Hirose Review 2024

|

|

Hirose is #11 in our rankings of binary options brokers. |

| Hirose Facts & Figures |

|---|

Hirose is a regulated and dedicated forex and binary options trading broker. |

| Awards |

|

|---|---|

| Instruments | Forex, binary options |

| Demo Account | Yes |

| Min. Deposit | $20 |

| Mobile Apps | Yes |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FCA, SC |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Yes |

| Signals Service | Yes |

| Islamic Account | No |

| Forex | Trade 45+ forex pairs with 1:30 leverage. |

| GBPUSD Spread | 0.9 |

| EURUSD Spread | 0.8 |

| GBPEUR Spread | 0.7 |

| Assets | 45+ |

| Binary Options | Make high or low decisions based on the direction of the financial markets. |

| Payout Percent | 90% |

| Ladder Options | No |

| Boundary Options | No |

Hirose Financial UK is an online CFD broker based in London and regulated by the FCA. Specialising in forex trading, the broker aims to deliver consistently low spreads on two leading platforms. In this review, we cover the company’s background, the broker’s fee structure, account types, trading tools, and more. Our team also share their verdict on trading with Hirose.

Our Take

- Hirose could be worth considering for forex traders interested in scalping, hedging or automated trading

- The broker offers competitive forex spreads, powerful trading platforms and robust FCA licensing

- However, the lack of education and research is a major setback

- The brand also does not offer any non-forex assets or copy trading tools

Market Access

Hirose is one of the few brokers in the UK that solely offers forex, facilitating the trading of 50 currency pairs through leveraged CFDs. All major pairs are available, as well as minors and exotics.

We like that Hirose offers a strong selection of tradable forex pairs, including some exotics that aren’t widely available at other CFD brokers. However, the lack of access to stocks, commodities and indices is a noticeable drawback and means the brokerage is suitable for forex traders only.

Supported forex instruments include:

- EUR/USD

- GBP/USD

- EUR/GBP

- CAD/JPY

- AUD/NZD

- HKD/JPY

- USD/TRY

- ZAR/JPY

Fees

We were pleased to see that Hirose UK does not charge commissions on trades and instead rolls these into the spreads.

Spreads are typically from 0.7 pips, with GBP/USD starting from 0.9 pips and GBP/JPY at 1.7 pips. These are competitive compared to popular brokers such as CMC Markets and Pepperstone.

Hirose also charges through some payment methods as well as rollover (financing) swaps. For example, the GBP/JPY rolling sell rate is -0.13363 and the rolling buy rate is 0.09587.

We appreciated that the broker doesn’t charge any inactivity fees, contrary to other brokers which do penalise you if you leave your account inactive. However, the charge with some deposit methods is not ideal and can be avoided with alternative brands.

Account Types

Hirose UK offers two live accounts: Lion Trader and MetaTrader 4. The account types are very similar in many aspects, with the main difference being the platform.

We particularly liked that automated traders are catered to on both platforms, with the availability of Expert Advisors (EAs). Hedgers and scalpers will also be pleased to know that there are no restrictions on their respective strategies. These can also be tested fully in the Lion Trader or MT4 demo accounts.

Another perk for us is that Hirose execution operates on a no-dealing desk (NDD) model, so the broker allows clients to trade directly with interbank rates.

Other account features worth being aware of include:

- The platforms are available on desktop, web, iOS and Android

- Margins of 3.33% for major pairs and 5.00% for minor pairs

- Minimum order distance of 3 pips

- Leverage up to 1:30

- 50% initial margin

Traders should note that minimum lot sizes are 0.01 and 1 in MT4 and LionTrader, respectively.

Overall, we think that the accounts offered are sufficient for most traders, however, the lack of a swap-free Islamic account or professional account will be a hindrance for some.

How To Open An Account

I thought the joining process was slick and hassle-free. To start trading:

- Open the Hirose application button

- Fill in your details, including name, country of residence and phone number

- Provide identification (such as a passport or driver’s license) to verify your account

- Wait for your details to be verified by the broker

- Hirose will send your account details to your email

- Log in to your account and deposit funds

Payment Methods

I was disappointed to see that Hirose Financial UK offers only two payment methods for both platforms: bank wire and Neteller. It is a shame that not even bank card funding is available since this is a standard offering at most brokers.

Deposits

Both payment methods facilitate GBP, USD, and EUR and fees are between 2-5% for Neteller. On the plus side, Neteller is fee-free if you are using LionTrader. Bank wire transfers in both platforms are also fee-free, though your bank may charge their own fees.

You can expect Neteller deposits to be processed between 10 – 15 minutes during business hours, whilst bank transfers can take up to 3 working days.

There is also a minimum deposit requirement of $20 (or currency equivalent) for Neteller and $50 (or currency equivalent) for bank wire. This is a slight drawback for me since many brokers such as XM require a nominal amount of $5.

Withdrawals

You must also withdraw via bank transfer or Neteller, with a minimum withdrawal of $20 (or currency equivalent) permitted. I did find a withdrawal fee of up to $8.50 for bank wire transfers, but this is lower than some other competitors. Thankfully, Neteller withdrawals are free.

Neteller

- Fees: Free

- Minimum withdrawal: 20 USD, EUR, GBP

- Maximum withdrawal: 5,000 USD (£4,000) per transaction

- Settlement: 24-48 hours

Local (Domestic) Bank Wire Transfers

- Fees: For GBP – £6.00, for USD – £8.50, for EUR – £8.50, per transaction

- Minimum withdrawal: 20 GBP, USD, EUR

International Wire Transfers

- Fees: For GBP – £8.50, for USD – £8.50, for EUR – £5.00, per transaction

- Minimum withdrawal: 50 GBP, USD, EUR

Overall, it would be good to see a better range of payment methods if Hirose UK is to compete with the top brands. Not offering debit or credit card transfers at the minimum is very disappointing.

Trading Platforms

Our experts are glad that Hirose UK offers two powerful and reliable trading platforms to investors: MetaTrader 4 and LionTrader (ActTrader).

When we used Hirose, we found that both platforms provide a strong suite of resources for new traders and advanced customisable features for more experienced investors.

MetaTrader 4

MetaTrader 4 (MT4) is one of the most popular and accessible online trading platforms. I rate the wide range of built-in features that allow for complex trading strategies to be devised.

I particularly value its customisability, with indicators and EAs that can be created and modified easily using the platform’s bespoke programming language, MQL4.

My favourite functionality includes:

- 9 chart timeframes, from 1-minute to 1-month

- Over 60 technical indicators and graphical objects

- 4 pending order types

- In-built email system

I like that the platform can be easily accessed through the desktop application, on iOS and Android mobile devices, or through the web app, so I can trade seamlessly between devices.

