The Fed, Interest Rates and Market Reaction One Day On

The US Federal Reserve confirmed that another rate rise was likely this year, sending the EURUSD below 1.19, and US 2-year yield to its highest level since 2008 on Wednesday.

While the Fed didn’t raise rates (as expected), the “dot plot” firmed up another rate hike in 2017.

One caveat, if you could even call it that, appeared in Yellen’s press conference. The Fed are concerned about inflation being too low on a structural level, although it seems as though they aren’t concerned in the US right now. Time will tell on that one, but keep a close eye on inflation numbers going forwards.

The balance sheet reduction was announced at $10billion a month, as expected. Yellen also confirmed in the press conference that tapering would continue even if rates weren’t increased.

To finish it all off…equity markets closed at a record high on Wednesday.

One day later…

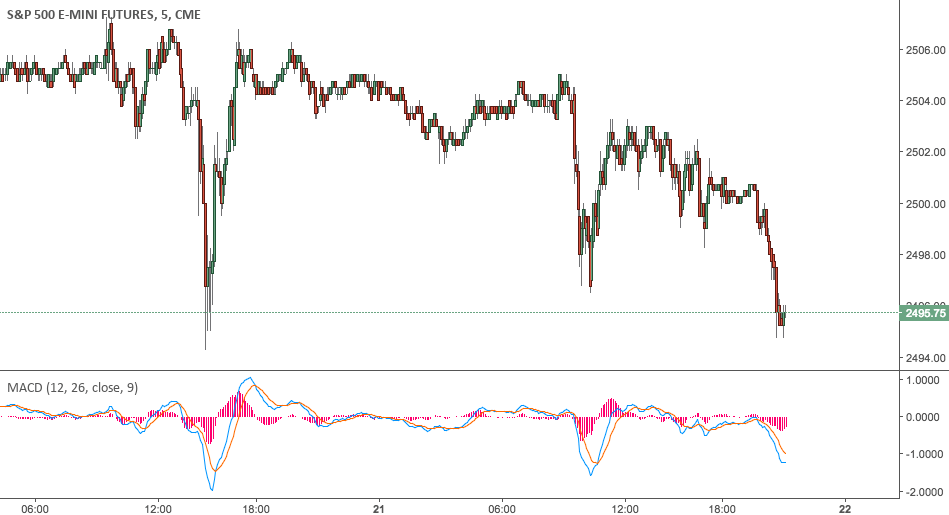

It wasn’t all roses today. Yields remain high, which leaves pretty much anyone who bought US treasuries in the last 9 years underwater. It’s a very interesting proposition. S&P futures were softer, and the Dow failed to make another record high for the first time in days.

Interestingly, the USD was a little soft today, especially against the Euro. The EURUSD has retraced almost 60% of it’s move on Wednesday. If dollar bulls were truely back, you’d expect another move lower from here into the next week or so. Problem is, the Euro bulls are still out in force.

Inflation is the problem, or the lack of it. Should we see continued inflation weakness, the Fed’s rate rises in 2018 will be thrown into question.