CoinTiger Review 2024

|

|

CoinTiger is #82 in our rankings of crypto brokers. |

| CoinTiger Facts & Figures |

|---|

CoinTiger is a centralised cryptocurrency exchange with a wide range of tokens and DeFi services for clients across the world. |

| Instruments | Cryptos, Futures |

|---|---|

| Demo Account | No |

| Min. Deposit | $1 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | $1 |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Islamic Account | No |

| Cryptocurrency | CoinTiger offers spot trades and futures contracts for thousands of digital currencies, including altcoins and stablecoins. |

| Coins |

|

| Spreads | N/A |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | Yes |

CoinTiger is a cryptocurrency exchange offering a wide range of tokens, crypto futures, and attractive trading platforms. In this review, we will evaluate the exchange’s selection of cryptos, fees, accounts, trading tools, security, deposits and withdrawals, and more. Our UK team also share their verdict after testing CoinTiger.

Our Take

- CoinTiger offers user-friendly trading platforms with decent analysis tools to facilitate a range of strategies

- Fees are competitive when compared to other exchanges, with maker fees as low as 0.08%

- The firm doesn’t offer any resources or educational materials, which is a major drawback for beginners

- The lack of regulation raises security concerns, making CoinTiger less reliable and trustworthy than established crypto brokers like FXCC and PrimeXBT

Crypto Tokens

CoinTiger is a cryptocurrency exchange offering an impressive range of 500+ pairs. This is more than most rivals.

All coins can be traded via spot contracts, though we were pleased to see that you can also access futures.

Speculators can invest in coins against USDT, BUSD, USDC, BitCNY, sUSDT, TCH, BTC, ETH, TRX and XRP.

Many popular altcoins are available to trade alongside Bitcoin, including Ethereum, Ripple, Dogecoin, Litecoin, Islamicoin, Hanzo Inu and Luna. This provides opportunities on both major and emerging tokens.

Fees

CoinTiger charges trading and withdrawal fees. However, it is good to see that there are no deposit or account-related fees.

The trading fees differ depending on the type of order you place. Overall, we found the fees competitive and in line with bigger names like OKX.

- Takers – Traders looking for instant order filling pay a 0.15% fee on the order

- Makers – Traders who are willing to place orders that fill later will be paying a lower 0.08% fee on the order

For example, a market maker could place a limit order at a price different from the current spot price. The order will then fill when the target price is hit. This means that the trader is a market maker. Because market makers’ orders aren’t instantly filled, they are compensated with a lower trading fee.

On the negative side, withdrawals also come with fees. These differ between coins, alongside varying minimum withdrawal volumes. For example, Bitcoin (BTC) has a minimum withdrawal limit of 0.002 BTC (~£50 at the time of writing) and a minimum withdrawal fee of 0.0005 BTC (~£11 at the time of writing).

We found the minimum withdrawal fees to vary greatly between assets. Because most withdrawal fees are flat, higher volume withdrawals charge a smaller percentage fee.

Accounts

As with most other crypto exchanges, CoinTiger only offers a single account. However, with this account, you have access to all the features available on CoinTiger. This includes all trading and exchange products and platforms, plus all available assets including spot and futures.

How To Open A CoinTiger Account

I found registering for an account at CoinTiger easy, taking me less than 5 minutes including the KYC verification:

- Go to the CoinTiger website

- Click the ‘Register’ button

- Fill in the account details. CoinTiger lets traders sign up with either an email address or a mobile phone number

- Complete the Captcha

- You will then be emailed/messaged a verification code to input

- Then click ‘Complete Registration’

- You can now input your KYC details to have access to fiat deposits

Funding Methods

CoinTiger allows traders to deposit coins into their accounts from third-party wallets, as well as fiat deposits through bank transfer. Traders depositing CNY can also use WeChat Pay and AliPay. However, other currency deposits must be facilitated via bank transfer.

