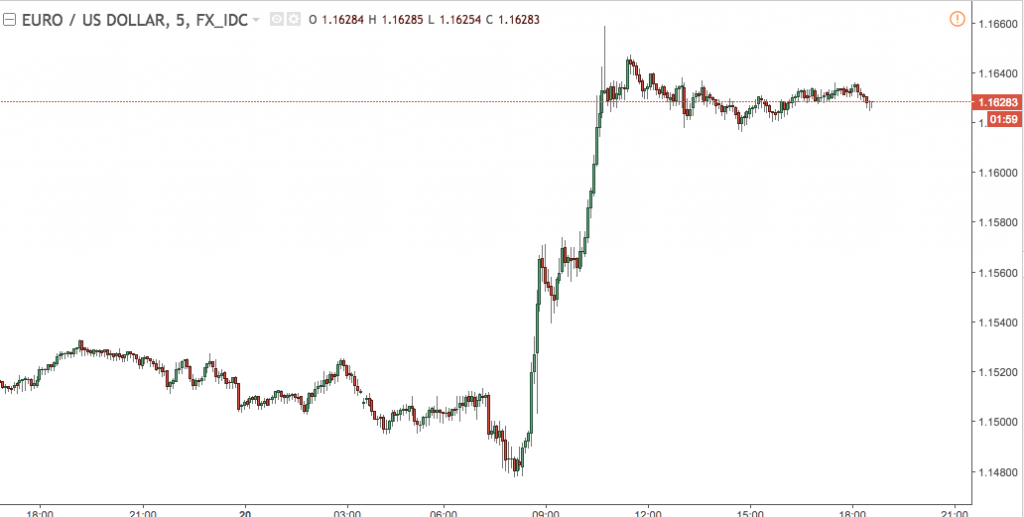

The EUR/USD Breaks 1.16 As Traders Continue Pricing In The End Of QE.

The Euro rallied as high as 1.1650 today, reaching its highest level in over a year, after the ECB left rates on hold and traders called Draghi’s bluff on QE and tapering in 2017. Despite his best attempts, Draghi’s dovish tone failed to keep a lid on the Euro, however September looks increasingly unlikely as the liftoff point for tapering.

Today’s market action tells us a lot about the sentiment towards the Euro and the US Dollar. Traders continue to believe that there is light at the end of the QE tunnel, and think that the next move for the ECB is to start winding down QE. This has been a theme talked about often on this blog, and it is gathering pace…the Euro is heading higher and is driven by a fundamental shift in Central Bank policy. Traders are pricing the end of QE in now. There is no stronger force in financial markets than a Central Bank, which is why this blog continues to cover bank policy and expectations.

Some thoughts on EUR/USD price action.

Today’s powerful move higher on the EUR/USD, and the lack of a significant retrace, tells us a lot about the powerful bullish sentiment. From a technical perspective, we’ve broken the highs of 3 May 2016. Furthermore, there was not a significant retrace, price has consolidated above 1.16 today and any selling has been quickly snapped up by eager buyers. If you like the idea of a long, or would like to add to your position, one strategy could be to wait for a retrace on some positive US data, and play the rejection.

Back in 2015 when the USD rallied against the Euro, doing the reverse of this strategy proved very profitable. With such a strong fundamental reason behind the downtrend, any news event that caused a move up in the EUR/USD could be faded at a significant resistance level. In current markets, one could employ a similar strategy, i.e. buy pullbacks at significant levels and look for it to break the highs.

Keep an eye on EU data, especially anything inflation related, as stronger inflation numbers will only add fuel to this uptrend.