Forex Trading

Introduction to online forex trading for UK traders. From what moves markets, to finding the best Forex brokers, we explain FX trading in detail. Learn a stop order from a limit order, know why spreads are important and read some winning strategies – and try it all out risk free with a forex broker demo account.

Forex trading is the business of trying to make money from the difference in exchange rate of one currency against another. The idea of trading currencies came about as a result of floating exchange rates, which allow a currency’s value to be determined by the “market” – the forces of supply and demand.

Top 3 UK Forex Brokers

-

XTB provides access to 70+ currency pairs with low spreads averaging around 1 pip on majors. The xStation platform offers an intuitive environment for forex traders with an excellent charting package encompassing 30+ indicators, plus a range of order types, catering to various strategies and risk management techniques.

-

Eightcap offers 50+ currency pairs in line with the industry average but trailing category leaders like CMC Markets with its 300+ currency pairs. However, Eightcap stands out with institutional-level spreads from 0.0 pips on major pairs like the EUR/USD, alongside low $3.50/side commissions. The broker also offers rich forex data to inform trading decisions, including key fundamentals, bullish/bearish indicators and a calendar that tracks key events in the foreign exchange market.

-

FXCC's key selling point is its forex trading conditions. ECN spreads come in as low as 0.0 pips during peak trading hours, while it supports a wider range of currency pairs than the majority of rivals with over 70 forex assets. Additionally, you have access to MT4, which was built specifically for forex trading and excels for its charting tools.

See all Forex Brokers in the UK

Introduction To Forex Trading

Foreign Exchange Trading, “Forex” or “FX” as it’s commonly known, is one of the most exciting and accessible markets for traders. The 24 hours access, low margin requirements, and constant action gives new traders a world of opportunity to learn, grow, develop strategies and discover markets.

How Does The Forex Market Work?

Unlike the stock or futures market, the foreign exchange market is decentralised and transactions take place between parties away from a central exchange. This can as small as exchanging a few dollars at the airport when you’re travelling, or as large as a major corporation moving revenue from sales in Europe (Euro’s) back to the US (dollars). Millions of these transactions take place every day all around the world. The Foreign Exchange market is fluid, diverse, and extremely liquid.

This type of decentralised market is not without it’s problems. The main issue for most people comes when they attempt to exchange money in small amounts. As transactions do not run through a central exchange, counterparties can theoretically set whatever price they want for a currency. Have you ever noticed that when you try to exchange currency the rate offered is often far worse than the “official” rate? Even when you purchase something online, there’s usually a significant difference. The difference is called the “spread”, which represents what gap between the “official” rate and the rate offered to you at the point of transaction. The spread charged by banks and merchant exchanges is usually quite wide, and gives them significant profit potential.

What Does All This Have To Do With Forex Trading?

Forex trading is essentially you, the trader, making a contract with a broker, to purchase (or sell) one currency versus another at an agreed upon price. For example, when you BUY the EUR/USD, you’re betting that the Euro will rise in value relative to the US Dollar. The price you pay is set by the broker, and is representative of the market consensus at that point in time. As competition for trading volume is fierce, brokers who offer the best prices and smallest spreads capture the most traders.

It’s important to note that as FX is a made market, prices can swing and spreads and change widely depending on the market conditions and your broker. Having a reputable and regulated broker is very important, as brokers are the ones who actually set the price.

Comparing Forex Brokers

If you are a retail forex trader (i.e, you’re not a professional working for a hedge fund or proprietary trading firm), the counter-party to your trade is often your broker, rather than another human. This is significantly different to the stock or futures market. Broker business models vary, they may hedge their risk by taking positions for themselves, or can offload your positions onto the market. All of that happens in the back end, and while it’s interesting information to have it’s not essential to your trading. If you’re serious about trading FX, it’s worthwhile looking into the way brokers operate. In the meantime, the important takeaway is that as a retail trader, the trades you make are often against your broker and not another individual.

As you can imagine, this represents a significant conflict of interest issue. When choosing a broker, make sure they are regulated and do your due diligence. Do you research, look at reviews and complaints online, and speak to them directly if you have any questions. If possible, choose an ECN broker who routes your orders through to the market (rather than taking the opposite side of your trade). Unfortunately, stories of traders being swindled by a rogue broker are all too common.

Start with our list of UK forex brokers to make sure you trade with a trusted broker, but also do your own research to find the broker that meets your specific requirements.

ESMA

One recent change for brokers has been the impact of ESMA (European Securities and Markets Authority) and the rule changes in Europe. Regulators across the continent (CySec, FCA, BaFin etc) all now implement new restrictions on brokers under their control. Since July 2017, leverage on forex has been capped at 1:30. In other parts of the world, this level remains as high as 1:500 or even 1:1000. So choosing a broker has become more important if you want to trade on margin. Larger deposits will now be required if using a European broker. In order to check, it is best to research detailed reviews, such as our own, or other reliable forex broker comparison websites, such as DayTrading.com

It is possible to use European brands and avoid the restrictions imposed by ESMA. This is because they only relate to retail investors. It is therefore possible to register as a professional client and still claim access to the higher levels of leverage. This requires certain proof of experience and trading capital, but is an option available at almost all brokers.

If you cannot (or do not want) to register as professional, then ASIC (Australia) or SEC (US) regulated broker might be a good choice, and will open up both higher levels of leverage, and possibly also higher risk products such as binary options – depending on your the broker you choose.

What Moves The Forex Market?

Like any free market, supply and demand are the core drivers of the Foreign Exchange market. There are countless factors that influence supply and demand in the FX market, as an introduction consider the following:

Macro-Economic Factors.

The Foreign Exchange market is driven macroeconomic fundamentals, the most important of which is interest rates. The interest rate differential between one country and another is one of the key reasons why one country’s currency is worth more than another’s. This is why forex traders pay such close attention to any fundamental news that can impact a country’s interest rate. Understanding how macroeconomics impacts foreign exchange is a broad topic and requires significant study. New traders are often scared off fundamental analysis for this reason, and look only to technical analysis as a quick fix. Macro is complicated, but even a basic understanding can improve your ability to assess information and form a narrative for why a currency is moving.

Market Moving Events:

Most forex traders are short term traders, and look to develop strategies to take advantage of short term price movements.There are a number of factors that move forex markets over the short term:

Major news announcements: these have a huge impact on the forex market. Fundamental data releases (e.g. Non-Farm Payrolls, CPI, etc) have the potential to move the markets hundreds of pips, especially if they are unexpected or well above or below expectations. Central bank comments have even more power, as they can fundamentally shift monetary policy, which can drive a currency for hundreds, if not thousands of pips. Forex traders should always check the economic calendar, price movements around news events can be sharp, liquidity is thin and spreads are generally wide.

- Political news: Whether it’s an election or a scandal, a shift in the political landscape can influence forex markets over the short term. Elections, and the uncertainty they generate, can generate volatility and directional movement. Comments from a country’s President or Prime Minister concerning the strength of their currency can also move markets. Unfortunately, it’s extremely difficult to know when these comments are going to happen.

- Market technicals: Some traders believe that technical analysis is the holy grail, and will lead them to riches. Many new traders are attracted to technical analysis as it is visual, easier to learn than fundamental analysis, and many trading systems use it. What you make of technical analysis is up to you, and how you interpret the charts, indicators and patterns.

What Currency Pairs Can You Trade?

The number of currency pairs available to trade is limited only by what your broker offers, and ranges from the major pairs through to exotic crosses. This massive selection is both an opportunity and a danger, as new traders can get overwhelmed with the array of choices available to them.