You can also deposit using a credit card. There is a minimum limit of 55 USD (£40) and a maximum of 20,000 USD (£15,500).

We were happy to find that Mastercard and Visa withdrawals have no minimum, but maximum limits of 20,000 USD apply.

It’s worth noting that fiat trading only goes through BTC, USDT and BitCNY. You can only use other currencies to buy coins. When depositing with fiat, you are buying crypto that can then be used to trade on the exchange.

Regulation

As with other similar crypto brands, CoinTiger is an unregulated exchange. This is standard in the crypto exchange market which is still regarded as a grey area in terms of financial regulation.

As such, there are always risks when using crypto exchanges and ultimately, your funds are not protected.

Furthermore, CoinTiger has received several unfavourable reviews of their service, with many clients reporting withdrawal issues, slow response times and heavy slippage on trades.

We urge traders to exercise caution if using unregulated crypto exchanges. For a safer option, we recommend considering a reliable broker that offers crypto CFDs, such FXCC or IC Markets.

Trading Platform

We were impressed that CoinTiger offers two spot trading platforms and one futures platform, similar to competitors such as Kraken.

All platforms are web-based and available directly on the CoinTiger website.

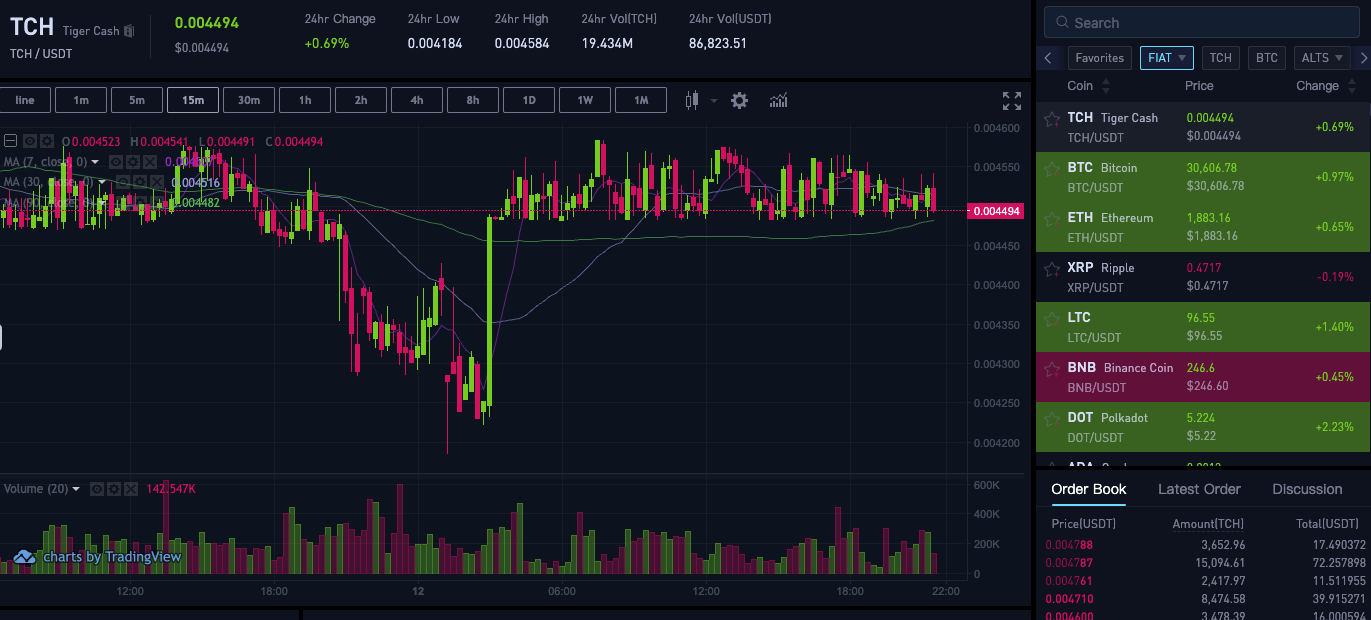

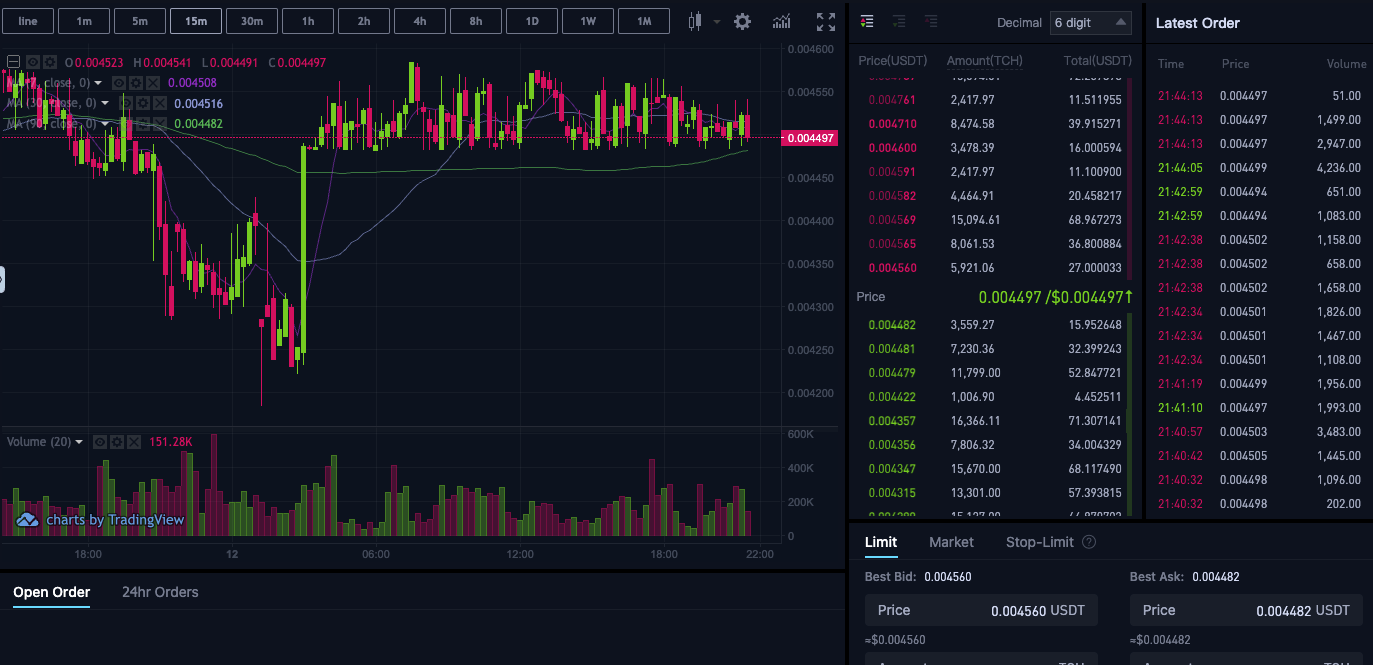

Exchange Platform

We liked that the CoinTiger Exchange trading platform is available as a Basic version and an Advanced version. Ultimately though, we found that the functions of these are the same, with the main difference being the upgrade in presentation and design.

The Exchange offers a decent range of 11 timeframes, suitable for a range of strategies. Even better, the charts are hosted via the respected TradingView software. Users can enjoy decent customisation features and technical analysis capabilities.

Traders can also place limit, market or stop-limit orders when trading.

Basic Platform

Advanced Platform

Futures Platform

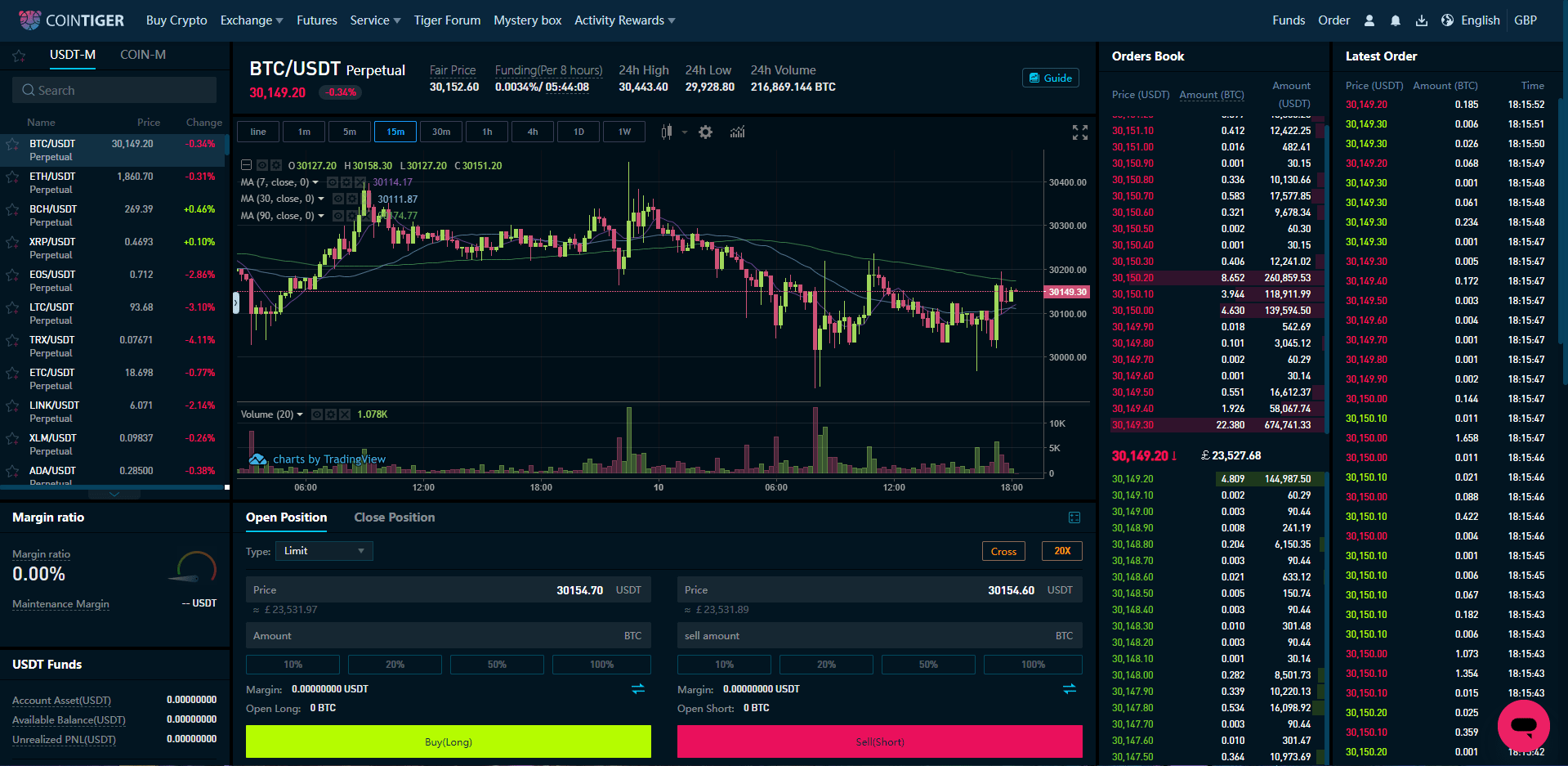

We found the Futures platform takes many of the same design cues as the Exchange platform, utilising the user-friendly TradingView solution.

It sports the same features as the Exchange platform, allowing traders to perform technical analysis, adjust between 8 timeframes and change the chart visuals.

Traders can either long or short futures contracts seamlessly from the ‘Open Position’ tab and then close their trades in the ‘Close Position’ tab. Furthermore, we were pleased to see that leveraged trading is available on this platform, with a total margin ratio indicator tracking the required levels on the side.

Overall, we liked the platforms provided for both spot and futures trading. They were intuitive and easy to navigate while providing many of the high-level features experienced traders would benefit from. However, these platforms are missing some features that others incorporate, including automated tools and copy trading.

Futures Platform

How To Place A Trade

I was impressed with the process of opening a position in the CoinTiger platforms, with all the steps smooth and easy to navigate:

- Login to your CoinTiger account

- Choose the platform you would like to trade on from the bar at the top of the screen

- Choose the cryptocurrency pair you would like to trade from the asset list

- Click on the timeframe you would like and perform your analysis to find the best time to trade

- The default locations for the order menus in all three platforms are at the bottom of the screen, below the chart

- Fill in the details of your trade in the order window (remember to choose whether you want to place a limit, market or stop-limit trade on the Exchange platform)

- When you are ready, hit the Buy/Sell/Long/Short button to place the trade in your desired direction

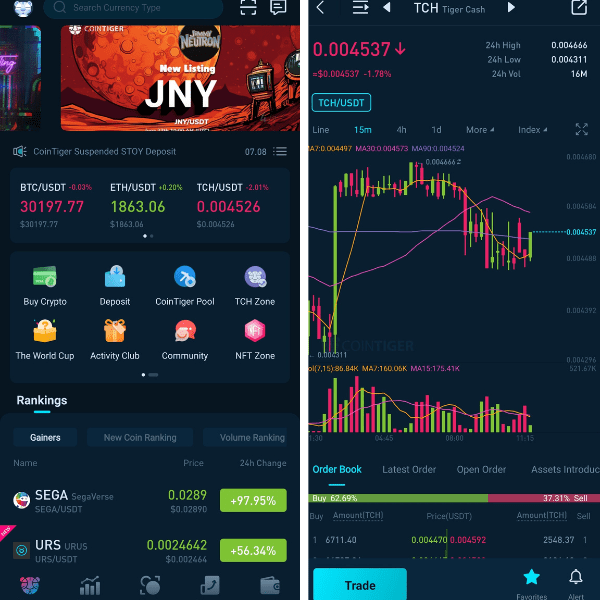

Mobile App

We were happy to see that CoinTiger has a mobile app available to download on Apple iOS and Android devices. You can download these from the link on the CoinTiger website or directly from each app store. With that said, the app has a 3-star rating on the Google Play Store, with very mixed reviews overall.

I did think that the design of the app was very intuitive and easy to navigate. The home page features key moving assets, popular assets, and shortcuts to different features. The market tab lets you chart each asset with much of the same functionality as the web-based platform. Trades are easy to make from the market tab, showing you the order book and the latest orders in real time.

Overall, whilst the design of the app is a strong point, the mixed feedback from long-term use suggests that there may be frequent issues that could be hard to ignore.

CoinTiger App

CoinTiger Leverage

CoinTiger offers leverage as high as 1:125 on certain contracts, although this varies depending on the value of the position. For example, the BTC/USDT pair has no maximum position size limit for a 1:2 leverage but has a maximum of 50,000 USDT for 1:125.

Initial margin rates also decrease as leverage goes up, reaching as low as 0.80% at 1:125 leverage.

Traders should be reminded that leverage can greatly increase your losses and since this exchange is unregulated, your balance is not protected.

Demo Account

CoinTiger does not offer a demo trading account. This is like many other crypto exchanges, with very few offering a true demo account option.

However, some exchanges do gift a small amount of currency to allow traders to practice before committing their own capital. We were disappointed to find CoinTiger does not offer this feature which would be particularly useful for beginners.

Bonus Deals

Our team found that CoinTiger offers several bonus schemes in the form of activity rewards and mystery boxes.

Activity rewards can be earned from the Activity Club on the CoinTiger website. These are challenges and tasks released frequently (roughly every month) that give traders the ability to earn rewards (usually crypto coins directly into their accounts).

For example, the AIWORLD Trading Carnival had a set of six tasks to complete. These include depositing over a set amount and trading a set amount of a particular token (AIWORLD). Doing so earns traders AIWORLD coins, with an additional reward for completing all the tasks within the 6-day time limit.

CoinTiger’s mystery boxes are purchasable boxes with randomised coin rewards inside. Sometimes, larger mystery rewards can also be found.

We recommend that traders read the conditions of each bonus carefully, as many often come with unrealistic terms.

Extra Tools & Features

We were pleased to find that CoinTiger offers a few additional tools to individual and institutional investors.

Individual investors have access to the CoinTiger Pool. This allows traders to stake coins as collateral on the blockchain in exchange for compensatory returns. For example, at the time of writing, the PICO Fixed Rate 30 Days Pool is available. It has a minimum deposit of 3,020 PICO and a 30-day lockup period. In exchange, participating users gain a 270% annual yield on the stake.

Institutional investors have access to the CoinTiger Cloud. This is a service to help list coins onto the exchange. Traders can submit new listings through the ‘Apply To List’ service. The application will then be audited, with a following review and presentation event. If accepted, the community of users can then vote on the listing applications.

We were disappointed to find that CoinTiger doesn’t offer any educational resources such as webinars, insight articles, a blog or a news section for announcements. We feel this would be an important addition for beginners if CoinTiger intends to compete with other brands in the industry.

Customer Service

CoinTiger has some useful support avenues, however, is missing some of the most desirable methods. With that said, we were pleased to see that support is available 24/7. Traders can use an online chatbot, the support centre, or submit requests, all available from the CoinTiger website.

The support centre has an extensive selection of articles to help with common queries, including account maintenance tutorials, trading support and account safety information.

Our experts were disappointed to find that there was no CoinTiger contact phone number, email address, or physical mail address, though this is standard practice among unregulated crypto exchanges who prefer to maintain anonymity.

Company Details & History

CoinTiger is a Singapore-based cryptocurrency exchange established in 2017. The exchange was founded by CEO and owner Frank Ling and now boasts over 2 million users across 100 countries.

The exchange has its own native token, TigerCash (TCH), claiming to have been the first cryptocurrency exchange to bring in its own form of equity.

As with most crypto exchanges, there is limited information on the company’s background and credentials, such as daily trading volume and number of active clients. Our experts consider this a concern from a safety and transparency perspective.

Security

While unregulated, the broker puts an emphasis on two-factor authentication (2FA), prompting its setup frequently online and through the mobile app. We did find this reassuring.

Furthermore, the broker also employs KYC protocols for traders looking to trade with fiat or withdraw more than 2 BTC. The website is encrypted to protect users’ privacy.

Overall, the exchange hasn’t had many reported problems with its security.

Trading Hours

CoinTiger is a delocalised cryptocurrency exchange. As such, traders are available to trade all assets 24/7. This makes CoinTiger a very flexible broker to trade with for investors across the globe.

Should You Trade Crypto With CoinTiger?

CoinTiger is an online cryptocurrency exchange offering a large range of tradable products, intuitive and powerful trading platforms, 24/7 trading and support, competitive fees, and a range of additional features and deals.

However, its unregulated nature and mixed reviews make the exchange difficult to recommend from a safety standpoint. Investors are recommended to exercise caution if they decide to trade with CoinTiger. Alternatively, consider reputable alternatives like FXCC or PrimeXBT.

FAQ

Can UK Traders Invest With CoinTiger ?

UK traders can invest with CoinTiger. Funding is accessible for UK clients, with Mastercard and Visa deposits available. Furthermore, traders can transfer coins directly to the exchange, making the brand universally accessible.

Is CoinTiger Trustworthy And Reliable?

CoinTiger is an unregulated exchange with limited restrictions on its trading practices. This means that no overseers are ensuring that traders are protected in the same way as FCA-regulated brokers. We therefore cannot give this brand a high trust score.

Does CoinTiger Offer A Good Trading Platform?

CoinTiger offers several bespoke, web-based trading platforms which are fairly competitive. Two variations of the Exchange platform are available for trading spot crypto pairs, and one platform is available for trading futures contracts. We think these platforms are intuitively designed, yet feature lots of high-quality tools, which are suited to both newer and experienced traders.

Is CoinTiger A Scam?

CoinTiger has had many mixed reviews of its service. Some reviews claim the exchange is not legit, while others seem to have no or slight issues. Considering the broker is unregulated, there is always a risk of scams or malpractice. As such, we recommend any trader looking to trade with CoinTiger do so with care.

Does CoinTiger Accept GBP Deposits?

CoinTiger only allows traders to trade through crypto coins. However, they do have the option to buy coins directly with fiat currency, including GBP. While GBP is not deposited directly into your account, the coins that do can be purchased directly with GBP through CoinTiger.

Does CoinTiger Require KYC Verification?

Yes, clients who intend to trade using fiat currencies, or withdraw more than 2 BTC will be asked to submit KYC documents as part of the exchange’s security procedures. This may include personal details such as name, address, date of birth and government ID number.

Article Sources

Compare CoinTiger with Other Brokers

These brokers are the most similar to CoinTiger:

- FP Markets - FP Markets is an ASIC- and CySEC-regulated broker that offers forex and CFD trading on a broad range of assets through the MT4, MT5 and IRESS platforms. With trading available through standard and raw spread accounts on thousands of international stocks, forex, indices, commodities, cryptocurrencies, bonds and ETFs, this broker has some of the most comprehensive market coverage available. FP Markets also offers a full range of additional features, including educational resources and access to powerful software such as Autochartist.

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage for experienced traders, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Swissquote - Swissquote is a Switzerland-based bank and broker that offers online trading and investing. The company has a high safety score and is listed on the Swiss stock exchange. The firm offers a huge range of products, from stocks, ETFs, bonds and futures to 400+ forex and CFD assets. Hundreds of thousands of traders have opened an account with the multi-regulated brokerage. Clients can get started in three easy steps while 24/7 customer support is available to assist new users.

CoinTiger Feature Comparison

| CoinTiger | FP Markets | Interactive Brokers | Swissquote | |

|---|---|---|---|---|

| Rating | 1.3 | 4 | 4.3 | 4 |

| Markets | Crypto | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities |

| Minimum Deposit | $1 | $100 | $0 | $1000 |

| Minimum Trade | $1 | 0.01 Lots | $100 | 0.01 Lots |

| Demo Account | No | Yes | Yes | Yes |

| Regulators | - | ASIC, CySEC, ESMA | FCA, SEC, FINRA, CBI, CIRO, SFC, MAS, MNB | FCA, FINMA, DFSA, SFC |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | No |

| Platforms | - | MT4, MT5, cTrader | - | MT4, MT5 |

| Leverage | - | 1:30 (UK), 1:500 (Global) | 1:50 | 1:30 |

| Visit | ||||

| Review | CoinTiger Review |

FP Markets Review |

Interactive Brokers Review |

Swissquote Review |

Trading Instruments Comparison

| CoinTiger | FP Markets | Interactive Brokers | Swissquote | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | No |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | No | Yes | No | Yes |

| Corn | No | Yes | No | No |

| Futures | Yes | Yes | Yes | Yes |

| Options | No | No | Yes | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | No | Yes | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | Yes | No | No |

CoinTiger vs Other Brokers

Compare CoinTiger with any other broker by selecting the other broker below.

Popular CoinTiger comparisons: