Equiti Review 2024

|

|

Equiti is #97 in our rankings of CFD brokers. |

| Equiti Facts & Figures |

|---|

Equiti is an international STP brokerage, with built-in analysis tools and a wide range of CFD and forex markets. The broker also offers sky-high leverage rates of up to 1:2000 and is regulated offshore for retail traders by the Seychelles FSA, among other tier-2 authorities. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Forex, CFDs, indices, shares, commodities, cryptocurrencies |

| Demo Account | Yes |

| Min. Deposit | $500 |

| Mobile Apps | Yes |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FSA, JSC, CMA, SCA, CBA, FCA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | Yes |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | The broker's CFD range encompasses all my favorites: forex, US, UK and European stocks, international ETFs, energy commodities, global stock indices and cryptos. They're all available with competitive ECN conditions from within the MT4 or MT5 trading platforms. |

| Leverage | 1:500 |

| FTSE Spread | 1.2 |

| GBPUSD Spread | 0.2 |

| Oil Spread | 0.028 |

| Stocks Spread | Variable |

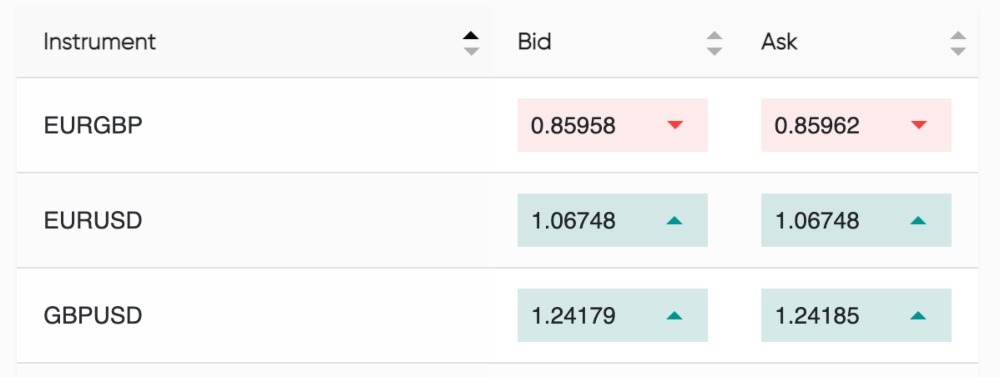

| Forex | During my testing, I uncovered nearly 70 foreign exchange CFDs - not a bad line-up compared to other brokers I review. The broker’s STP execution model means that execution times for me are generally quite low and spreads are competitive, starting from 0.0 pips. |

| GBPUSD Spread | 0.2 |

| EURUSD Spread | 1.6 |

| GBPEUR Spread | 0.9 |

| Assets | 65 |

| Stocks | I think the broker’s selection of 300+ US, UK and European stocks is OK, but certainly not the most impressive I’ve seen. That said, I am a big fan of the 14 different ETFs which allow me to diversify my portfolio across more global investments. |

| Cryptocurrency | I’m pretty happy with Equiti’s 1:10 leverage and spreads from $5 on popular crypto pairs like BTCUSD. Savvy clients can also utilize the broker's signals and market news to get crypto trade ideas and keep abreast of industry developments. |

| Spreads | Variable |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Equiti is a multi-asset brokerage providing opportunities on the popular MetaTrader 5 platform. Customers can trade forex, shares, ETFs, cryptocurrency, and more with competitive fees and no dealing desk intervention. This review will evaluate the key features, including spreads, trading accounts and UK regulation. We also look at how to sign up and login to the client portal, plus how to deposit your capital and open a trade at Equiti.

Our Take

- Equiti is good for UK investors looking for a no-frills trading environment with high leverage up to 1:2000

- The broker offers the reputable MT5 trading platform, with no restrictions on scalping, hedging or Expert Advisors (EAs)

- The lack of additional tools and education resources is a notable drawback and doesn’t compete with the top brokers

Market Access

The Equiti instrument list is widespread, with plenty of opportunities to create a diverse portfolio.

We were pleased to see a good choice of CFD products, comparable with the likes of Forex.com. The suite of cryptocurrencies is also stronger than most competitors, though UK traders should note that they may not receive any regulatory protection.