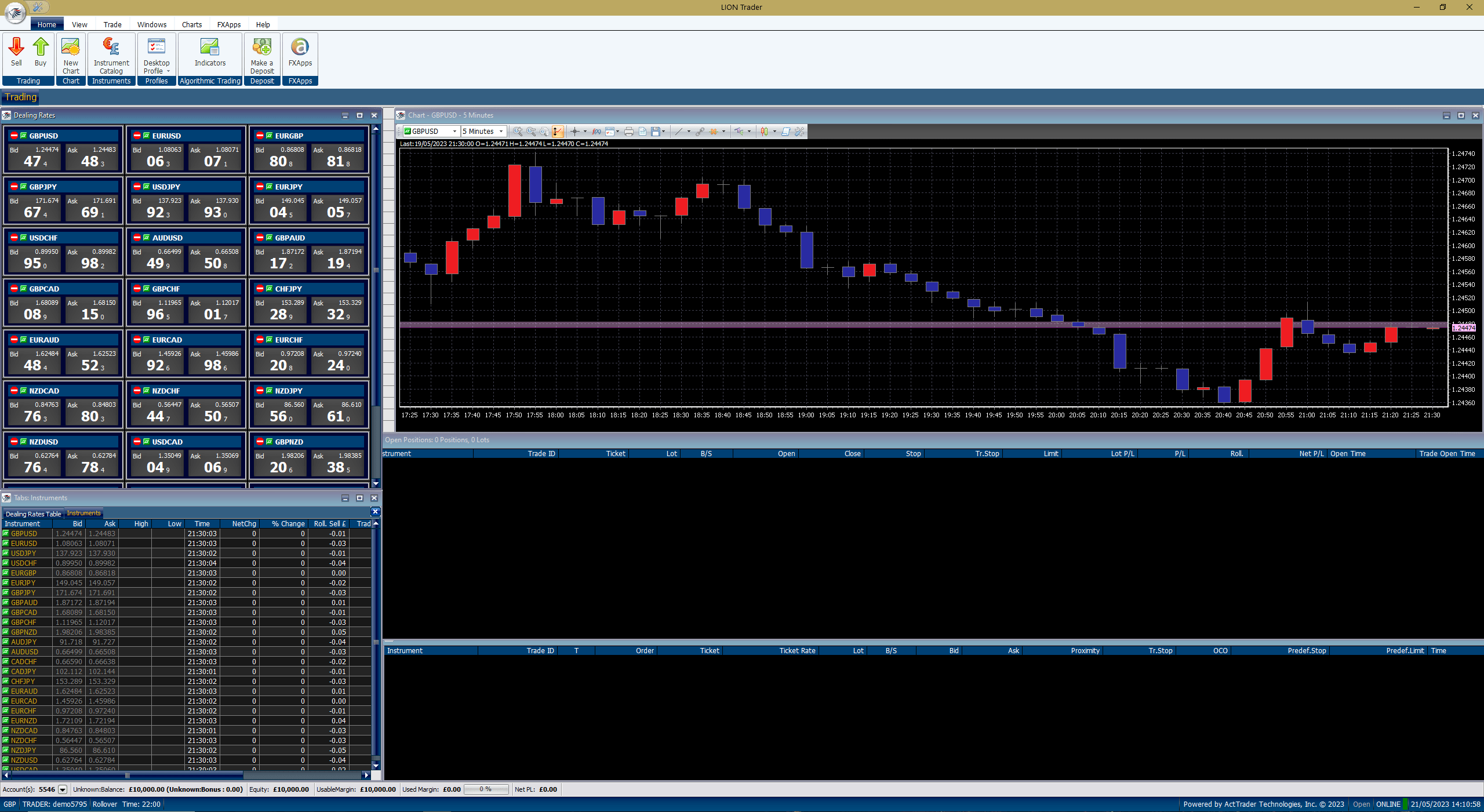

LION Trader

LION Trader is Hirose UK’s customised version of the reputable ActTrader platform. I liked that this powerful platform offers easy single-click trading and an intuitive design, making it a good solution for newer traders.

The platform can be accessed through the desktop application, which can be downloaded from the broker’s website, or directly via the web app.

Some of my favourite features include:

- 50 technical indicators plus downloadable strategies

- One-click trading directly from the charts

- The Actfx scripting language

- Automated trading bots

- 11 timeframes

- Price alerts

Overall, I found the platforms are both sophisticated and feature-rich, perfect for traders looking to apply complex strategies.

I would recommend the LION Trader platform for beginner traders because of its intuitive design and ease of use. However, MT4 includes a more comprehensive suite of tools, indicators and learning resources for all experience levels.

LION Trader Platform

Hirose App

We were pleased to see that clients can access both the MetaTrader 4 and LION Trader mobile apps, available for iOS and Android devices.

These provide a great way to watch the markets and perform technical analysis while on the go. We were happy to see that both apps come with a range of mobile-adapted technical features, including the ability to set price alerts, set up indicators, and place orders.

Overall, we prefer the MetaTrader 4 mobile platform because of its wider range of tools and sleeker design. We are also more familiar with the app, like many other traders.

While the LION Trader mobile application is easy to use, it has a much lower user rating and reviews than the MT4 platform (2.8/5 compared to 4.3/5) on the Google Play Store.

Leverage

Hirose offers a maximum leverage of 1:30 on major forex pairs, as per leverage requirements set by the FCA. This ensures that you cannot magnify losses too significantly. However, it is still possible to lose money.

Our team recommend taking advantage of any risk management tools available in the platform, including stop losses.

Demo Account

Both Hirose platforms offer free demo accounts so you can practice implementing strategies without risking real funds. I was able to open a LionTrader demo within minutes, receiving $10,000 in pre-loaded virtual money.

How To Open A Demo Account

- Go to the “Platforms” tab on the websites and choose your preferred platform

- Click the “Free PRACTICE Account” button

- You will then be taken to a registration page (LionTrader) or be asked to download MT4

- Filling out the registration will give you your LionTrader demo account details

- In MT4, you can choose to open a demo account following the instructions

- Log in to your respective platform and start practising

LionTrader Web App Demo

UK Regulation

Our team was pleased to see that Hirose UK is regulated by the Financial Conduct Authority (FCA), the gold standard for financial regulation.

The regulator ensures that brokers follow protocols to minimise financial foul play against traders. This includes the segregation of funds, ensuring the broker does not spend clients’ funds for their day-to-day operating costs.

Furthermore, FCA-regulated brokers are covered by the Financial Services Compensation Scheme. This is a scheme that allows traders to claim up to £85,000 in compensation if the broker does not meet its financial commitments.

Hirose Financial’s FCA license number is 540244.

Education & Trading Tools

While using Hirose, I found a few sections dedicated to trading education, aimed largely at new traders. This tab has several sections including a glossary, a platform trading manual, a short guide to the basics of trading forex, technical analysis explanations, summaries of key economic indicators, and information on micro lots.

