Gold Bullion vs. Gold Coins

Gold Bullion or Coins – What’s right for you?

Why you should think about gold as an investment

Many investors are beginning to think of gold as a way to either diversify a portfolio or speculate to make gains currently unachievable through investment in other underperforming assets. Certainly, in times that the global economy is heading downhill and government debt is piling up without realistic signs of abating, gold presents a clear opportunity as a store of value.

Many investors are beginning to think of gold as a way to either diversify a portfolio or speculate to make gains currently unachievable through investment in other underperforming assets. Certainly, in times that the global economy is heading downhill and government debt is piling up without realistic signs of abating, gold presents a clear opportunity as a store of value.

If Central Banks move to ease the current monetary environment in order to stimulate economies, then this could prove inflationary and further good news for gold, which is also seen as a hedge against inflation.

So it makes perfect sense for investors to look outside the more traditional assets of equities, bonds, and cash and move toward gold. There are, of course, several ways to invest in gold, though two of the most commonly thought of are gold bullion or gold coins.

When making the decision which is best for you, it’s necessary to consider the different investment properties of both.

Gold – the bull market of the last decade

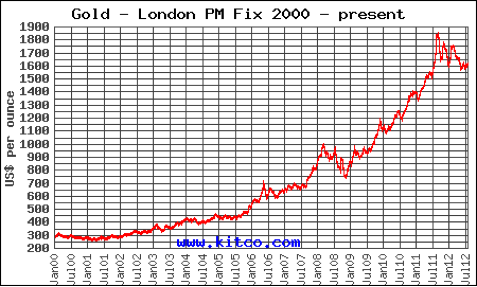

At the turn of the last millennium, as Gordon Brown, the then UK Chancellor of the Exchequer, was selling the UK’s gold reserves, the gold price stood at around $290 per ounce. The chart below shows how it has traded since then, and the increasingly bull market that it has been while the wider global economy has lurched from one crisis to another. Anyone holding gold through this period would have seen their investment increase nearly six-fold. The price of gold has retreated by around 15% from its high last year, a pattern that repeats the pull-backs seen in 2006 and 2008.

So you want to hold gold – but should it be bullion or coins?

When an investor buys gold bullion products, he will pay for the value of gold that he is buying. This will be based upon weight and grade – though bullion grade gold is 99.5% pure. Of course, he will pay a small premium over the cash price at which gold is traded on the international markets – after all, the selling dealer needs to make some money to pay for his costs. When he comes to sell his bullion, the investor will probably need to accept a price at a small discount to the cash price of gold, for the same reason that he has paid a premium when buying in the first place.

An investor in coins, however, is likely to pay a price vastly over and above the value of gold in the coin. A coin has a different basis of valuation, being linked to other factors such as rarity, condition, and age rather than the gold itself.

Bullion investors would consider that coin collectors are, perhaps, slightly mad. Why would anyone pay vast amounts of money over the value of the gold content were it to be melted down? But a coin collector would argue that they are investing not just in the gold, but in the history behind the coin. And if that coin is hundreds of years old, but in mint condition, then the value skyrockets.

In 2002, a rare 1933 Double Eagle gold coin was sold through auction at Sotheby’s. When it was originally minted, it had a value of about $20. However, though 445,000 of these Eagles had been minted, they were never circulated, and within a few months the majority had been melted down. So, any of these coins found today could be worth a fortune. In 2002, the Sotheby’s coin was sold for $7.6 million. Even today, after such a huge rally in gold since that coin was sold, the gold content would only be valued at around $1700.

It’s unlikely though, that that Double Eagle, were it to come to auction today, would now be valued at around $38 million; the equivalent rise in gold through that period. When gold rallies strongly, gold bullion will rise comparatively faster than the value of gold coins. Even though the value of gold has increased, the rarity of a coin will not have increased. Investors in bullion products can realise sizeable profits in a short space of time.

Also, gold bullion investors deal in a far more liquid market, where products are readily bought and sold. Selling a coin through a specialised dealer or auction house can take weeks, if not months.

In terms of product availability, risk of asset, and liquidity, there are arguments in favour of both bullion investing and coin collecting. The ultimate choice will depend upon how you feel about the different types of investing in physical gold, and the aims for that investment. Many gold investors hold both bullion and coins in their portfolio, some even using bullion as a ‘trading position’. Whatever you choose as your preferred investment route into physical gold, you can be sure that you will be placing your investment cash into a commodity that will give you a hedge against inflation, and be increasingly seen as a store of value in uncertain political and economic times.