Popular assets include:

- Shares – 300+ UK, EU, and US company stocks such as Adidas, Facebook, P&G, and Tesco

- ETFs – 8 innovative technology exchange-traded funds including iShareCEETF and ARKSpace

- Forex – 11 major, 18 minor, and 40 exotic currency pairs including GBP/USD, EUR/GBP, and USD/JPY

- Commodities – UK and US oil, alongside precious metals and soft commodities including gold, silver, cotton, and coffee

- Indices – 14 major global stock indices available as rolling or futures contracts, including the FTSE100, DE30 and S&P500

- Cryptocurrency – 80+ digital currency coins or 4 cryptocurrency ‘groups’ to trade as one product such as Bitcoin and Ethereum

Equiti Fees

Equiti offers ECN/STP execution with no dealing desk intervention, meaning you can access tight raw spreads from 0 pips. These will fluctuate throughout the day due to market activity.

I was offered spreads of 0.6 pips on the GBP/USD and 0.5 pips on the EUR/GBP when I tested the platform. Importantly, these are competitive when compared to top brokers such as Pepperstone and IC Markets.

In return for tight spreads, you will be liable for commission charges. These fees are $3.50 per side, which is around the industry norm.

We were pleased to see Equiti does not charge any fees for deposits to a live trading account. However, withdrawal fees do apply for some methods, which is a shame. The most expensive charge applies to bank wire transfers, with withdrawal requests liable for a $30 flat fee.

You will also need to pay rollover fees for positions held overnight.

Account Types

One account type is available at Equiti. There are no premium services available to high-volume investors, which is disappointing.

The good news is, you can trade all instruments under one profile and access tier-one liquidity from providers. With spreads from 0.0 pips and reasonable commissions of $3.50 per side, I found the account conditions were competitive.

In addition, I like that you can have up to three accounts open under one registration. This is beneficial if you want to trade with different base currencies depending on your chosen markets.

How To Open An Equiti Account

I found the registration process for an Equiti account straightforward. You will need to follow the same process to open a demo account.

- Select the ‘Start Trading’ icon from the top right of the broker’s website

- Choose ‘United Kingdom’ from the country of residence dropdown menu

- Add your name and email address. Create a password

- Use the tickbox to confirm non-US residency or citizenship and select ‘Continue’

- Automatic redirection to the client portal will be completed

- Choose ‘Become A Real Trader’ from the dashboard interface

- Click ‘Send Me A Code’ to initiate your account verification. Add the six-digit code sent to your email

- Add your phone number and select ‘Continue’

- Add your date of birth, nationality, and address and select ‘Continue’

- Select ‘Complete Verification’ and upload proof of identity and residency to finalise your application

Note, you can deposit up to £2000 without completing the KYC stipulations. If you want to fund more, you can click on the ‘Complete Verification’ icon from the dashboard interface when ready.

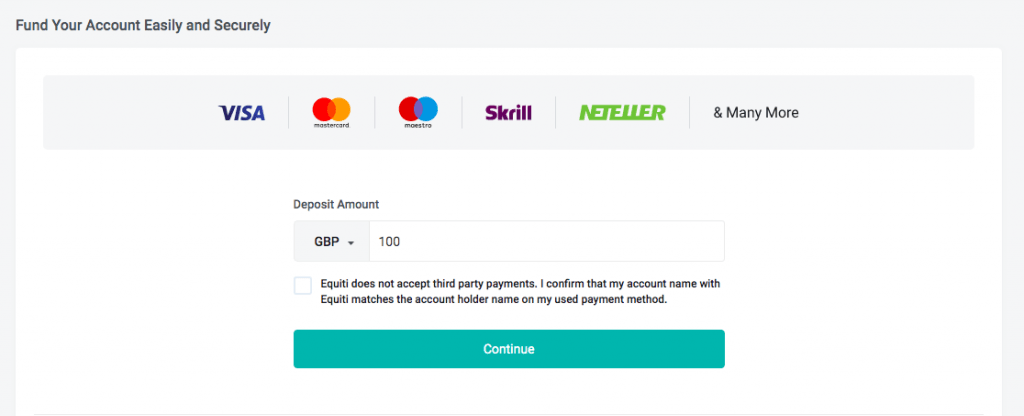

Payment Methods

Deposits

We were pleased to see a good range of accepted deposit methods including bank transfer, e-wallets and crypto wallets. However, I was disappointed to see that UK traders will not be able to deposit in GBP via debit/credit cards, since card payments are only accepted in USD or JOD.