Overall, I thought the features were good for covering the basics for newer traders but are insufficient to fully teach beginners. Award-winning brokers such as IG Index offer a comprehensive suite of educational materials along with webinars and seminars. It would have also been nice to see some additional research tools such as an economic calendar. A copy trading feature would be another welcome bonus for new traders.

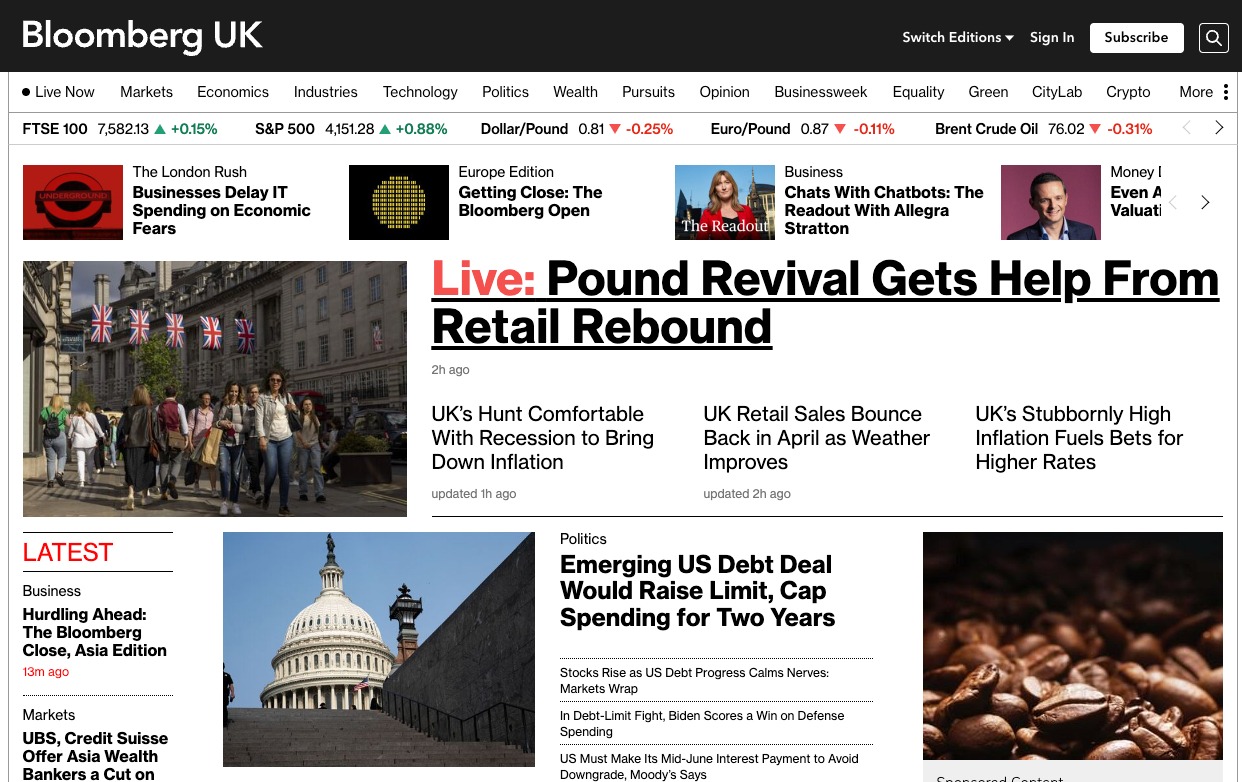

With that said, I was impressed to see that the LionTrader platform offers access to reputable news site, Bloomberg. This is a feature typically found at market-leading brokers, so it’s a bonus for us.

Bloomberg UK Market News

Customer Service

When testing Hirose, we found several different contact avenues that you can go down, including a contact form, live chat support, email, telephone and Skype. Office hours are Monday to Friday, 9:00 am to 6:00 pm.

- Contact form: Located on the Contact Us page on the website

- UK telephone number: +44 (0) 20 3089 3880

- Live chat: Located at the top of the website

- Email Address: info@hiroseuk.com

Skype screen share details can be obtained by submitting a request from the Contact Us page, which I thought was useful for traders who require more personalised support.

Overall, I find the range of support methods decent, only missing social media or personal account manager support.

Company History & Overview

Hirose Financial UK is the UK arm of the Hirose Group, based in London.

The Hirose Group was originally founded in Japan in 2004 by Hirose Tusyo, a foreign exchange service. The group expanded, opening the first FCA-regulated Japanese forex broker in 2010.

The group provides its services to over 200,000 clients worldwide and facilitates over $200 billion (£150 billion) of forex trading every month.

