Structured Products

The Aim of a Structure Product

Before looking at how a structured product works, we should note the goals of the product. Quite simply, such a product will aim to produce either income or capital growth, or both, while offering either partial or full protection to the original investment capital. They usually have a maturity date (that is they will have a fixed term), though open ended funds are becoming more commonplace.

Before looking at how a structured product works, we should note the goals of the product. Quite simply, such a product will aim to produce either income or capital growth, or both, while offering either partial or full protection to the original investment capital. They usually have a maturity date (that is they will have a fixed term), though open ended funds are becoming more commonplace.

A structured product achieves its aim by combining investments in derivatives (options and futures) linked to single shares, indices, commodities, bonds or even currencies. The structured product manager will produce a formulaic investment that is designed to achieve the investment goals, and then offer it as a per-packaged investment (the structured product).

How a structured product works

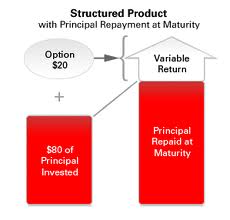

There are two elements to a structured product. The first is the protection, and the second is the performance.

Securing the protection

The fund manager will make an investment that will guarantee all or part of his initial investment back after a period of time. This investment may be made into cash, government bonds, or derivative products. Whatever the method and financial instrument used, the key factor will be the solidity of the provider. For example, if an investment manager had invested the protected portion in the form of cash deposits with Icelandic banks in 2007, by 2008 that cash would have disappeared with the bankruptcy of those banks.

Achieving the Performance

Having achieved the protection, the manager will then invest the remainder of his funds into a higher risk asset designed to produce the return he desires. Sometimes performance levels will be capped, in order to preserve gains made to a certain level without risk of losing them toward the end of the investment term. Very often this part of the investment will be leveraged, or geared, in order to achieve the exceptional gains needed, and most often this will mean using options or futures to multiply gains that would otherwise be made investing in the underlying security.

A simple example

ABC Bank offers a structured product that guarantees return of the invested amount at the end of a five year term, but with a gain equivalent to the upside of the FTSE 100 Index should it move higher.

In order to achieve the protected part of the structured product, ABC invests 85% of its fund into a bond which will return the whole of the original investment at the end of the five year term.

Now let us move to the performance part of the product. The target will be based upon the performance of the FTSE 100 Index over a five year period. Clearly, the manager has only a small part of the original fund left, 15%, to invest in the FTSE 100. If he invested directly in the index, then he would have no hope of achieving such growth (as the target growth applicable under the structured product is on the whole of the invested amount, not just the ‘risk’ portion). So, what the manager does is select appropriate FTSE 100 call options that will give him the gain he is seeking in five years at investment maturity should the FTSE 100 rise. If the index falls over the period, then the call options will expire worthless. (He will allow for commissions, fees, and possible loss of option premium in his calculation.)

Though the manager has separated the two elements, they are linked to each other to produce both the capital protection and the exposure to the upside of the FTSE 100 Index.

Uses of structured products

Structured products can be used to diversify a portfolio, reduce risk, or take advantage of specific market views. They used to be the preserve of large financial organisations, and were costly to produce and manage. However, they are now widely available as packaged products to retail investors, though many financial advisors find them difficult to explain to clients as they involve the use and manipulation of complex financial instruments.

Many investors who wish to have exposure to riskier assets, whilst limiting potential losses, perhaps even receiving full capital protection, are attracted by structured products.

Beware

Although capital protected, not all structured products have 100% capital protection. The protection is really only as good as the financial institution backing the protection: if the institution fails an investor may lose his money.

Also, an investor should be aware of the effects of inflation on the purchasing power of his money. Even though the capital is protected, if there is no other return then that capital will be worth less in real terms than it was when first invested.

For many investors, understanding each unique structured product is a virtual impossibility. This means putting trust in a financial advisor or structured product provider.

Finally, the capital protection and targeted gain will be over the period of the investment. Any early withdrawal will mean the capital protection no longer applies and the returned amount will be less than originally invested.

In conclusion

Structured products can be good investments for those that want a limited risk to their investment cash with the possibility of gains linked to riskier investment assets. However, investors should ensure the financial viability of the institution underwriting any capital protection, as well as be certain they can afford to invest over the fixed term of the structured product.