Nonetheless, we were reassured that the broker does not charge any fees and all methods except bank wire transfer offer instant funding.

Payment methods that do accept GBP deposits include Skrill, Neteller and bank wire transfer, all of which are fee-free.

Equiti Deposits

I like that Equiti offers a unique branded, pre-paid MasterCard. The payment method offers quick deposits and is available to all clients who have deposited at least £200 into a live trading account since opening. We also found that the card can be synced to an iOS or Android app to make mobile transactions and complete card top-ups.

How To Fund Your Account Via Wire Transfer

- Sign in to the Equiti client portal

- Click on ‘Deposits’ from the left menu and select ‘Bank Transfer’

- Scroll down to find the UK account details

- Initiate the transfer via your online banking account

- Once completed, send a payment confirmation to backoffice.sey@equiti.com

Withdrawals

You can make a withdrawal back to the original payment method. Similar to deposits, I found that all UK-compatible payment methods except wire transfers are processed instantly. Allow up to 3 working days for withdrawals via bank transfer.

I was a little disappointed to see a withdrawal charge applied to all methods, the most expensive being a flat fee for wire transfer:

- Skrill – 1% fee up to £30

- Neteller – 1% fee up to £30

- Bank Wire Transfer – £30 flat fee

- Cryptocurrency (USDT, BTC, ETH) – 1% fee up to £500

Trading Platforms

When trading with Equiti, only the MetaTrader 5 (MT5) platform is on offer. It is a shame that the broker doesn’t provide any proprietary software, as many of the leading brokers do. However, we are confident you will have high-quality tools and features at your disposal when using MT5.

The third-party terminal is used worldwide and trusted by millions of retail investors. You can download the platform to a computer device, or use it as a web trader or mobile app.

Our experts consider MT5 as more tailored to experienced multi-asset traders, though it is popular among beginners too. We recommend you spend some time in the demo account to learn the functionality before investing your own money.

You can fully customise the interface to suit your strategy and preferences. We also like that there are no trading restrictions when using the platform, so hedging and netting are permitted. Some of my favourite features include the expert advisor development and backtesting functionality, ideal for automated trading strategies.

Other features include:

- Market Depth data

- 21 timeframe views

- 6 pending order types

- 88 in-built bots and EAs

- Multi-thread strategy testing

- Integrated economic calendar and live market news

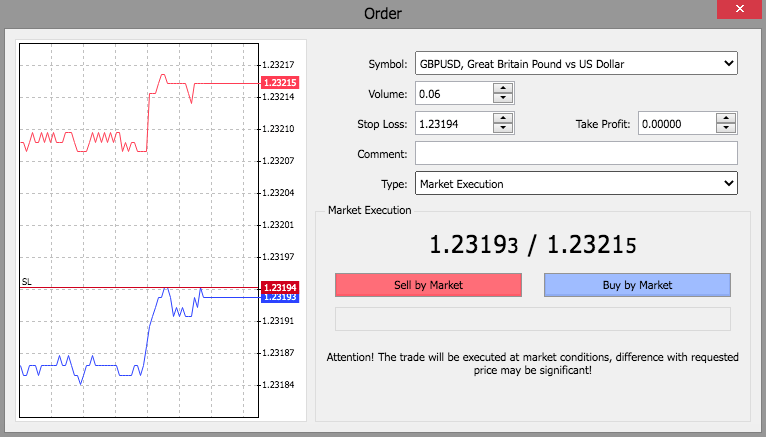

How To Place A Trade

We appreciate that there are several different ways to place an order on MT5, the most convenient being via one-click trading directly from the charts. All other methods will initiate the standard order screen, which is easy to use and enter your trade requirements. Right-click on an instrument symbol from the Market Watch window and select ‘New Order’, then:

- Add the volume to trade (lots) using the arrow toggles

- Choose ‘Market Execution’ or ‘Pending Order’ from the dropdown order type menu

- Add a stop-loss or take-profit risk parameter if required

- Add a comment if required

- Select ‘Buy’ or ‘Sell’ to execute the position

MT5 Order

Mobile App

You can use the MetaTrader 5 terminal as a mobile-compatible app. Equiti customers can download the application for free on iOS and Android devices.