The firm is FCA regulated under license number 540244 and operates under UK company registration number 07423885.

Overall, we are comfortable that the company is legitimate and not a scam.

Trading Hours

Hirose operates 24-hour forex trading from Sunday night to Friday night, UK time.

Overnight trading is not possible, but the wide range of global currency pairs available means that there will always be some pairs that are actively tradable during all times of the day. This means you can essentially trade for 24 hours a day if you wish.

Bonuses & Promotions

As we expected, Hirose does not offer any types of bonuses or gifts for trading with them, which aligns with strict FCA restrictions against unfair trading incentives. Instead, clients can make use of the extra tools and features outlined above.

Should You Trade With Hirose Financial UK?

Hirose UK offers traders competitive spreads and zero commission trading on a wide range of forex pairs, while also giving traders access to two sophisticated trading platforms. Furthermore, the broker is regulated by the FCA and has built a solid reputation.

However, its shortcomings are apparent, with a limited number of payment methods, zero non-forex assets, and a mediocre education centre and additional tools. Ultimately, the broker is a middle of the road forex broker.

FAQ

Is Hirose UK Regulated?

Hirose UK is a legit online forex broker regulated by the Financial Conduct Authority and should be relatively safe to use. The stringent FCA restrictions should ensure traders are treated fairly by the broker and are entitled to protective measures such as negative balance protection. As such, we have given Hirose a high trust score.

Does Hirose UK Offer Stocks And Shares?

Hirose Financial UK is a pure forex broker, offering no other types of tradable instruments. The broker does not offer indices, commodities and stocks, or other trading vehicles like options or futures. This to quite uncommon in today’s financial market and a notable drawback.

Which Trading Platforms Does Hirose Support?

Hirose supports the MetaTrader 4 and LionTrader platforms. LionTrader is a customised version of the ActTrader solution offering the broker’s full selection of 50 currency pairs. MetaTrader 4 is a widely used trading platform, though we found that only 46 currency pairs are available when using MT4 with Hirose.

Is Hirose UK A Halal Broker?

Hirose UK does not offer a halal Islamic trading account. Swaps have to be paid on all account types, thus making this broker not the best for Muslim traders.

Does Hirose Offer A Deposit Bonus?

Hirose UK does not offer any types of deposit bonuses or welcome rewards. This falls in line with the regulatory oversight provided by the FCA, which restricts the use of trading incentives.

Article Sources

Compare Hirose with Other Brokers

These brokers are the most similar to Hirose:

- Grand Capital - Grand Capital is a MetaTrader broker with welcome bonuses, trading competitions and an intuitive copy trading service. Several account types and 400+ assets provide trading opportunities for various types of investors and strategies. New users can also open an account and start trading in a matter of minutes.

- World Forex - World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

- Dukascopy - Dukascopy is an online broker operated by a Swiss-regulated banking group. It offers a good selection of 500+ markets, with forex, stocks, gold, ETFs, indices, bonds and cryptocurrencies available. It also offers flexible trading opportunities through the choice of CFDs or binary options. Traders will use MetaTrader 4 or a proprietary platform that is well-suited to automated trading.

Hirose Feature Comparison

| Hirose | Grand Capital | World Forex | Dukascopy | |

|---|---|---|---|---|

| Rating | - | 3.9 | 4 | 3.6 |

| Markets | Forex | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto |

| Minimum Deposit | $20 | $10 | $1 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, SC | FinaCom | SVGFSA | FINMA, FCMC, JFSA |

| Bonus | - | - | - | - |

| Education | No | No | No | Yes |

| Platforms | MT4, ActTrader | MT4, MT5 | MT4, MT5 | MT4 |

| Leverage | - | 1:500 | 1:1000 | 1:200 |

| Visit | ||||

| Review | Hirose Review |

Grand Capital Review |

World Forex Review |

Dukascopy Review |

Trading Instruments Comparison

| Hirose | Grand Capital | World Forex | Dukascopy | |

|---|---|---|---|---|

| Binary Options | Yes | Yes | Yes | Yes |

| Ladder Options | No | No | No | No |

| Boundary Options | No | No | No | No |

| CFD | No | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Crypto | No | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | No | Yes | Yes | No |

| Copper | No | Yes | No | Yes |

| Silver | No | Yes | Yes | No |

| Corn | No | Yes | No | No |

| Futures | No | No | No | No |

| Options | No | No | No | No |

| ETFs | No | Yes | No | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | Yes | No | No |

Hirose vs Other Brokers

Compare Hirose with any other broker by selecting the other broker below.

Popular Hirose comparisons: