or bots to run custom strategies, indicators, or scripts. I like that you can set the EAs to monitor charts 24/7 and open and close positions on your behalf.

Other useful functionality includes:

- 23 analytical objects

- Nine chart time frames

- Financial news stream and custom price alert tools

- Three order execution modes and four pending order types

- Single-thread strategy tester with MQL4 programming language

- 30+ integrated technical indicators plus the option to download 1000+ additional including the harmonic pattern scanner

MT4

You can download MetaTrader 4 to desktop devices including on Windows and Mac, or use it as a web terminal through all major browsers such as Google Chrome. Alternatively, you can use the MT4 mobile app, compatible with iOS and Android devices.

The mobile application provides Hugo’s Way customers access to all the powerful tools and features of the PC versions, though provides smaller screen charting and zoom functionality. I like that you can view the live news stream, set price alerts, and review margin requirements in real time from any location.

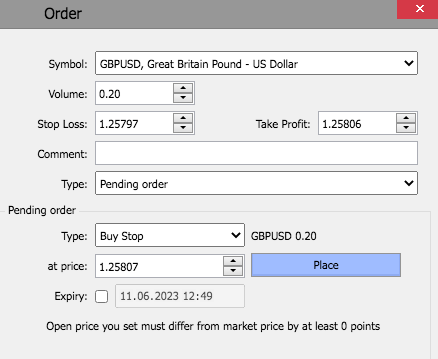

How To Trade

It is quick and simple to open new positions on the MetaTrader 4 platform. One way to open a position is to find the instrument of interest via the ’Market Watch’ window. Double-click on the product to open the order window. You can follow the order screen down and complete the requirements:

- Volume

- Stop Loss/Take Profit (if desired)

- Comment (optional)

- Order type

You then click ‘Sell’ to open a short position or ‘Buy’ to open a long position.

Demo Account

An MT4 demo account is offered to prospective clients, which we found competitive when we compared Hugo’s Way vs XM and EagleFX.

We found the broker’s demo account offers an unlimited time limit, leverage up to 1:500 (available in increments of 100), and a virtual balance of up to £1 million. You can practise trading indices, forex, crypto, and more, risk-free.

To sign up, you can either register by selecting ‘Demo Sign Up’ from the footer of the broker’s website and completing the online application form. However, we found it quicker to follow the below process:

- Choose ‘Web Trader’ under the ‘Trading’ header on the broker’s homepage

- Add your name and email address to the ‘Open An Account’ pop-out screen (highlighted in red)

- Agree to the T&Cs and select ‘Next’

- Login credentials including your investor password will be displayed on the following screen (make note of these)

- Click ‘Complete’

UK Regulation

Hugo’s Way is an unregulated broker, registered in the Seychelles. Lack of government or financial watchdog oversight means you may not be protected if the brand were to face financial difficulties.

Having said that, the broker does claim to hold client funds in segregated accounts with tier-one institutions such as HSBC and Barclays. It is difficult for us to confirm the credibility of this claim, alongside the brand’s risk management protocols in place.

We did not find any evidence of negative balance protection but KYC compliance is adhered to, with ID verification and proof of address required at sign-up.

As you won’t be covered by the UK’s Financial Conduct Authority (FCA), you will be unable to seek compensation from the FSCS. This offers reimbursement of up to £85,000 in the case of business insolvency, and is a serious drawback of trading with Hugo’s Way.

We did like that you can enable two-factor authentication (2FA) as an additional security protection measure. Hugo’s Way implements 2FA via Google Authenticator. To enable it, login to your client area. Select ‘Enable’ from your dashboard interface under the ‘Account Info’ header. Scan the QR code on the screen of the dashboard and enter the verification code from your mobile.

Leverage

As an unregulated firm, Hugo’s Way can offer substantial leverage with no restrictions. Though this is not as high as some alternative brands, often in the region of up to 1:1000, you can trade forex pairs and metals with the highest leverage of 1:500. The leverage for other instruments is lower:

- Stocks – 1:20

- Indices – 1:200

- Energies – 1:100

- Cryptocurrency – 1:100

Hugo’s Way has a 100% margin call and a 70% stop-out level.

Bonus Deals

We were not offered any bonuses or financial incentives when signing up for a Hugo’s Way live account. This includes a friends and family referral scheme. This is disappointing for an unregulated brand given no stipulations for reward rules and eligibility.

You can however use the brand’s generous leverage to boost your position sizes using borrowed funds.

Extra Tools & Features

Our experts rank Hugo’s Way negatively when it comes to additional tools. If you’re looking for education, trading tools, or expert analysis, you will be disappointed.

There is a very basic ‘Insights’ section, where we did find some suitable information for beginners, but it does lack YouTube video integration, diagrams, and user guides. Some of the basic topics include ‘What Is Forex?’ and ‘How To Become The Best Trader?’.

We would like to see essential education such as a keyword glossary or a pip calculator introduced in the future.

I was also disappointed that there is no copy trading function, VPS hosting, or strategy guides. Look out for an MT4 plugin for trade duplication services.

Hugo’s Way Customer Service

Hugo’s Way customer support is available 24/7 which is good to see, but contact methods are limited. You can get help via live chat or online contact form only. There is no phone number or email address provided. That being said, when we tested the chat function, we were pleased with the response time of less than two minutes.

The live chat function is available via the orange logo at the bottom right of the website. You can submit your query via the support form on the ‘Contact Us’ page.

You can also find help using the FAQ section on the broker’s website. We liked that information is sorted into categories including account funding, account management, and trading. The search function is very helpful, meaning you can find useful pages based on keywords.

Company Details & History

Hugo’s Way is an offshore broker, registered under Hugo’s Way Ltd. The brand was founded in 2017 and is registered in the Seychelles. Company information is quite limited, which does raise concerns about the brand’s credibility.

The broker offers ECN or STP execution, with liquidity sourced from 50+ banks and financial institutions.

Trading Hours

Hugo’s Way trading hours vary by instrument. You can trade forex with the broker 24/5, due to the four major financial market opening times. Cryptocurrency has more flexibility, available to trade 24/7, with no market closures. Stocks, on the other hand, will be available to trade during their respective exchange opening times.

We were disappointed that Hugo’s Way does not publish specific trading hours by instrument, or an economic calendar with public holiday dates or major events impacting trading hours.

The MetaTrader server is set to a GMT+2 or GMT+3 time zone, depending on daylight saving hours. You can view trading hours by product by right-clicking on the instrument and choosing ’Specification’.

Should You Trade With Hugo’s Way?

There was nothing particularly stand-out when we used Hugo’s Way. The lack of additional services and trading tools such as educational content or a proprietary copy trading service is disappointing. The brand is also unregulated, with expensive trading fees which don’t bolster our ranking.

FAQ

Is Hugo’s Way A Legit Broker?

Hugo’s Way is a legitimate brokerage, registered to an office location in the Seychelles. However, the broker is unregulated, meaning there is no oversight from the Financial Conduct Authority, and fund safety is not guaranteed. We also found that trading fees are expensive, a small instrument list, and a lack of additional extras such as education, VPS hosting, and copy trading services.

Does Hugo’s Way Have Low Trading Fees?

Our experts did not find Hugo’s Way trading fees competitive. You will be liable for a $5 commission fee per lot traded, plus variable spreads with major forex pairs with over 1 pip. Alternative ECN providers will typically provide raw, tight spreads from 0 pips in times of minimal volatility.

Is Hugo’s Way A Regulated And Trustworthy Broker?

Hugo’s Way is not regulated and does not provide the same investor protection as FCA-regulated brokers. As such, we cannot confirm that the brand is safe or trustworthy. With that said, the broker does claim to segregate client funds with tier-one institutions and there have been no recent scam reports online.

Is Hugo’s Way Good For Beginners?

Hugo’s Way is best for more experienced traders looking for unrestricted trading in traditional and digital currencies, with leverage up to 1:500 and automation capabilities in MT4. Beginners may struggle with the lack of educational resources and limited flexibility with payment methods. The lack of regulation and client protection is also a major drawback.

Is Hugo’s Way An ECN Broker Or A Market Maker?

Hugo’s Way uses an ECN/STP pricing model and is therefore not a market maker broker. All orders are fulfilled directly through the brand’s 50+ liquidity providers, including tier-one banks.

Article Sources

Compare Hugo's Way with Other Brokers

These brokers are the most similar to Hugo's Way:

- FP Markets - FP Markets is an ASIC- and CySEC-regulated broker that offers forex and CFD trading on a broad range of assets through the MT4, MT5 and IRESS platforms. With trading available through standard and raw spread accounts on thousands of international stocks, forex, indices, commodities, cryptocurrencies, bonds and ETFs, this broker has some of the most comprehensive market coverage available. FP Markets also offers a full range of additional features, including educational resources and access to powerful software such as Autochartist.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

Hugo's Way Feature Comparison

| Hugo's Way | FP Markets | Pepperstone | IG Index | |

|---|---|---|---|---|

| Rating | 1.5 | 4 | 4.8 | 4.4 |

| Markets | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities |

| Minimum Deposit | $10 | $100 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | - | ASIC, CySEC, ESMA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4 |

| Leverage | 1:500 | 1:30 (UK), 1:500 (Global) | 1:30 (Retail), 1:500 (Pro) | 1:30 (Retail), 1:222 (Pro) |

| Visit | ||||

| Review | Hugo's Way Review |

FP Markets Review |

Pepperstone Review |

IG Index Review |

Trading Instruments Comparison

| Hugo's Way | FP Markets | Pepperstone | IG Index | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | No | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | Yes | Yes | No | Yes |

| Options | No | No | No | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | No | No | Yes |

| Spreadbetting | No | No | Yes | Yes |

| Volatility Index | Yes | Yes | Yes | Yes |

Hugo's Way vs Other Brokers

Compare Hugo's Way with any other broker by selecting the other broker below.

Popular Hugo's Way comparisons: