Bitcoin’s woes worsen as China ban confirmed.

September 15, 2017

Yuan denominated Bitcoin crashed today in today on news that China’s second largest exchange, BTCChina , will halt trading as of September 30. As of 11.30am EST, the Yuan BTC cross was down a massive 35%.

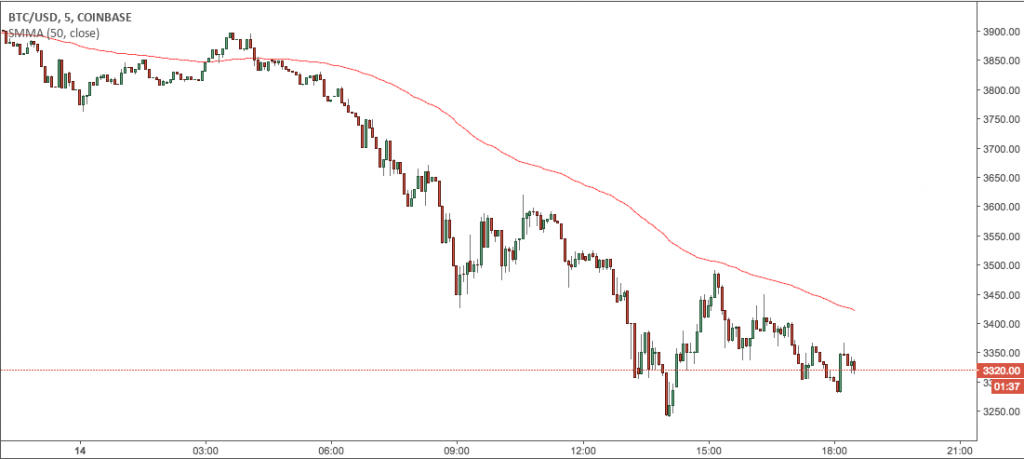

BTC/USD didn’t far much better, at 6.30pm EST it’s down -14% and trading below the crucial $3500 dollar support/resistance level. ETH/USD is also suffering, down around -16%.

Beijing has taken a number of steps to limit crypo markets in China over fears of capital flight. China makes up around 40% of BTC volume, the removal of this demand will have significant implications. China is also home to some of the largest mining operators, and with the cost of creating one Bitcoin currently around $1000US, we could see these margins squeezed.

Proponents of the BTC would say this is a Buy The Dip opportunity. For the detractors, this is evidence that the bubble has burst (at least for the time being) and a more realistic valuation is at hand.

The perils of structural risk.

As I’ve noted on this blog, BTC and crypto currencies present a massive opportunity…but that opportunity comes with significant risk. Unlike the regular risks associated with regulated stocks, the risk to crypto is structural.

– The Chinese decision to essentially outlaw components of crypto currency is something that could happen in any country.

– Brokers aren’t regulated. Be aware that you’re giving money and have no idea who they are, where they’re located or what their operation is like.

– Volatility: the immature crypto market is volatile, and we can see massive moves in price. The market is usually pretty thin, big market orders can decimate the book.

As always, trade with caution. Perhaps this is a buying opportunity, perhaps not. The technology behind bitcoin is nothing short of genius but it remains to be seen if the currency itself has staying power.