Could 2017 Be The Perfect Year For Equities?

Cast your mind back 12 months, did you think we’d be having the type of year we have in equities? I know I didn’t. There was a lot of doom and gloom out there…but all we have seen is green, green and more green. European worries are all behind us, populism is back in check, sovereign debt is under control and growth is back on track…plus, Trump hasn’t delivered any of the economic worries that were forecast.

We’ve never seen more record closes and less volatility in the market, ever. Lets run through some of the amazing market stats that today gave us:

- Today, Monday 18 December, the Dow Jones Industrial Average closed for it’s 70th record high of the year. It has never done that before in it’s 100 year history. The tech heavy NASDAQ passed 7000 for the first time ever.

- The S&P500 is the most overbought it’s been, on a weekly RSI, since 1958.

- There have been no down months since President Trump was elected.

- In fact, unless we have some volatility in the last couple of weeks of December, 2017 is going to be a Perfect Year with no down months. Should this happen, it will be the first time ever that stock made 12 monthly gains in a row in a calendar year.

- US Treasuries flattened last week, the most in years actually. Today we saw the curve steepen the most since Trump was elected.

- The VIX did not manage to hit a record low (suprised!), however it’s still trading with a 9-handle.

A sign of excess, or just the beginning?

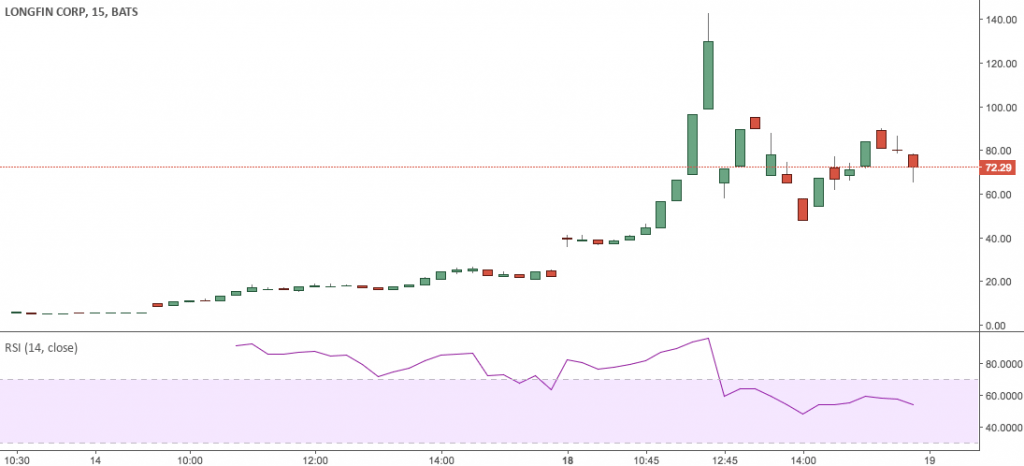

We should also mention LongFin, which saw absolutely crazy price action today. LFIN IPO’d on Thursday, opening at 6.65. The company is basically a FinTech company, that uses all the current buzzwords in it’s marketing, that offers FX hedging solutions. A day after it IPO’d it announce that it acquired a blockchain company. All aboard the rocket ship! Today price hit $142.82, and was halted a over 15 times today due to volatility.

This is a sign of excess. It’s similar to the way internet companies traded in the tech bubble. This is the crypto bubble hitting the equities market…and it could just be the beginning.