Major pairs

The major currency pairs are the most liquid, highly traded, and have the tightest spreads. They typically include:

EUR/USD: The Euro and US Dollar

USD/JPY: The US Dollar and the Japanese Yen

GBP/USD: The British Pound and the US Dollar

USD/CHF: The US Dollar and the Swiss Franc

…and to a lesser extent, you could include the “commodity currencies” in this category:

AUD/USD: The Australian Dollar and the US dollar

USD/CAD: The US dollar and the Canadian Dollar

NZD/USD: The New Zealand Dollar and the US Dollar

Most forex brokers offer these pairs to trade.

Minor pairs:

Are generally comprised of crosses of the major pairs, e.g the GBP/JPY, AUD/EUR, etc. These pairs are usually more volatile than the majors, have wider spreads, and are less liquidity. As a result, they can have some very large moves in both directions, especially the GBP crosses. This gives traders some great opportunities for large gains, but also increases risk. The minor pairs offer some excellent trading opportunities for those that are comfortable with the extra risk inherent to them.

The Exotics:

These include currencies not listed in the majors, and are often paired against with the US Dollar or the Euro. Spreads are generally wider, and volume is significantly thinner, which can cause much less or much more volatility, depending on the pair. New traders often find these pairs difficult to trade due to the difficult market conditions and characteristics.

Which Pairs Should You Trade?

If you’re just getting started, it’s very tempting to trade a wide variety of pairs. As a guide, new traders should look to focus on the major pairs, as they have the tightest spreads, most volume, and are more liquid. Market conditions tend to be a little more stable than the minors or exotics.

Minor pairs can also be interesting, especially if you have an understanding of a country’s economy and want to leverage that. For example, an Australian trader who is familiar with the AUD may look for opportunities in the AUD/JPY, AUD/EUR as well as the AUD/USD. There’s also some great opportunities to pair very weak and very strong currencies against each other in the minor pairs.

There is a lot of opportunity in the Forex markets, resisting the temptation to trade everything all at once and narrowing your focus will ultimately help you develop as a trader.

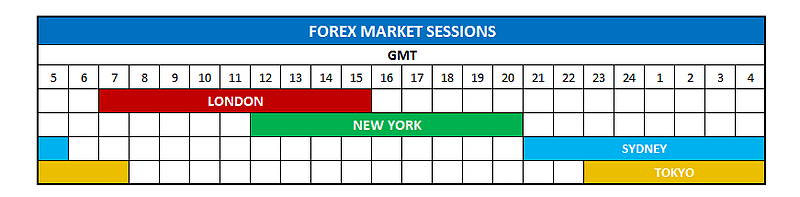

Forex Market Hours.

One of the main reason traders are drawn to Forex is that the market is open 24 hours a day, 5.5 days a week. On the plus side, this means that you can get in and out of positions anytime of the day and night, and are generally not susceptible to gap risk like in the equity markets. On the flip side, some traders find the 24 hour nature of the markets to be extremely draining, as they have to be alert through all hours of the day.

- Opening hours: The FX market opens the week on Monday morning in Asia. Depending on the daylight saving times around the world, this can be anytime between 7am and 9am Australian Eastern Standard Time. Here’s a useful tool to find trading hours in your timezone: http://www.forexmarkethours.com/

- Close: The FX market closes at 5pm Friday in New York (Eastern Standard Time) and is closed for the weekend. On all other days, daily rollover takes place at the 5pm close, with a short break in trading on most brokers (5-15 minutes, depending on the broker). Liquidity is often thin around the daily rollover and during the “out of session” hours.

Trading sessions:

Even though the FX market is open 24 hours a day, trading and liquidity follow the global equity market sessions around the world. Each of these sessions has it’s own characteristics, and should be taken into account when trading FX.

- Asian Session: Often referred to as the Tokyo session, and comprises mostly of Asian markets, beginning with New Zealand and Australia and then working through the timezones west. The Asian session is generally characterised by lower volume and tighter ranges, however this can vary depending on news events specific to those markets. The JPY, NZD and AUD can have big moves during the Asian session, especially on significant news events.

- The London/European Session: Begins with Frankfurt, and an hour later with London. The London session is when significant volume hits the Forex market, most pairs will see volume and volatility during these times. New information is priced in as large European institutions and traders adjust their positions or exchange currencies.

- The New York Session: The US session officially opens at 9.30am New York time, however US fundamental data is often released at 8.30am, which can see a large influx of liquidity into the markets then.

The crossover between the London and New York sessions generally see’s the most volatility and liquidity. This is when the majority of key fundamental data is released, and the largest financial institutions in the world are adjusting their positions or processing transactions.

What Timeframe Should You Trade?

This is one of the most common questions that new forex traders ask. It’s recommended that new traders focus on trading daily charts as the setups are cleanest, and there’s less chance of getting chopped out by noise. The biggest issue the new traders have with this is the lack of action. If you’re the type that want’s to trade lower timeframes, the 4hr and 1hr charts are a good place to start.

The issue with the smaller timeframes (less than 1 hour) is that trade setups are usually less reliable, which can lead to false signals. The noise generated by random price action is amplified the smaller timeframe you take.

Types Of Forex Contracts

It is possible to trade currencies in several different ways, which might not be apparent to beginning traders. The following are the types of forex contracts that can be traded in today’s market:

- CFD (Contracts for Difference). This is the most popular, as it allows for easy, leveraged trading.

- Spot forex contracts

- Futures forex contracts

- Currency swaps

- Options forex contracts

Spot Forex Contracts

When we mention forex contracts or forex trading, what readily comes to mind is conventional forex trading, which is actually known as spot forex trading. Spot forex trading is defined as a trade in which the trader and the dealer perform currency exchange transactions with both delivery of the asset and financial settlement being done immediately or on the spot. This is the modus operandi of the online foreign exchange market that every trader in this market is familiar with. However, not all currency transactions are done on the spot. Some traders may decide to use other ways of trading forex as we shall see below. You can read more about spot contracts and trade examples here.

Futures Forex Contracts

The futures forex contract differs from the spot forex contract in the timing of the delivery and settlement of the asset, which is done at a future date and not on the spot. In essence, the contractual prices are decided immediately, but delivery of the currency asset and settlement is done in the future. Currency futures are traded on the Chicago Mercantile Exchange and on the Globex platforms.

Another big difference between the futures forex market and the spot forex market is that the futures markets do not operate on a 24 hour basis. There are specific times when the currency contracts can be traded. This is in contrast to the 24 hour daily nature of the spot forex market. Just like in the spot forex market, the terms of the contract make it obligatory for all parties to the deal to exercise the contracts. This feature distinguishes futures forex contracts from the next type of forex contract. The futures markets are tightly regulated by the Commodities and Futures Trading Commission (CFTC). Learn more about futures contracts here.

Forex Options Contracts

Currency options are traded on the Chicago Mercantile Exchange, the Philadelphia Stock Exchange and the International Securities Exchange and can be defined as derivative instruments in which the owner of the contract has the right to exercise the option by exchanging one currency asset for another at a predetermined exchange rate and at a future date. However, the terms of this contract does not make it mandatory for the trader to exercise the option at that date. In essence, the trader can choose not to exercise it if he does not find it profitable to do so.

For this contract, there must be a pre-agreed strike (the exchange rate), an expiry date (maximum of three months) and the contract is fragmented into trade sizes which can only be purchased in multiples of that trade size. Currency options are used as hedges against unstable exchange rates. Large corporations who do business that requires exchange of large volumes of money in transactions where a minute shift in the exchange rate can translate into a difference of hundreds of thousands of dollars, like to use currency options in this manner. One reason why there aren’t many individual traders in this market is because the margin requirements are large. In the US, the maximum allowable margin is 1:20, which means that a trader must be able to muster $5,000 as margin for a single $100,000 options contract trade.

Currency ETFs and Swaps

There are a few other ways that currencies can be traded. These are:

a) ETFs

b) Currency Swaps

Exchange traded funds (ETFs) are usually funds that track the performance of a basket of instruments. As such, an ETF can actually be a forex ETF in which the fund tracks a basket of currencies, or can be a composite basket which tracks a set of currency assets, commodities and stocks. Such forex ETFs can be traded on the stock markets using a retail broker.

Currency swaps are forex agreements undertaken by two parties to exchange or swap the principal and/or interest payments on a loan in one currency for an equivalent amount of a net present value loan in another currency.

Types of Forex Orders

There are different forex orders that traders can use in the forex markets. Each of these orders has its peculiarities and should only be used in certain situations and under certain conditions. The forex order process is as important as any forex trading strategy, as using the wrong forex order a certain condition can destroy the trade before it even takes off.

The nomenclature and order placement procedure for some of these forex orders differ from one trading platform to another. The MetaTrader4r platform, which is the most common platform used by retail traders in the forex market today, has a very simplified forex order process that every trader can understand. Other proprietary trading platforms like Actforex (used by Ava Financial Limited) and Currenex retail forex trading platform, are more complex and will need some getting used to. By the time the trader moves on to the more professional institutional Level II forex trading platforms, the complexity of forex orders placement increases. Understanding these differences is key to understanding how to place forex orders correctly during the trading process.

There are two main types of forex orders:

1. Instant (market) order

2. Pending orders

Instant/Market Orders

Instant orders, also known as market orders, are forex orders that are executed at the prevailing market prices. They are not delayed orders. Examples of forex orders that constitute market orders are:

- Market Buy

- Market Sell

- Stop Loss

- Take Profit

- Trailing Stop

The Market Buy is an instruction to the broken or dealer to initiate a long position on a particular currency asset at the prevailing market price. It is used by the trader with an expectation to gain from rising prices.

The Market Sell is an instruction to the dealer or broken to initiate a short position on the currency asset at market price with an expectation to profit from falling prices.

The Stop Loss is an instruction to the broker to automatically close an active position if the asset price has moved contrary to the trader’s position by a specified member of pips. It is used as an account preservation strategy to safeguard a trader’s account from steep losses.

The Take Profit order is an instruction to the dealer/broker to automatically close an active position which has moved in the trader’s favour by a specified number of pips. It is used as an account protection strategy as this order type aims to lock in profits from the trade before the position reverses.

The Trailing Stop is another forex order type used as an account protection strategy. It works by adjusting the stop loss position to chase advancing prices when the trader is in profits, thus locking in profits. When prices start to retreat, the trailing stop assumes a stationary position, and if the market price hits the trailing stop, an instruction is sent to the broker to close the position automatically. If the retreating price does not touch the trailing stop before resuming the advance, the trailing stop will continue the chase of the advancing prices.

In using the stop loss, take profit and trailing stops, the trader is bestowed with the right to choose an appropriate price level with which to set these positions.

Pending Orders

The pending orders we have in the forex market are as follows:

- Limit orders

- Stop orders

- OCO orders (One Cancels the Other)

Limit Orders are orders that are used when there is an expectation that the price of the currency asset will reverse when they get to a certain key level. Limited orders have a buy and sell component. A buy limit is used when there is an expectation that the price of the asset will drop before advancing in the opposite direction. A trader will therefore use a buy limit order if he expects the currency asset to retreat to a level of support before advancing. The entry price for a buy limit is therefore set at a point where there is reasonable price support. In the same vein, a trader will use a sell limit order, setting the entry price at a reasonable level of resistance if he expects the price of the currency asset to advance to such a resistance level and the pull back. You can learn more about limit orders with trade examples here.

Stop Orders are orders that are used when the trader wants a confirmation that price of the asset will breach a key level of support or resistance, and continue in the same direction of upward advance (buy stop) or downward advance (sell stop). In this case, the entry price is set beyond the key levels of support (sell stop) or resistance (buy stop). The advance price of the asset will trigger the trade entry on its way. Traders must be careful when using the stop orders. They must confirm that prices have truly broken the key levels and not just touched it. This is confirmed if the candlestick in view closes beyond the key levels, indicating a true price break. You can learn more about stop-loss orders and common mistakes when placing them here.

Requirements for Trading

To be able to participate in the forex market, a trader needs access to this huge virtual exchange. This he can do by obtaining a forex trading account with a broker licensed to provide this service, identification document such as an international passport, drivers’ license and a utility bill or bank/credit card statement as proof of address. These documents are required for account activation.

Once the account has been activated, the trader can then use an acceptable means of transferring funds to his trading account domiciled with his broker in order to start trading. This can be done via a bank transfer, credit/debit card or any of the e-wallet services like Paypal, Moneybookers and Neteller. It is this money that will serve as the initial capital for buying and selling currencies for money.

Compare Spreads

What are Market Spreads and How can a Trade Find the Best?

Market spreads are the main cost of trading incurred by the trader. Possessing some knowledge of the various forex market spreads that exist will help a trader make informed choices on which currency assets to trade based on the margin available to him.

Market spreads are the main cost of trading incurred by the trader. Possessing some knowledge of the various forex market spreads that exist will help a trader make informed choices on which currency assets to trade based on the margin available to him.

A look at the instrument table of a typical retail forex trading platform will clearly reveal a table of currency pairs, and the difference in the bid/ask prices of the listed currency assets will also be clearly visible to the trader. The question is: why do different currency pairs have different spreads? To answer this question, we will compare the spreads of the different assets, understand how these spread difference came about and how the trader can put this information to his beneficial use when trading.

The difference between the bid and ask prices is the spread of the currency. In a dealing desk operated price structure, the spread is the only cost that the trader will incur during trading. In an ECN environment, there are other commissions that are paid in addition to the spread, and the commissions on each asset differ. Different currency assets have different spreads.

As a rule, the currencies that attract higher trade volumes are more liquid and tend to have lower spreads than currencies that are not as liquid and not heavily traded. This is a function of the law of demand and supply. Where there is more liquidity, costs are reduced. Reduced liquidity increases costs. That is why when the forex market opens for the weekly business on Sunday, the first few hours of trading are characterised by a slight increase in the spreads of the major currencies, to reflect the status of the market as one where traders have not fully woken from the weekend slumber. As the markets pick up on Monday, the spreads drop down to their regular levels to reflect increased liquidity from greater trader participation. The following currency pairs are the most traded, and are listed in order of trade volume:

- EUR/USD

- GBP/USD

- USD/JPY

- USD/CHF

Being the most traded currency pair in the forex market, the EUR/USD has the lowest spreads of all traded currencies on any platform you visit. In contrast, the exotic currencies attract the highest spreads in the currency market. Currencies such as the USD/NOK attract spreads of up to 50 pips, and the pairing of the US Dollar and the South African Rand (ZAR) attracts spreads of up to 150 pips on some forex platforms.

Intra-Day Volatility

Currencies with low spreads have lower intraday movements. Consequently, a trader who trades low-spread currency assets will have reduced margin requirements. Intraday stop loss levels can be set to tighter levels of between 30 to 50 pips. In contrast, a trader trading the high-spread currency pairs will require higher margin requirements, and intraday stop loss levels must be widened to accommodate the wide intraday price swings. You can imagine trading a currency like the USDSEK which can swing as much as 1000 pips on a single news trade.

With this information, traders should be able to adjust their account sizes relative to the currency assets they want to trade. Traders who want to include the exotic currencies in their trading arsenal should work to expand their trading capital so as to accommodate the swings in price.

Whichever asset is traded, traders should practice responsible risk management on their accounts so that the spreads do not eventually work against them. Beginners should stay away from currency assets with wide spreads until they gain more experience.

How to Make Money on Forex Trading

This is a short tutorial on how to make money trading the forex market. Make sure you first understand all the basics, before taking on more risk and attempting consistent profits. The reason why many retail traders fail is that too little time and attention is paid to acquiring the foundational knowledge of the market structure, how the forex market functions and how this market can be traded for money.

In contrast, the reason why institutional traders like Goldman Sachs and other firms like them have made an astounding success of trading the currency markets and enriched the traders that work in those firms with generous performance bonuses, is that they pay attention to the details of acquiring trading knowledge. Every trader in an institutional firm has a mentor/supervisor, and graduates from level to level as they gain more experience.

As a retail trader, do you have a mentor or someone who supervises you and teaches you properly over time (not just over a single weekend)? Do you have access to forex trading materials and ebooks? Do you visit professional sites to get expert opinions on how to trade the markets? Do you visit forex online forums and review sites? If you don’t, then you are not yet on the road to making money from forex trading. So learning how to make money from forex trading requires that you start from these sites mentioned and build from there.

Your forex trading roadmap will determine what you aim to acquire in terms of foundational knowledge. A trader who wants to compound for wealth over a period of time must, in addition to the conventional forex trading knowledge, also seek to understand the principle of compound interest and other similar topics that will keep him on track.

Once you understand the basics, you are ready to take on the market. Are you trading for the long term? Then you need to learn the principle of compounding for wealth over a period of 5 to 10 years. Starting with $1000 and aiming for 10% monthly returns on your account balance, you will be surprised at how much you will be worth in a period of 10 years. Most people who save for their children’s college education of retirement fund are always hard-pressed achieving their targets because there is a limit to the amount of work an individual can do. How many people can work up to 16 hours a day for 10 years without a major physical and mental shutdown? Such people do not understand how to use the power of compound interest in an investment vehicle like forex trading to do the work for them.

The key principle here is consistency using low risk. Aiming to make $100 out of $1000 from 20 trading days is very low risk indeed. This is the equivalent of making 200 pips from 0.05 lots trade size, 10 pips a day. With currencies like the EUR/USD possessing intraday ranges of 100 pips or more, and over 50 currency assets to choose from, how is it not possible to achieve this target?

This is where you build on what you already have. By now, you must know what works and what doesn’t. You must have a strategy for trading and you should have at least been able to achieve some success. It is now time to build on your knowledge by monetising it in the form of forex products. This is where you can give out trading signals on a subscription basis, or create master-slave EAs that copy your trades to the accounts of other traders. This is the ultimate icing on the cake and is a form of residual income. A master-slave EA is a fully automated process. Your EA scans the market for opportunities based on your strategy and copies this to subscribers’ accounts for execution. You can make $10,000 clean every month from this system with only 100 active subscribers. How about giving the signals out to your forex affiliates who generate money for you from trading spreads?

How Much Can You Earn On Currency Trading?

There are two categories of traders in the market:

There are two categories of traders in the market:

a) Individual traders (also called retail traders)

b) Institutional traders (also called the “smart money” traders)

The difference between these two trader classes in terms of knowledge, experience, earning power and returns on investment are as far apart as the US is from Japan. However, it is actually possible for a retail trader to cross over to become a smart money trader if he is able to imbibe the trading techniques of the smart money traders.

How Much Do Smart Money Traders Earn?

Smart money traders include financial institutions such as banks and hedge funds. Here there are veterans who have played the markets for upwards of 25 or 30 years. They also have access to complex trading algorithms as well as some of the most advanced tools that the trading markets have to offer. They also have access to billions of dollars in trading capital and can literally turn the market on its head with hefty order flows.

Institutional traders have paid subscription access to live news feeds on market events and get this information way ahead of the retail money traders. The fees that they pay for such access can easily fund the trading accounts of up to 20 retail traders effortlessly. Armed with these tools, they can easily see where the market is headed and use the sheer force of their trading capital to lock in “early bird” positions on a currency asset.

Once they are in the market in full force, the retail traders will find it very hard to get good order fills. The moment they profit from price spikes that their actions have initiated, they will start to offload their positions and who gets filled in at the retreating prices of the profit taking activity from the smart money guys? It is the hapless retail traders who bear the brunt.

1) A major bank can have up to 10 billion dollars in forex market exposure at any given time in year. A return of 40% for a trading year will net a major bank up to 4 billion dollars. This is not counting money obtained from exposure and trading in other derivative markets.

2) Colocation services refer to provision of infrastructure that will lead to faster reception of data from broker services to trading platforms. They include FIX protocol infrastructure, virtual private servers and other kinds of software. Most of these are available on subscription basis. A bank providing brokerage services with 50,000 trading clients paying $100 a month for such collocation services (i.e. $1200 per annum for a client) will easily gross 600 million dollars per annum from this arrangement.

3) Banks are liquidity providers for ECN trading and they charge commissions for this service, which ECN brokers pass down to clients. A bank can have up to 10 ECN brokers under its wing, and each ECN broker can have up to 10,000 clients, so the bank can easily have 100,000 traders on its network. If each of those traders make 3 Standard Lot sized ECN trades a week at a cost of $3 per Standard Lot traded, this comes to income of (3 X 3) X 100,000 = $900,000 a week. If trading occurs 50 weeks in a year, discounting days lost to holidays, a bank can easily net 45 million dollars in ECN commission fees per annum. This is a conservative figure, not forgetting that ECN traders are usually high net-worth traders who trade large volumes and therefore generate more commissions.

Is it any surprise that institutional trading firms earn billions of dollars in profits, and are able to pay their trading staff and the management generous bonuses and give them paid vacations?

How Much Do Retail Traders Earn?

Only 5% of retail money traders are able to earn money from forex. In fact, the money that comes from the other 95% of losing traders actually go into paying for the profits of the smart money guys. One reason why this is the case is that most retail traders are poorly trained, inexperienced and lack the tools necessary for successful trading. Most successful retail traders do not make more than $2,000 consistently every month, and this figure is even for the minority of those who earn on the high end of the spectrum. Otherwise, most retail traders who actually make money gross $700 monthly on average.

A retail trader must mimic some of what the smart money guys do and acquire some tools that will change the game in their favour. Some of the actions that need to be taken are as follows:

- Get access to proper training through forex online forums. Attend as many free or low end paid webinars as well from leading forex experts.

- Amass sufficient trading capital and trade only on Level II platforms. You will need at least $20,000. If you cannot get this at once, use a compounding model of 10% monthly returns on a $1000 account until you get to $20,000 (usually after one year), and then withdraw your money and open an ECN forex trading account.

- Get a paid Virtual Private Server (VPS) close to the news service of your broker to get faster access to news releases.

- Develop a trading strategy that works and automate it.

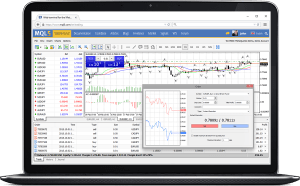

Forex Trading Platforms

There are several trading platforms in use in the forex market today. Even though there are literally thousands of brokers offering forex trading services, the trading platforms they use can be classified into a few platform types which we shall discuss below.

MetaTrader

This is by far the most popular retail forex platform used in the market today. Almost every broker out there has adopted this software from Metaquotes Inc. The reason is simple – it is such a simple platform to understand and use that most traders will not trade with any other platform. Even brokers who never used to offer the MT4 platform have found out that this is costing them a lot of business and have started adopting its use.

This is by far the most popular retail forex platform used in the market today. Almost every broker out there has adopted this software from Metaquotes Inc. The reason is simple – it is such a simple platform to understand and use that most traders will not trade with any other platform. Even brokers who never used to offer the MT4 platform have found out that this is costing them a lot of business and have started adopting its use.

The flagship version has been the MetaTrader4, which is a vast improvement on its predecessor. The MT4 allows traders to use customised indicators and expert advisors, making it so popular. It comes with its own programming interface, the MQL which can be accessed clicking F4. A newer version has been produced, the MetaTrader5 but this is yet to catch on in popularity like the MT4. The MetaTrader4 is available as a downloadable desktop client from the websites of brokers that offer it for trading.

ActForex

ActForex provides a variety of enterprise forex trading platforms under the ActFX brand. These include the following:

ActForex provides a variety of enterprise forex trading platforms under the ActFX brand. These include the following:

- ActWebTrader which is a web-based forex trading platform that requires JAVA to operate. It requires no software downloads. It is optimised to run in any browser.

- The recently introduced ActVAT (ActFX Visual Strategy Editor) which allows traders to program and edit strategies directly from the charts without having to write any programming code.

- The conventional ActTrader forex platform which is a downloadable platform suite that is used by brokers such as Ava Financial Limited (AvaFX).

- ActPhone: The ActForex trading platform for the iPhone. This is available from the App Store.

- ActDroid: The ActForex trading platform for the Android devices (phones and tablets). This is available from the Google Play store.

- ActPad: The forex trading platform for the iPad, available also from the App Store.

- FxApps: This is not really a forex trading platform, but a store to enable traders download algorithmic trading strategies as apps for their smartphone forex platforms.

Currenex

The Currenex trading platform is a product fromt he stable of Currenex Inc. There are three versions of its trading platforms:

- The Currenex Viking Trader for retail traders.

- Currenex Classic ECN platform for professional and institutional traders.

- Currenex Mobile Trader which is a mobile trading platform built for the iPhone.

Currenex also offers FIX protocol software that are used by prime liquidity providers such as JP Morgan, Deutsche Bank, Goldman Sachs, UBS Investment Bank and RBS.

Currenex platforms are used by brokers such as CMS Forex, FXCM Pro, FXDD, Varengold Bank FX, GFX and London Capital Group. The Currenex Classic ECN platform is quite difficult to use, unlike its retail trading counterpart.

SpeedTrader

The SpeedTrader trading platform comes to us from the stable of Stock USA Execution Services Inc. There are four versions of the SpeedTrader platform:

- SpeedTrader 2.0: This is the retail trading platform for Level I trading.

- SpeedTrader Pro: This is used for Level II direct market access or ECN trading.

- Sterling Trader Pro: This is a more advanced trading platform used for Level II institutional trading.

- iSpeed Trader Mobile (mobile trading platform).

Mobile Trading Platforms

Mobile trading platforms, or forex trading apps, have become quite popular with the advent of the smartphones. Presently, there are four versions of mobile trading platforms used by brokers today.

- There are iPhone and iPad trading platforms.

- There are mobile trading platforms for Android phones and tablet devices.

- There are mobile platforms for the Blackberry, although these are not very popular.

- There are the Windows-based mobile platforms, which were actually the first versions of mobile platforms available.

Each broker has its own customized version of these platforms in the form of applications that can be downloaded from the App Store (iPhone and iPad), Google Play (Android devices), the Blackberry App World or from the Windows store.

Algorithmic Platforms for Automated Trading

These are a new set of trading platforms that are used for automated and algorithmic trading. These have started gaining widespread use as from 2010. Not widely available, they are available to only a few brokers. Examples of this platform type are cAlgo platforms from Spotware Systems Limited and the ActVAT platform from ActForex Inc mentioned earlier.

Multi-terminal Platforms

Multi-terminal platforms are used by professional fund managers and multiple account traders. They are built strictly to be used to trade multiple accounts with a single execution. Not many brokers offer this platform, and it is not really for individual traders.

Forex Account Managers

Forex account managers represent a spectrum of third party forex trading support services that are offered to a forex investor by a company or an individual.

Forex account managers represent a spectrum of third party forex trading support services that are offered to a forex investor by a company or an individual.

These services range from forex signals/alert services provision on one end, to full scale third party forex trading services on behalf of the forex account owner. In between, there are forex account managers that provide both sets of services. Whatever the level of service provided, the structure is the same: the account owner plays very little part in trade analysis and in some cases the execution of trades, which is left in the hands of the forex account manager.

The issue of using a forex account manager to handle transactions is a controversial one. In some jurisdictions, the practice has some restrictions, and traders are expected to sign all manner of forms that will transfer the power of attorney concerning the trading activity on the account to a third party. Such a third party (i.e. the forex account manager) is expected to be licensed in some way in the financial markets to ensure their professional competency and accountability. In other jurisdictions, no such regulations exist and a forex account owner can easily engage anyone of his choice to manage the forex account. The latter is quite rampant, but has always produced problems with accountability and reliability. Ideally you want your manager to have true fiduciary responsibilities.

How do forex account managers generally operate?

The trader is expected to open an account with a forex broker, The choice of which broker to use is agreed on between the forex account owner and the account manager. Once the account is opened, activated and funded, the account owner hands over the trading platform login details to the account manager. The account owner also has an investor password given to him that provides viewing access to the account history but does not confer trading privileges. When profits are made, the account owner and the account manager share profits according to an agreed formula.

Specifically, most forex account managers will operate an arrangement known as PAMM; a Percentage Allocation Management Module account management system. Under the PAMM system, the account manager is required to prove his competency by first opening the account, funding it with his own money and trading the account for at least 2 months. This money is known as the Manager’s Capital and it gives subsequent contributors to the PAMM account the assurance that their interests will be protected because the account manager is fully involved financially.

The PAMM Account

We will now describe the fundamental operations of forex account management using the PAMM model. As earlier mentioned, the forex account manager first opens a PAMM account with a broker that provides trading software capable of managing multiple accounts from a single platform.

Let us use an example of a forex account manager, whom we shall call Manager John. He starts with about $2000 and trades the account for 3 months, growing the account to $5000 in this time. Pleased with this performance, two other traders, Trader Jan Kay and Trader Black decide to invest $3,000 and $2,000 respectively, with a promise to pay Manager John 20% of their profits monthly. The account balance for the PAMM account is now at $10,000, and the ratio of equity stands at 5:3:2.

Now after the first month of trading, if the PAMM account was able to register a profit of $4,000, this profit will be shared according to the equity ratio. Manager John gets 50% of profits, which is $2,000, while Jan Kay and Black get $1,200 and $800 respectively. From their share of the profits, Jan Kay and Black each pay Manager John 20% of their profits and this equates to $240 and $160 respectively. As long as profits are made, there will be money to share. When there are losses, all parties absorb the losses accordingly.

This is how forex account managers operate in the present day, using PAMM accounts. The PAMM account model confers several benefits for all participants:

1) It allows traders who are very proficient in trading to become forex account managers under the PAMM model.

2) Intending investors are able to see the performance of the account manager BEFORE they commit their funds to the PAMM account.

3) The forex account manager has no access to contributed funds. The brokers usually have a system in place to ensure this.

4) All parties to the trade arrangement are able to leverage on the power of increased funds to hold larger positions and this allows them to potentially make more money.

5) The PAMM account allows investors to make money from forex without lifting a finger.

This is an introduction to how forex account managers operate. If you are interested in getting a forex account manager to work for you, get a broker that allows PAMM account operations. It is the safest way to get forex account management to work for you.

Micro Accounts

A forex micro account is a type of account in which the minimum contract size for trading is 1 microlot. One microlot is the equivalent of 0.1 minilots, and 0.01 standard lots. The forex micro accounts were specially created for two reasons:

1) There have been complaints in some quarters that forex demo accounts do not give a 100% accurate depiction of the market events that occur in live trading. To counter this, forex micro accounts were created to give traders that are not very satisfied that they are getting a feel of the live market from their demo accounts the opportunity to have a taste of live trading with real money, but usually small amounts of it. As such, you will find forex micro accounts that can be opened with as little as $25.

2) The forex micro accounts enable market participants with very little trading capital to trade forex without jeopardising their account unduly due to over exposure and over-leveraging.

It is true that for some brokers, trade conditions in a virtual environment and a real money environment are different. This is usually the case with market makers, who function as counterparties to a trader’s positions in the real money forex market. In fact, it is an unrealistic expectation for traders to believe that trade scenarios in demo accounts and live accounts will be the same. Pricing and execution of trades in the real money forex trade scenario will certainly differ somewhat. If there are trade conditions that will lead to slippage (e.g. a large forex weekend gap), you may not see this happening on a demo account but you will definitely see this on a live account. It is for this reason that many brokers have given traders the opportunity to use small amounts of money to test real market conditions using a micro account.

In addition, there are traders who are afraid to venture in with thousands of dollars, and there are also those who will not be able to muster up to $1000 to trade. Using the globally accepted rules of money management and leveraging of 1:100, a trader with $1000 in his account should not trade more than 0.1 lots at a time. If this is the case, what happens to those who can only muster $100? Surely they cannot use the same trade size as the standard account owner, but must use 1/10th of the position size of the $1000 account owner. This is where the concept of trading micro lots comes in very handy. By being able to trade contract sizes starting from 0.01 minilots (1 micro lot), such traders can find themselves within the limits of proper risk management.

Requirements for Operating a Forex Micro Account

The requirements for opening a forex micro account are not much different from opening a standard account. The only difference is in the minimum account opening balance, which is anything from as low as $25 to a maximum of $300. Traders opening forex micro accounts are still required to fill out online account opening forms, submit personal identification documents and documents that prove the trader’s residence.

Advantages of Micro Lot Accounts

Trading Experience – One big advantage that cannot be quantified in terms of money is the experience of trading in a real money market scenario. Ideally, a trader’s learning curve should not be from a demo account to a $1000 account. At this stage, this can be compared to learning to crawl and then running without the benefit of a walking experience. By stepping into this gap and being the trader’s bridge, the forex micro lot account provides the “walking phase” of a trader’s forex trading experience. Every forex trading beginner should open a forex micro account as a transition between the demo account and the forex live standard account.

A good thing about the forex micro account is that it is not only meant for beginners, but also traders with some level of experience who have done nothing but consistently lose money and make other traders elsewhere rich. If you fall into this category, then you need to go back to the micro lot account to do some more learning and hopefully figure out your trading style.

Reduced Risk Profile – If you have access to only a little money as trading capital and your broker offers 1 mini-lot as the minimum contract size, the forex micro account is your deliverer in this case. If you have only $200, do not try trading with a broker that offers 1 mini-lot as minimum contract size; you will lose your money in no time. Rather, shift to the forex micro account brokers.

The forex micro account is a trader’s friend; use it and gain from the experience.

Regulation of Forex Markets

According to a report released by the Bank of International Settlements in 2010, the forex market has a daily turnover of $3.98 trillion. In July 2011, the Dow Jones newswires estimated that this figure had risen to $4.7trillion, which is a marked increase from the just over $1.5trillion daily turnover recorded in 2007.

Regulation of the Forex Market in the UK

In the United Kingdom, the Financial Conduct Authority (FCA) is the regulatory agency that is responsible for the regulation of the activities of market dealers and brokers.

The FCA also works to ensure protection of traders in the market from any untoward market occurrences. The Financial Conduct Authority is an autonomous body, even though it gets its powers from the UK Treasury. Located in London with another branch in Edinburgh, the FCA came into operation in June 1985 (originally called the FSA). Its powers were strengthened by the Financial Services and Markets Act of 2000 after the collapse of the oldest bank in the UK (Barings Bank) in 1999. This collapse was an indication of the failure of the self-regulating mechanism that had been in operation and so the strengthening of the FCA was done to clean up a defective system.

The forex brokerage business operates somewhat like banking business when it comes to issues of settlement of clients’ claims. The premise is that not every trader will withdraw their funds at the same time, so the broker must have sufficient segregated funds to be able to cater for settlement of withdrawal requests. This goes to mitigate against inabilities occasioned by large volume of withdrawals. Some brokers try to prevent this by controlling the frequency of withdrawals by customers. However, this is not how FCA-regulated brokers operate.

Rather, forex brokers in the UK are expected to operate a segregated account in which clients’ trading funds are warehoused. This was a policy thrust that was a fallout from the October 2005 scandal at Refco, in which traders’ funds were intermingled with that of the broker, which prevented traders from recovering their money after a major accounting fraud caused this firm to declare chapter 11 bankruptcy.

Traders using FCA-regulated brokers are eligible for compensation in case of broker default under the FCA Regulated Brokers Compensation Scheme. Under the terms of this scheme, an established default of a firm as from January 1st 2010 entitles the trader to receive up to £50,000 compensation per firm, and 100% of the first £30,000 and 90% of the next £20,000 per firm.

The FCA has an online register which displays the list of forex brokers who are in good standing. To be in good standing, a forex broker must have fulfilled all the conditions set out by the FCA for operations of a retail forex brokerage business for some time. Brokers are expected to state their license registration numbers clearly on their websites.

What this means is that traders who use FCA-regulated forex brokers have a comprehensive protection package in case of broker defaults or bankruptcies.

Signals and Alerts

Forex signals software is used by traders to generate trade alerts in the forex market. These alerts either show up as pop-ups on the trading platform, or can be delivered to the trader by email or by SMS. Some can also be designed as master-slave software, where trade alerts generated can be sent to subscribers to the service.

The following software qualify to be called forex signals software:

- Indicators

- Chart pattern recognition software

- Candlestick recognition software

- News trading software

Indicators

Indicators can either be provided by the broker on their trading platforms (default) or can be programmed by the trader or on his behalf by someone who has the required programming skills. Custom indicators are better suited to function as forex signals software. Custom indicators are usually programmed to display a pop-up showing the trade buy or sell trade signal, along with a sound alert so the trader is informed duly about the opportunity. Some custom indicators are also programmed to deliver alerts in the form of text messages to the subscriber’s phone number. Whatever the method of delivery, custom indicators are about the most popular forex signals software.

Chart Pattern Recognition Software

Chart patterns are an important aspect of technical analysis and can be used with a great degree of accuracy in predicting market moves. Being able to recognize chart patterns is therefore a great asset to a trader. Now, we have software that can do the job. Chart pattern recognition software come in various forms. There are some that come as software plug-ins that can be attached to the trading charts or the trading platform, while others are provided as forex signals from third party vendors, which the trader can now implement on his platform. A very popular version of this comes from the stable of Autochartist. Traders who are skilled in recognizing chart patterns can also work with programmers to design their own software. This forex signals software is a must have for every retail forex trader.

Candlestick Recognition Software

Candlesticks are an indispensable tool to the trader. We daresay that any trader who cannot use candlesticks to detect trade signals is probably not going to do well in forex. That is how important candlesticks are. A candlestick can make the difference between making money and losing it. If a trader has software that can detect important candlestick patterns on the charts, that trader will have an unassailable edge over others in the market.

Candlestick recognition software are an important forex signals software tool. The problem is that there are several candlestick patterns and not all of them are very important. In addition, they should only be used at certain points. For instance, a bullish reversal candlestick pattern appearing when the market is clearly at a strong resistance will not really help the trader. So candlestick recognition software should not only be able to recognize a candlestick pattern, but must also be able to tell the trader if that pattern gives a tradable signal. Presently, there are very few of such quality candlestick pattern recognition software in the market, and the available ones are very pricey indeed. Such is the premium attached to this forex signals software. If you can lay your hands on a good one, guard it jealously.

News Trading Software

Generating signals based on news is about automatically interpreting press releases and how the information released might affect the markets.

How Do We Assess Forex Brokers?

1) Cost

Traders pay fees when they trade. In addition to spreads and ECN commissions, there are other “costs” to trading that many traders are not aware of.

– How much does the broker require as account opening balance?

– What are the actual spreads for each currency asset?

– Will the trader earn interest on money just left in the account, or will the trader be penalised for account dormancy?

– Are there costs to value-added services such as news feeds or squawk boxes?

– Cost of transactions – 25% – Trading Process – 40% – Trading Tools – 20%

– Customer Service – 5% – Reviews – 10%

2) Trade Conditions

Traders sometimes find it difficult to use certain trading platforms due to the complex nature of the interface. The more complicated a trading platform is to use, the more likely that a trader will commit errors in order placements. Apart from user-friendliness, does the broker provide an atmosphere for good trading experience? I recall once using a broker whose platform had all manner of bugs and the platform kept tripping off at crucial periods of trading. How frustrating is that?

3) Trading Tools

Trading tools enhance the trader’s ability to profit from the market. Do the traders have access to interactive charts, indicators, squawk boxes, and other account tools?

4) Customer Service

Whenever a trader has issues, can he get a satisfactory response and speedy resolution of the issue at hand by the broker’s customer service department? Or does it take forever to get a response from the customer service department as was the case with a broker I once used in the past? It was such a bad experience; imagine a situation where even my own account officer was nowhere to be found when I needed him the most.

5) Reviews

The good thing about reviews that come in from forex review sites and online trading forums is that you get to hear unadulterated opinions about performance of brokers from traders from all over the world. I am usually glad when I see reviews from my countrymen. What better gauge of broker performance can you have than the experience of someone who lives in your territory, telling you about his experiences with a broker, complete with an unbiased rating? Bad brokers are usually very scared of these places because this is where many of them are exposed for what they are. They even pay people to counter bad reviews for them but eagle-eyed traders can always spot these lame attempts at cover-up from a mile away. In contrast, good brokers love such places because this means easy advertising and more business for them at no cost.

It’s clear that certain brokerage firms stand out in terms of cost of trading, the trading process, trading tools and what other traders think about their services. Of all these parameters, we would advise traders to choose brokers based on trading process, trading tools and cost in that order when making a choice. Usually if these three parameters are in place, the trader can make the best of his trading experience without bothering about reviews (which could be subjectively biased) and without having recourse to the customer service departments.

Strategies and Systems

Most traders would love to find a forex trading strategy or a system that guarantees profits, but is there such a thing? The big institutional trading companies have developed their own trading algorithms over the years and keep their strategies a well guarded secret, but individual retail traders don’t have the time, skill and resources to do so.

Many con artists have capitalised on the naivety of retail forex traders, with seductive web pages promising quick and easy profits. There is of course no such thing as easy money in a space where so many people are actively trading, so let us dispel some dangerous myths:

Firstly, there is no perfect forex trading strategy. Even a major institutional trading firm can suffer losses from surprise market movements or putting too much trust in a trading system, or as a result of carelessness by one of their own traders.

Secondly, if you come across a webpage that claims to have a strategy that can turn “$500 into $36,000 in three months”, please don’t believe a word of it, and don’t believe any testimonials either as they might all be fake. Scam strategies and systems is a profitable market where unscrupulous people make money on naive beginners who really want to believe in easy profits.

Your Own Forex Trading Strategy

Now that you know what a forex trading strategy is not, we will tell you the characteristics of a good system.

1) A good forex trading strategy is one that can deliver profits consistently over time. No system can guarantee a profitable trade every time, but it has to deliver more profits than losses over a period of time. If you have a forex trading strategy that can deliver 30 wins and 20 losses in 6 months, and you have a net return of 50%, you actually have a good strategy. If you have one that delivers 50 wins and 15 losses, but your return over 6 months is only 10%, then obviously this strategy is not as good as the first one even though it posted a higher winning ratio.

2) A good forex trading strategy must have a solid risk management system. As we can see from (1), the overall profitability of a forex trading strategy depends to a large extent on risk management. If a strategy has a high win ratio but poor percentage returns, then there is a problem with the risk management strategy of that system even though the strategy helps the trader make good trade calls.

3) A forex trading strategy must be able to withstand the swings of the market and adapt. For instance, there are some currency pairs which were typically range bound about 2 to 3 years back, but which have suddenly assumed trending status. One such currency pair is the EURGBP.

With this realistic mindset you can try to find an honest strategy for sale, but chances are it will be close to impossible because:

- Why would anyone sell a system that works rather than simply profit from it personally, with less competition?

- The web is flooded with scam systems, and finding one that works is a needle in a haystack situation.

Our recommendation is not to believe in easy money, but to learn the basics of currency trading and from there conduct experiments while documenting failures and successes, and create your own system based on your own circumstances and “trading style”. Your trading style is determined by how much money you are comfortable and able to risk on a single trade, how long you can stand to wait before closing the trade, and other things that depend on your personality traits.

Robots and Auto Trading

A forex robot is software designed to perform automated or semi-automated trading on the trader’s behalf. If the robot opens a trade position on the trader’s behalf, then the forex robot is referred to as “fully automated”. If the robot displays a pop-up window alerting the trader to the existence of a “trade signal” based on the robot’s programmed strategy, but leaves the execution to the trader, it’s a “semi-automated” bot.

A forex robot is software designed to perform automated or semi-automated trading on the trader’s behalf. If the robot opens a trade position on the trader’s behalf, then the forex robot is referred to as “fully automated”. If the robot displays a pop-up window alerting the trader to the existence of a “trade signal” based on the robot’s programmed strategy, but leaves the execution to the trader, it’s a “semi-automated” bot.

There are benefits to using legitimate forex robots, but there are also some serious pitfalls to their use. We will examine some of these below as a way of helping traders use bots responsibly.

Benefits of Automation

Forex robots can be used to trade on autopilot and remove the stress of having to analyse charts for trade opportunities, or sitting all day by the computer waiting for the opportunities to develop, or taking the risk of losing one’s job by switching between the work screen and the trading platform while in the office (Many employers will not be amused by staff not being fully attentive and committed to tasks in the office, and naturally, not many a boss would be comfortable with employees having alternative sources of income that would give the worker some degree of leverage in the employer-employee relationship).

Robots are designed to trade without emotion. Emotions can become a very negative influence in trading, and by seeing the opportunity and being able to know when to open and close trades according to the pre-programmed strategy, the forex robot is able to make a decision without equivocation on the trader’s behalf.

Dangers with Automation

Problems occur when a robot is either programmed with a faulty strategy, does not manage risk properly, or is simply a scam product. Most forex robots sold online are junk products made by scammers that are drawn by the allure of the $4 trillion that changes hands daily in the forex market.

If your trading is done automatically and poorly, you can rack up a lot of losses before you realise it!

If you are using a bot, chances are that you may have bought it online or may have obtained a pirated version of the software. Whatever the case, commercially sold robots often have one flaw: they do not necessarily factor in the individual trader’s tolerance for risks and losses, trading goals and expectations. Another potential problem is the unrealistic expectations of the trader, who might be poorly equipped to deal with strings of losses or the time it takes to turn a sizeable profit

Finding The Best Software for automated forex trading

There are a large number of different software for automated forex trading on the market. Some of them are free to use when you sign up for an account with certain brokers while other software charges a fee for you to be able to use them. This can be a monthly fee or a one-time fee.

Most software can be used in association with a large number of different brokers but there is some software that is exclusively available to clients of a certain broker.

When considering which software to get you should always consider which software will be best for you and your trading strategies. There is no software that is always the best choice for all traders. They all feature different drawbacks and benefits. You should choose the software that suits your needs the best. Sometimes the best option is to develop your own software instead of buying a premade solution. You can choose to either create the software yourself or hire a coder to do so for you. You can read more about both options further down on the page.

When considering which software to get you should always consider which software will be best for you and your trading strategies. There is no software that is always the best choice for all traders. They all feature different drawbacks and benefits. You should choose the software that suits your needs the best. Sometimes the best option is to develop your own software instead of buying a premade solution. You can choose to either create the software yourself or hire a coder to do so for you. You can read more about both options further down on the page.

It is common that traders start out using commercial software and then decide to develop their own software that is tailormade for their needs as they become more skilled traders. Paying someone to develop software can be expensive when you first start trading but can be well worth the cost if you start trading more frequently. Using commercial software when you first start trading can also help you figure out exactly what you want from your software. This makes it easier to make the perfect software when and if you decide to develop your own software.

Below you can find some examples of popular solutions for automated forex trading:

- AlgoTrader Software

- Etna Automatic Trading Software

- eSignal Automated Trading Software

- MetaTrader 4

- MetaTrader 5

- Option Robot Automated Software

- Robo-advisors

- Tradestation Automated Software

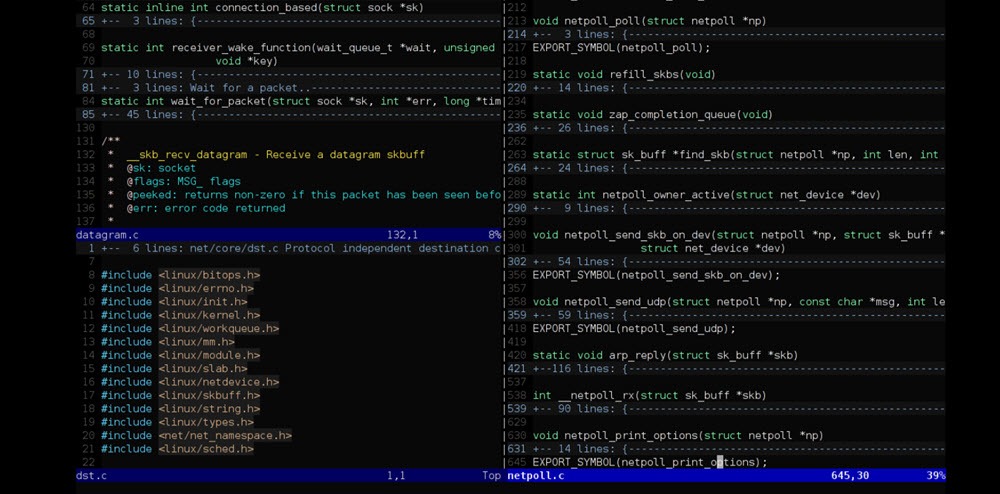

Developing Your Own Software

If the commercially available automated trading software doesn’t offer what you need then the best option is to develop your own proprietary software. If you do this then you are only limited by your own imagination. You can do almost any function as long as it is compatible with the forex broker platform that you are using.

Creating your own software does not have to be as hard as you might imagine. There are a number of good code editing tools that you can use to easily create software. A good example of a code editor is VIM. If you prefer to hire someone else to code your software then you will easily find someone who can do so on one of the many freelance coder marketplaces that are available online. You can easily outsource the coding to a low wage country such as India to be able to create your software without spending a fortune.

Developing your own software is associated with a number of benefits and risks:

Benefits:

- You can create software that is 100% designed with your needs in mind.

- You can create a smaller better-optimized software that is able to operate and perform trades quicker than bloated commercially available solutions that need to feature more features than your custom software needs.

- Creating your own software allow you to perform advanced algorithmic trading that commercial trading software might not be able to use. You can custom build the software around the algorithm you want to use.

Risks:

- It can be expensive to create custom software. It is cheaper if you outsource it to a low wage country but this makes the project harder to manage. The final price will likely be higher than the initial quote.

- There is a risk that there are bugs in the software. The algorithm might not work as expected. Commercial software has been used by thousands of traders and bugs are quickly discovered and resolved. This might not be the case with your software since you will have to test it yourself to make sure it works as expected. The responsibility for any damage will be yours.

- It can be expensive to keep the software up to date as trading platforms develop.

- It can be hard to find someone to make changes and improvements to a custom software developed by someone else.

I recommend that you look to see if there is suitable commercial software available before you decide to develop your own software.

If you are unable to find commercially available software then are two ways that you can develop your own. You can either code it yourself or you can hire someone to do it for you.

Developing a trading software by yourself

You need two things if you want to be able to create your own trading software.

- You need at least a basic understanding of programming and how to write efficient code. More advanced knowledge is preferable and will make the process easier and quicker. Basic knowledge is enough to create a simple trading software and allow you to learn how to create more advanced functions by using online programming guides and tutorials. There are also many forums very you can get help if you are unable to find the solution to a problem.

- You need to know how to create a trading algorithm and how to implement this algorithm into the software. It is also possible to automate trading using signals from a signal provider. If you want to do this then you do not need to create an algorithm. You just need to program a piece of software that execute trades based on the signals. Signal based trading is however a type of copy trading and not completely automated trading since you are dependent on a signal provider. There is no need to create custom software for signal trading. There are many commercially available software that can do this. The quality of the signals will decide your success when signal trading, not the software you use.

There are many different software packages that can help you create your trading software. Some of them can provide you with a code to base your software on. There are also a number of different software that can make it easier to edit the code and add new functions to them,

There are no tools that allow you to create software without any prior knowledge. There is some software that claims to be able to do this but they are not very good and only allow you to create very basic software based on existing modules. To be able to create the software you need to have a basic knowledge of the programming language you want to use to create your software. There are several good programming languages to use. Which is best depends on exactly what you want your software to do.

Using VIM to create your software

One of the best tools you can use to make it easier and more efficient to create your software is WIM. WIM is a universal text editor specifically designed to make it easy to develop your own software. It is used by a huge number of skilled programmers and coders from around the world.

One of the best tools you can use to make it easier and more efficient to create your software is WIM. WIM is a universal text editor specifically designed to make it easy to develop your own software. It is used by a huge number of skilled programmers and coders from around the world.

Vin was first created in 1991 by Bram Moolenaar (Vim’s founder). It was based on Bill Joy’s vi text editor.