When I used the app, I found it to be stable, offering all the advanced functions of the PC versions. You can make changes to your account, view your full trading history, and buy/sell instruments with the click of a button. I also liked that you can set notifications from the PC terminal to a mobile device too.

Execution

Equiti is a straight-through-processing (STP) broker. This means orders are routed directly to liquidity providers with no dealing desk intervention.

We found the brand uses 35 liquidity providers including 20+ tier 1 banking firms. As such, you will benefit from order execution at the best prices, with a small markup spread added by Equiti.

Equiti Leverage

Equiti provides very high leverage, up to 1:2000 on some products. This is much more than you would be able to access via FCA-regulated brokers due to margin restrictions.

With that said, we did find that the maximum leverage varies significantly between instruments. We were offered 1:200 leverage on some major forex pairs vs 1:20 on exotics.

Traders should always understand the risks of leverage trading and apply appropriate risk management tools to all positions.

Demo Account

I was pleased to see that you can practise trading risk-free on the Equiti MT5 demo profile before you commit to a live trading account.

We liked that there is unlimited usage available, and the paper trading profile incorporates real-time market data. You can trade all instruments and have £10,000 in virtual funds to put your strategies to the test.

Demo Platform

How To Open A Demo Account

You will need to register for an Equiti account before you can access demo conditions. Follow the registration process we outlined further above to get started.

Once signed into the client portal, choose ‘Demo’ under the platforms section.

Is Equiti Regulated?

Equiti is a registered entity of Equiti Group. The brand is regulated by the Seychelles Financial Services Authority (FSA) as a Securities Dealer Broker, license number SD064.

We do not rate this as a respected financial watchdog, and you will not have access to all the protection measures offered by FCA-regulated brokers. For example, live trading accounts are not guaranteed against negative balance status.

We did feel reassured that client funds are kept in segregated accounts with tier-one banks. However, there are no compensation schemes available, so we would not recommend depositing more than you can afford to lose, in case of business insolvency.

Note that the firm’s Equiti Capital arm, which provides liquidity solutions to pro traders, is regulated by the FCA.

Bonuses

While using Equiti, we were not offered any welcome bonus rewards or financial incentives. This is a shame, though the brand focuses on its competitive fees as its advantage.

We did find an active refer-a-friend scheme, which can be used to generate additional trading funds. We reviewed the terms and conditions and found that a £500 minimum deposit is required, plus an investment of at least two lots traded to be able to participate in the programme. All successful referrals provide a £50 reward for both you and your friend.

Extra Tools & Features

If you need some extra guidance, or looking for trade-enhancing tools, Equiti is probably not the broker for you. I found the brand is very restricted when it comes to additional trading tools and educational content.

There is no online learning academy with details on how to use technical indicators of the MetaTrader terminal, how to trade equities with leverage or the basics of forex investing. For those looking for comprehensive educational resources, CMC Markets and AvaTrade are better picks for beginners and intermediate traders.

We were also disappointed that there is no copy trading, VPS hosting, or access to third-party software such as Trading Central or Autochartist. This ranks the brand down considerably for us.

Nonetheless, UK clients can access a market news page. This offers up-to-date macroeconomic analysis and breaking news bulletins. We particularly liked the ‘Trade Ideas’ section, which is ideal for beginners looking for a steer.

Customer Service

We were impressed that Equiti customer support is available 24 hours a day, 6 days a week. This is beneficial, especially being able to speak to someone over the weekend.

Contact options are a little limited to just email and live chat, but you can use the FAQ section on the broker’s website with ample guidance available when needed.

On the downside, when we tested the live chat function, we were not able to reach a customer service agent immediately and received a response after 15 minutes. This was disappointing when compared with other competitors.

- Email – support.sey@equiti.com

- Live Chat – ‘Support’ icon bottom right of the broker’s website

You will also find Equiti Capital active on social media sites including LinkedIn, Facebook, and Twitter.

Company History

Equiti is an international brokerage, founded in 2008 as Divisa Capital Group. The brand now operates under the Equiti Group of companies, alongside other subsidiaries including Equiti Capital UK Ltd and Equiti Global Markets. The brand has a head office presence in London, Dubai, Limmasol, and more.

Equiti is an STP broker offering forex and CFDs across a range of markets, including indices, commodities, shares and cryptocurrency.

The brand has been awarded several industry recognitions including the Fastest Growing Multi-Asset Broker at the Global Brands Magazine Awards 2022 and the Best Online Broker for Cryptocurrency CFDs at The European Awards 2022.

Trading Hours

Equiti trading hours vary by product depending on market opening times. The forex market, for instance, is open 24/5, except for some breaks, outlined as an example below:

- Sunday – 9:01 pm to 12:00 am (GMT)

- Monday To Thursday – 12:00 am to 8:59 pm and 9:05 pm to 12:00 am (GMT)

- Friday – 12:00 am to 8:57 pm (GMT)

We were pleased to see published holiday hours by market available on the broker’s website. Additionally, we found a ‘Market Calendar’ available under the Analysis tab from the client dashboard menu. I was able to easily filter by corporate or economic categories including event types, and companies.

Should You Trade With Equiti?

Equiti provides all the basics of a decent multi-asset brokerage. Though there is nothing particularly stand-out offered by the brand, active traders looking for low-cost investments on the trusty MT5 terminal may consider this broker. We were, however, very disappointed with the lack of additional trading tools, which does not provide a competitive advantage vs alternative brands.

FAQ

Is Equiti Legit?

Yes, Equiti is a legitimate multi-asset broker, established in 2008. The brand is regulated by the Seychelles Financial Services Authority (FSA) as a Securities Dealer Broker, license number SD064. You can be assured of segregated client funds, however, negative balance protection is not guaranteed.

Is Equiti A Good Broker?

Equiti is a decent broker, though our experts found that it does not provide any stand-out services. Investors can trade several asset classes on the MT5 terminal, with competitive tight spreads. The broker is, however, missing some important tools including copy trading and VPS, which is a shame.

Does Equiti Have A Mobile App?

Equiti does not offer a proprietary mobile application. Having said that, the MetaTrader 5 terminal offers an iOS and Android mobile app, which provides all the advanced functions offered on the PC version.

Are Equiti Trading Fees Competitive?

Yes, you can access competitive fees when trading with Equiti. All instruments can be traded with tight spreads thanks to the broker’s no-dealing desk execution model. A $3.50 commission fee applies per side, which we found to be competitive.

Is Equiti Good For Beginners?

We would not rate Equiti as the best broker for beginners. There is no educational platform or learning materials. We were also not offered any social or copy trading terminal, to learn from more experienced traders. Having said that, there is a demo profile to practise trading on the MT5 platform, risk-free.

Article Sources

Compare Equiti with Other Brokers

These brokers are the most similar to Equiti:

- Admiral Markets - Admirals is an FCA- and ASIC-regulated broker with an excellent range of leveraged instruments, including forex, stocks, indices, ETFs, commodities, cryptos and more. The broker supports the MetaTrader 4, MetaTrader 5 and TradingCentral platforms. With both spread betting and CFDs available and thousands of instruments, this broker provides more flexibility than most rivals.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- Vantage FX - Founded in 2009, Vantage offers trading on 1000+ short-term CFD products to over 900,000 clients. You can trade Forex CFDs from 0.0 pips on the RAW account through TradingView, MT4 or MT5. Vantage is ASIC-regulated and client funds are segregated. Copy traders will also appreciate the range of social trading tools.

Equiti Feature Comparison

| Equiti | Admiral Markets | Pepperstone | Vantage FX | |

|---|---|---|---|---|

| Rating | 2.8 | 3.5 | 4.8 | 4.7 |

| Markets | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities |

| Minimum Deposit | $500 | $100 | $0 | $50 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FSA, JSC, CMA, SCA, CBA, FCA | FCA, CySEC, ASIC, JSC | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, ASIC, FSCA, VFSC |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5 |

| Leverage | 1:500 | 1:30 (EU), 1:500 (Global) | 1:30 (Retail), 1:500 (Pro) | 1:500 |

| Visit | ||||

| Review | Equiti Review |

Admiral Markets Review |

Pepperstone Review |

Vantage FX Review |

Trading Instruments Comparison

| Equiti | Admiral Markets | Pepperstone | Vantage FX | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | No | Yes | Yes | Yes |

| Corn | No | No | Yes | No |

| Futures | No | No | No | No |

| Options | No | No | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | Yes | Yes |

| Volatility Index | No | Yes | Yes | Yes |

Equiti vs Other Brokers

Compare Equiti with any other broker by selecting the other broker below.

Popular Equiti comparisons: