EZ Invest Review 2024

|

|

EZ Invest is #83 in our rankings of CFD brokers. |

| EZ Invest Facts & Figures |

|---|

EZ Invest is a CySEC-licensed broker, launched in 2008, that offers trading on popular financial markets through leveraged CFDs. Traders can choose between multiple respected platforms, including MetaTrader software and a user-friendly in-house app. The reliable multilingual customer support team are also on-hand to support new users. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Forex, CFDs, indices, shares, commodities, cryptocurrencies |

| Demo Account | Yes |

| Min. Deposit | $500 |

| Mobile Apps | Yes |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | CySEC |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | Yes |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes (MT4) |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | EZ Invest offers leveraged CFDs on popular asset classes, including forex, stocks, indices and commodities. Execution speeds are decent but a large deposit is needed for the best pricing conditions. |

| Leverage | 1:30 |

| FTSE Spread | 0.2 |

| GBPUSD Spread | 1.1 |

| Oil Spread | 0.01 |

| Stocks Spread | Variable |

| Forex | With over 190 forex spot pairs, EZ Invest outperforms many rivals in terms of access to the currency markets. Users can also choose between desktop software, a webtrader plus a solid mobile app. On the negative side, spreads aren't the tightest on entry accounts. |

| GBPUSD Spread | 1.1 |

| EURUSD Spread | 0.6 |

| GBPEUR Spread | 2.3 |

| Assets | 190+ |

| Stocks | Trade hundreds of stocks from leading countries and economics, including Apple and Amazon in the US. 24/5 support is also available to help new stock traders get started with the broker. |

| Cryptocurrency | EZ Invest offers a narrow selection of popular cryptos paired with the US Dollar and Euro. However crypto-Euro pairs are less common so the broker is a good fit if you want these products. |

| Coins |

|

| Spreads | Floating |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

EZ Invest is an online broker offering multiple assets across three trading platforms. This broker review covers the login process, deposits and withdrawals, demo account and fees. We also look at EZ Invest’s regulatory status and trading accounts. Find out if you should start trading with EZ Invest today.

EZ Invest Headlines

Established in 2008, EZ Invest is a global forex and CFD broker owned by WGM Services Ltd. The company is headquartered in Cyprus and is regulated by the Cyprus Securities and Exchange Commission (CySEC). The broker caters to beginners as well as experienced traders. Whilst EZ Invest is not regulated by the FCA, British traders can open a live trading account.

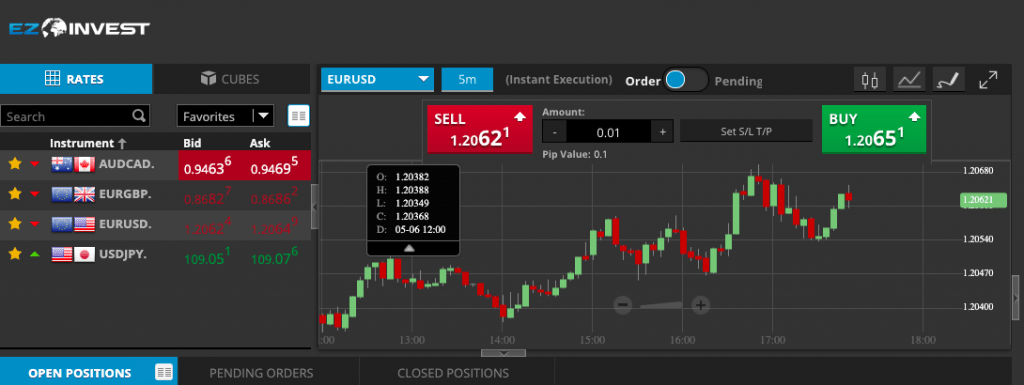

Trading Platforms

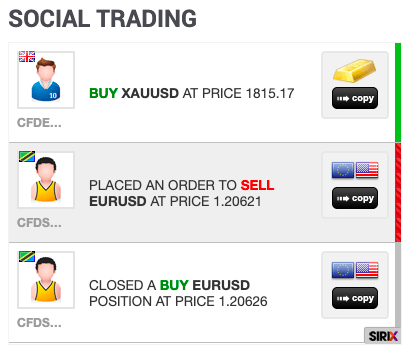

Sirix

Sirix is a user-friendly web-based platform with enhanced trading functionality. The terminal has a built-in social trading feature where you can copy successful users. A live analysis and chart feature also provides access to other trader’s position analysis. Sirix also provides the following:

- Ability to set stops and limits

- Interactive charts and graphs

- One-click order execution

- Direct deposits

Sirix

Sirix

Sirix is available on any computer or laptop via your browser.

MetaTrader 4

MT4 is an industry-leading forex trading platform. It provides access to expert advisors (EAs) and comes equipped with advanced graphing capabilities, charts, indicators and automated trading. In fact, MT4 is fully customisable and traders can integrate more features using MQL4 coding.

MetaTrader 4

MT4 is available to download on Windows PC or Mac.

Products

EZInvest offers a range of tradeable instruments:

- Forex – 50+ major currency pairs i.e. EUR/USD, GBP/USD, EUR/GBP

- Commodities – 30+ commodities i.e. Crude Oil, Gold, Silver and Sugar

- Stock CFDs – 100+ company stocks i.e. 3M, Hilton, Adidas Tesla and Visa

- Indices CFDs – 27+ indices i.e. Nasdaq, FTSE 100, S&P 500 and Dow Jones 30

- Cryptocurrencies – 15+ cryptocurrency i.e. Bitcoin, Dash, Ethereum and Litecoin

Spreads & Commission

EZ Invest offers variable and tight spreads depending on the account type:

- Bronze – Spreads from 3 pips

- Gold & Gold Pro – Spreads from 1.5 pips

- Platinum & Platinum Pro – Spreads from 0.5 pips

There is zero commission on currencies, £10 per lot on futures, 1% on stocks and 0.5% on cryptos across Bronze, Gold and Gold Pro accounts. On the Platinum and Platinum Pro accounts, the only difference is a £7 per lot commission on currencies.

Leverage Review

EZ Invest offers flexible leverage up to 1:200 depending on account type. Leveraged trading allows you to open positions with more capital than you have available. This increases potential profits but also heightens the risk of losses.

Leverage on the Bronze, Gold and Platinum accounts are capped at 1:30, while the Gold Pro and Platinum Pro accounts offer generous rates up to 1:200.

The leverage rates are significantly higher than usually available to UK traders under FCA regulations. Therefore, traders should apply the appropriate risk parameters as part of their strategy. All accounts have a margin call level of 100%.

Mobile Trading

The EZ Invest Mobile Trader allows you to manage and execute trades at any time. The mobile app provides full access to your trading desk, markets and analysis tools, including tick-charts. However, it’s worth noting that it doesn’t have the same level of detail or functionality as the MT4 and Sirix desktop terminals.

EZ Invest Mobile Trader

EZ Invest Mobile Trader is free to download on iPhone and Android via Google Play and the App Store.

Payment Methods

The minimum initial deposit on EZ Invest is $500. EZ Invest does not charge any deposit fees, however, their processing times could not be verified.

The broker offers a number of payment methods:

- Bank wire transfer

- Credit/debit cards i.e. Visa and Mastercard

- E-wallets i.e. Skrill (Bitcoin deposits are subject to a 6.5% fee)

Clients must upload supporting KYC documents (i.e. proof of identity and address) in order to withdraw funds. Trader can simply log in to the EZ Invest Area to upload the documents. Withdrawals are only processed back to the original deposit source. Withdrawal requests are processed within 24 hours.

Demo Account

EZ Invest offers a free demo account where traders can practise strategies in real market conditions without risking cash. The demo account has full access to instruments, the lowest spreads of 0.5 pips and 1:200 leverage. You can also apply any virtual balance to the account. To open an account, you simply need to fill out a registration form with contact details and login credentials.

Deals & Promotions

At the time of writing, EZ Invest does not offer any bonuses or promotions. However, you can always check the EZinvest.com website for any new additions. Always read bonus terms & conditions before accepting an offer.

Regulation

EZ Invest operates under WGM Services Ltd which is authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC). The company’s license number is 203/13. As well as other European Economic Area (EEA) countries, CySEC regulation grants the broker to provide services in the UK under FCA Reference Number 620960. CySEC is a respected and legitimate financial authority, which indicates that EZ Invest is not operating as a scam.

Additional Features

EZ Invest offers a number of resources and tools to enhance the trading experience, including:

- Margin calculator

- Social trading solution

- Weekly economic calendar

- Analyst views (only accessible after sign up)

- Educational tools i.e. the basics of trading and videos

Social trading solution

Live Accounts

EZ Invest traders have a choice of five account types with different features:

- Bronze – This account is suited to beginners and requires a £1,000 opening balance and comes with access to the basic education package.

- Gold – This is one of the broker’s top trading accounts and requires a £25,000 opening balance. It comes with access to the basic education package, exclusive market updates and support, quarterly account reviews, 50% stop out levels, plus a premium algorithmic investing system. Trading on margin is offered up to 1:30.

- Gold Pro – A £25,000 opening balance is required. It includes the same features as the Gold account, except a 25% stop out level is applied. Plus, traders can use leverage up to 1:200.

- Platinum – This account is ideal for advanced traders. It requires a £100,000 opening balance and includes the same features as Gold & Gold Plus, but with a premium educational package and 50% stop out level. Clients can utilise margin rates up to 1:30.

- Platinum Pro – A £100,000 opening balance is required, with the same features as the Platinum account. Increased leverage up to 1:200 is available.

To sign up, visit the ‘Start Trading Now’ link on EZInvest.com. Once you’ve opened an account, you can log in via the ‘Sign In’ button. Contact the customer support team to open an Islamic swap-free account.

Pros

- No re-quotes

- Free mobile app

- Social & copy trading

- Positive broker reviews

- Generous leverage rates

- Access to the MT4 platform

- No dealer desk intervention

- Hedging strategies are supported

- Wide range of financial instruments

- MT4 ECN Bridge technology that provides access to the interbank FX market

Cons

- No MT5 platform

- High minimum initial deposit

- High account opening balance

- No negative balance protection

- Only offers major currency pairs

Trading Hours

EZ Invest clients can trade on the platform 24 hours a day, 7 days a week. Each instrument is subject to different market opening and closing hours. For example, the forex market is only available Monday to Friday. The broker is also closed on bank holidays to align with global financial markets.

Customer Support

You can contact EZ Invest Customer Support via:

- Email – support@ezinvest.com

- UK phone number – +442034142038

- Live chat – found on the bottom right corner of the website

- EZ Invest offices – 11, Vizantiou, 4th Floor, Strovolos 2064, Nicosia, Cyprus

Security

EZ Invest applies a high standard of security to protect personal details, account information and funds. The website is encrypted with advanced SSL certificates and no account information is saved on the broker’s database. The MT4 and Sirix platforms are secured with encryption technology and industry-standard data privacy protocols.

Should You Trade With EZ Invest?

EZ Invest offers a promising trading experience with a wide range of instruments and leading trading platforms. The broker also caters to different skill levels and trading needs through five account types. The major drawback is the high minimum deposit requirements. While the broker is not regulated by the FCA, its CySEC license means the broker can operate in the UK. Overall, we are comfortable recommending EZ Invest.

FAQs

Is EZ Invest Legitimate Or A Scam?

EZ Invest is owned by WGM Services Ltd which is regulated by the CySEC. This body is a highly-respected and legitimate financial authority. Its CySEC regulation allows the broker to operate freely in the UK. Therefore, we are confident that EZ Invest is not a scam.

How Much Capital Do I Need To Trade With EZ Invest?

The minimum initial deposit to open an account is $500 or GBP equivalent. However, the lowest opening account balance requirement is £1,000 on the Bronze account for UK traders.

Does EZInvest Offer A Demo Account?

EZ Invest offers a free demo account with a flexible virtual balance. You can practise strategies in real market conditions without risking actual money. To open a demo account, you simply need to fill out a registration form with contact details and login information.

Which Trading Platforms Does EZ Invest Offer?

EZ Invest offers three trading platforms: the Sirix Web Terminal, MetaTrader 4 and the EZ Invest Mobile Trader. All are free to use and available through the broker’s website.

Is EZ Invest A Good Broker?

EZ Invest is a good all-round broker. It offers a solid choice of instruments, tight spreads, generous leverage and a range of account types. It also has high-security standards and is regulated by the CySEC. As a result, EZInvest.com receives mostly positive customer reviews.

Compare EZ Invest with Other Brokers

These brokers are the most similar to EZ Invest:

- Admiral Markets - Admirals is an FCA- and ASIC-regulated broker with an excellent range of leveraged instruments, including forex, stocks, indices, ETFs, commodities, cryptos and more. The broker supports the MetaTrader 4, MetaTrader 5 and TradingCentral platforms. With both spread betting and CFDs available and thousands of instruments, this broker provides more flexibility than most rivals.

- FP Markets - FP Markets is an ASIC- and CySEC-regulated broker that offers forex and CFD trading on a broad range of assets through the MT4, MT5 and IRESS platforms. With trading available through standard and raw spread accounts on thousands of international stocks, forex, indices, commodities, cryptocurrencies, bonds and ETFs, this broker has some of the most comprehensive market coverage available. FP Markets also offers a full range of additional features, including educational resources and access to powerful software such as Autochartist.

- Swissquote - Swissquote is a Switzerland-based bank and broker that offers online trading and investing. The company has a high safety score and is listed on the Swiss stock exchange. The firm offers a huge range of products, from stocks, ETFs, bonds and futures to 400+ forex and CFD assets. Hundreds of thousands of traders have opened an account with the multi-regulated brokerage. Clients can get started in three easy steps while 24/7 customer support is available to assist new users.

EZ Invest Feature Comparison

| EZ Invest | Admiral Markets | FP Markets | Swissquote | |

|---|---|---|---|---|

| Rating | 2.3 | 3.5 | 4 | 4 |

| Markets | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities |

| Minimum Deposit | $500 | $100 | $100 | $1000 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | CySEC | FCA, CySEC, ASIC, JSC | ASIC, CySEC, ESMA | FCA, FINMA, DFSA, SFC |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | No |

| Platforms | MT4 | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5 |

| Leverage | 1:30 | 1:30 (EU), 1:500 (Global) | 1:30 (UK), 1:500 (Global) | 1:30 |

| Visit | ||||

| Review | EZ Invest Review |

Admiral Markets Review |

FP Markets Review |

Swissquote Review |

Trading Instruments Comparison

| EZ Invest | Admiral Markets | FP Markets | Swissquote | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | No |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | No |

| Futures | No | No | Yes | Yes |

| Options | No | No | No | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | Yes | No |

EZ Invest vs Other Brokers

Compare EZ Invest with any other broker by selecting the other broker below.

Popular EZ Invest comparisons: