Binary Options Trading

Binary options trading in the UK is an established form of short-term speculation that simplifies investing down to a binary yes/no choice. It is the instrument of choice for traders that want simplicity and predictability.

In this tutorial we explain how binary trading works and the critical aspects that all traders should know, including comparisons with CFDs, spread betting and vanilla options, plus a free guide to getting started, in-depth strategy tips and vital regulatory, tax and safety information.

Top 3 UK Binary Options Brokers

-

Established in 2017, Pocket Option is a binary options broker offering high/low contracts on forex, stocks, indices, commodities and cryptocurrencies. With over 100,000 active users and a global reach, the platform continues to prove popular with budding traders.

-

IQCent is an offshore binary options and CFD broker based in the Marshall Islands. The brand continues to offer a range of unique account types with bonuses and perks, including payout boosts, TradeBacks and free rollovers. With 100+ assets, around-the-clock trading and 98% payouts, the firm is popular with aspiring short-term traders.

-

CloseOption is a Georgia-headquartered broker with over a decade in the trading industry. The brand offers high/low binary options trading on forex and crypto markets, with decent payouts, welcome bonuses, 24/7 customer support and intuitive trading software.

Binary Options Trading for Beginners

Binary options are a simple financial instrument, with a straightforward premise and a clear outcome. At its most basic, the instrument works by asking you whether the value of an asset, such as gold, will be above or below a given value at a certain time. If you think you know, you buy the option for a given price. If correct, you win your money back plus a predefined payout, typically expressed as a percentage. If you are wrong, you lose the money you paid for the contract, also known as the initial stake. This is why binary options are often referred to as “all-or-nothing” trades.

Binary options trading is available on almost any financial market that you can think of. Whether you want to make money on forex, indices like the FTSE 100, agricultural commodities like wheat, cryptocurrencies like Bitcoin, Ethereum or Solana, or stock prices like Meta (previously Facebook), Apple or Amazon.

The simplicity of binary options trading leads many to believe it to be gambling, expecting that investors simply guess which option to buy. However, any binary options trading expert would explain that successful binary trading requires careful analysis and strategy.

Advantages

- Simple

- Limited risk

- Any asset available

- Adaptable strategies

- Internationally popular

- Good for hedging & shorting

- Available with halal accounts

- Suitable for automated trading

- Clear outcomes before purchase

- Free from UK income & capital gains tax

- Several variants for unique market scenarios

Disadvantages

- Easy to overlook risk management

- No UK regulatory support

- Somewhat poor reputation

- Limited profit per position

Why Binary Options Trading Is Popular

The most commonly touted benefit to binary options trading lies in its simplicity, following a format so clear-cut that almost no knowledge of the financial markets is required to get started. However, the popularity of the contracts can be traced to several other advantages.

Primarily, with transparent pricing, payout and loss information, your risk in each trade is clear and fixed. This competitive trade control is not restrictive, though, as some firms will offer payouts upwards of 90% and almost every market in the world can be speculated upon with binary options trading.

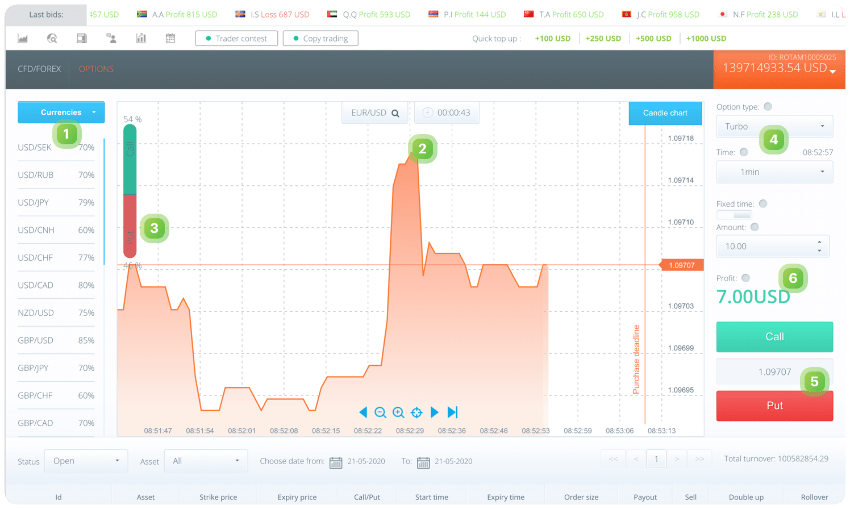

Race Option Trading Platform

How Binary Options Trading Works

Binary options contracts are a form of over-the-counter (OTC) financial derivative that gives investors the chance to profit from the fluctuations and volatility of global markets. As derivative contracts, BOs do not transfer ownership of the underlying asset (for example GBP/EUR) to the purchaser. Instead, profit or loss is calculated from the difference in the value of the asset at the expiry time and purchase point.

Before purchase, binary options display a clear strike (target/threshold) price, expiry time and payout system. These three key features are explained in detail below.

Strike Price

The strike price defines the boundary value to which your prediction is compared. In a simple call (increasing) option, this is the level that you want the asset to beat before expiry. For a put (decreasing) option, you want the asset to be worth less than the strike price upon expiry.

Some variants will use the current asset value as the strike price, while others will provide one or more strike prices based on the length of the contract. Longer contracts will typically result in target prices that are further from the base price.

Expiry Times

The expiry time of a BO contract defines when the brokerage checks whether your prediction was correct. For example, a 60-seconds option will compare the asset’s value to the strike price 1 minute after purchase. One benefit of a binary options trading system is that a wide range of expiry times can be chosen. Popular timeframes include 5-minutes, 15-minutes and 30-minutes contracts.

Payouts

The payout of a binary option will be displayed before the opening of the contract, giving you a total understanding of the trade’s profit potential. Payouts are usually given as a percentage of the option price. In other words, if your prediction is correct, you will earn the payout times the option value. For example, if you invest £100 into a successful contract with a payout of 90%, you will walk away £90 richer.

The flip side of binary options payouts is even simpler. If your prediction is incorrect, you just lose what you staked on the position, for example £100.

Types Of Binary Options

Binary options are a flexible contract type, with several variants offering new opportunities for profit, price prediction, risk management and timeframe adaptability. The most common variants for binary options trading are explained and simplified below:

- High/Low (Up/Down): The form outlined so far in this guide, high/low binary options ask you the simple question “will the price be above or below the strike price upon expiry?”.

- Touch/No Touch: Providing more opportunity to be proven right, though often for a lower payout, this product simply asks if the price will go above or below the strike price at any point before expiry. If the option ends in the money, you will not have to wait for the expiry for your payout.

- In/Out (Range Or Boundary): For an added challenge, you can restrict yourself to a channel of prices. This form of binary options trading requires you to predict whether the asset’s value will be within or outside the stated range upon expiry.

- Ladder: Ladder binary options provide an opportunity to mitigate your risk or open yourself up for more profit, depending on how you play it. This contract acts as a series of high/low options with several price points, or rungs, staggered up the price chart. The higher (or lower) the rung that the asset value finishes beyond, the greater the payout. While these binary options can have payouts upwards of 100%, the price movement required for the top levels can be significant.

How To Get Started With Binary Options Trading

So, you know the basics and some theory behind “all-or-nothing” options and a few different strategies you can apply to them. Now, how to start making money from them? Below is a step-by-step guide to starting your hopefully profitable journey.

1. Find A Suitable Brokerage

The first stage is to set up an account with a firm that offers binary options speculation in your region. Your choice of broker is one of the most important decisions you will have to make, having a significant impact on your learning curve, expenses, experience and success. Below are some of the most important features to consider when selecting an agency. Our top recommendations can be found here.

- Trading Platform: Companies will offer different software packages and trading interfaces. These will be the primary way you interact with the markets for graph manipulation and placing orders. Trading platforms tend to strike a balance between simplicity and analysis opportunity. Those with more scope for advanced technical analysis will often seem harder to use for beginners, though provide greater opportunity for complex strategies, algorithm development and informed success. The most popular online platforms tend to combine simple interfaces, advanced live charts functionality, strategy tester capabilities and decent security. MetaTrader 5 (MT5) is one such software package that often leads the top 10 platform rankings, also coming with an intuitive script creator, 21 60-second onward timeframes and demo backtesting features. However, though often used for comparison and review, MetaTrader 4 (MT4) does not support binary options trading.

- Assets: Not all firms will offer the same range of instruments and underlying assets for binary options trading. Opening an account that only offers contracts on US stocks is a waste of time and possibly money if you aim to speculate on the relative strength of the pound against the dollar. Ensure that a firm serves the markets and products that you want before you register for an account.

- Regulation: While the FCA does not allow any real UK-based companies to sell binary options contracts to retail traders, regulation is not to be ignored. There are still many fake, fraudulent and predatory organisations online that aim to scam their users under the pretence of fair product sales. This is why we recommend always using a regulated broker that is licensed by a reputable offshore agency.

- Mobile Apps: Many prefer to carry out their technical analysis, order placement or account management while on the move, hoping to turn dull commutes or waiting times into a productive activity. To this end, it is often wise to ensure that your chosen BO trading service offers mobile access, whether iPhone or Android. Ideally, this would involve a dedicated mobile app that is available for free download to iOS or APK devices and retains the full functionality and security available on a desktop terminal.

- Payouts & Costs: High-frequency, active investors will find that a small deviation in payout percentages, commissions and account fees can quickly rack up to eat away at hard-earned profits. In the long run, especially with a strategy that follows a proportional capital model (staking a percentage of your capital, rather than a convenient quantity), this can compound into a huge income loss. Carefully consider the payouts, trading fees, deposit costs, withdrawal fees, inactivity charges and any other expenses involved with each brand. Be particularly wary of binary options providers claiming many of their clients see 100% win rates because no strategy is that good.

- Minimum Deposit: To even begin making money through binary options trading, you need to deposit some capital into your account. However, some companies will place a lower limit on what you can deposit; without meeting this you cannot start placing trades. Some firms have no minimum deposit restrictions but those that do tend to keep the limit low, often around 5, 10, 20 or 50 GBP. However, some specialist companies will require upwards of £100 or even £1,000.

- Reviews: Often, the best way to know that the company is a trustworthy firm that puts its clients first and behaves fairly is to check the testimonials offered by other traders. Do some background research on each of your options and find out what others have said about deposit and withdrawal systems, pricing models, customer support, problems and educational material. Alternatively, see our list of the best binary options trading brokers which have been reviewed by our experts.

- Promotions: Many brokerages will use binary options trading demo account contests, live competitions and prize draws to entice and retain clients. If you want to add a little extra fun to your experience or simply like the prospect of free capital, check out which demo and live tournaments are offered by each firm. Other incentives can include a welcome reward, no deposit bonus deals and cashback bonuses with or without verification. However, stricter licensing bodies will often ban such activities, so you may need to trade off against this added security. Moreover, winnings and bonuses from such promotions will often come with wagering restrictions, which require a certain quantity of activity before they can be withdrawn, so read the T&Cs carefully.

- Paper Trading: Online demo accounts are an important tool in any UK trader’s toolbox. Using a simulated market environment with virtual funds and a real-time copy of the financial markets, paper trading accounts provide a risk-free way to practice binary options trading. Useful for simply testing the waters, honing new 60-second strategies, exploring new markets or practising basic skills, demo accounts are a vital feature of the best firms. Some companies will even allow you to open simulator accounts without taking any money and placing no minimum deposit restriction or sign-up requirements.

- Payment Methods: Try to make sure that the brand supports payment methods that you already have access to or are convenient for your needs. You do not want to have to apply for a new type of payment card or register for an e-wallet service just to fund a trading account. Popular payment methods include PayPal, debit card payments, cryptos like BTC and ETH, bank wire transfers and e-wallets like Skrill and Neteller.

- Other Features: The array of services that a company can offer does not stop here, though not all will be interested in every feature. Some of the best additional binary options resources that may sway your decision could include an in-built economic calendar, specialist trading calculator, no maximum trade amount, VIP accounts and payout methods, free trial game events, instant withdrawals, chargeback support, open trading hours on weekends, rapid price quotes, in-depth live market data, 2FA on login and multiple license certificates.

2. Pick An Instrument

Once you have a suitable account that supports binary options trading, you need to pick your product. If you came into this with a market or instrument in mind, that is great. If not, there are several factors this review recommends you consider.

Assets are generally split into categories or markets. These are foreign exchange (forex/FX), the comparative strength of different currencies, indices, basket equities that provide a holistic measure of an economy or industry, commodities or raw materials like gold, wheat and oil, stocks and shares from different global exchanges, cryptocurrencies and funds, actively managed baskets of specific equities.

Different markets display different characteristics. For example, cryptocurrency assets are notorious for their volatility, which gives short-term binary options trading more potential for profit, as well as loss. Forex pairs are available 24/7 but have periods of higher volatility and liquidity when the relevant country’s exchanges are open, dropping down outside these times.

Consider the time of day, your interests and knowledge, risk appetite and experience level to choose the right market.

3. Buy Your Binary Options Contract

You are now ready to purchase a contract. Ideally, you should follow an explicit strategy with tested risk management systems and techniques that will outline exactly what timeline, stake, entry points, strike price and payout combination is acceptable.

As a starting point when it comes to risk management, we recommend the 2% rule. This requires that you never stake more than 2% of the capital you are okay with losing on any one trade. While this can mean a slower rise to success, it will reduce your chances of being wiped out by a streak of bad luck or overcome with emotion and taking unnecessary risks.

When you are ready, purchase the contract, sit back and wait to see if your first foray into binary options trading finishes in the money.

Strategies

Top Five Binary Options Trading Strategies

1. Candlestick Analysis

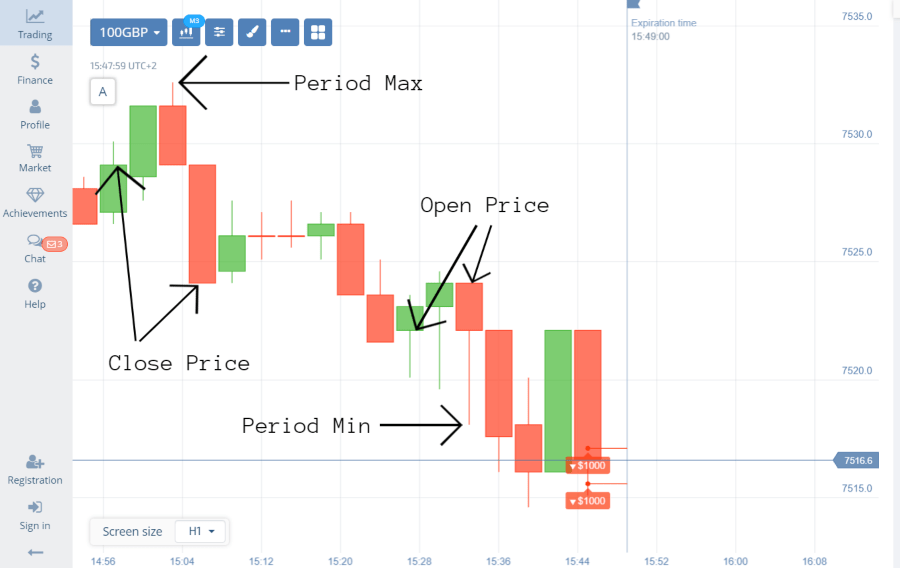

Basic price charts use a line to designate the movement of the markets. These graphs use the closing prices of each period and join them using straight lines. However, these do not give much information about the activity inside each timeframe. This is where Japanese candlesticks come in, providing more information in a visual, uncluttered format. Candlestick charts are an adaptable approach that can be used for anything from a 60-second scalping strategy to a 15-minute price action binary options trading strategy.

Candlesticks each contain five discerning features, four shape characteristics and one colour. Starting with the simplest, the colour of the stick denotes the overall price movement of the asset. Bullish (positive) movements are usually green or blue, while bearish (negative) trends are red. Some binary options charts also use a filled candlestick for a bullish move and an empty one for a bearish market, or a combination of colour and filling.

In terms of the candle’s shape, four key points tell you the opening price, closing price, period high and period low. The open and close points are drawn as horizontal lines, with vertical lines connecting the edges to create a quadrilateral called the “body”. The maximum and minimum values that the asset reached within each timeframe are shown as vertical lines extending from the body of the candle in the relevant direction, called the “wicks” or “shadows”.

Japanese Candlesticks

These are the key features of binary options trading candlestick analysis, providing a wealth of market information in a simple-to-read, visual format. However, their benefits extend beyond this, with more information to be drawn from the charts. The size of the candlestick body represents the market pressure. For example, a long green candle suggests strong buying pressure, while a squat, empty one indicates weak selling pressure.

The relative lengths of the wicks can also be used to infer at which points the buying or selling pressure rose. For example, a red Japanese candlestick with a long upper shadow and little-to-no lower shadow suggests that buyers tried to push the price up but were rendered unsuccessful by the end of the price period.

All of these characteristics can be used independently or together to form a range of binary options trading strategies. You could use the general trends in colour to gain a feel for overall market sentiment and follow the momentum. Alternatively, you can look for patterns in the specific shapes of the candles prior to major shifts to predict future volatility.

Heikin Ashi Candlesticks

Japanese candlesticks can also be taken further within binary options trading through the use of Heikin Ashi candlesticks, which smooth out the volatility of the market using the average price of the previous period to influence the next, opening up a host of new patterns and analysis opportunities.

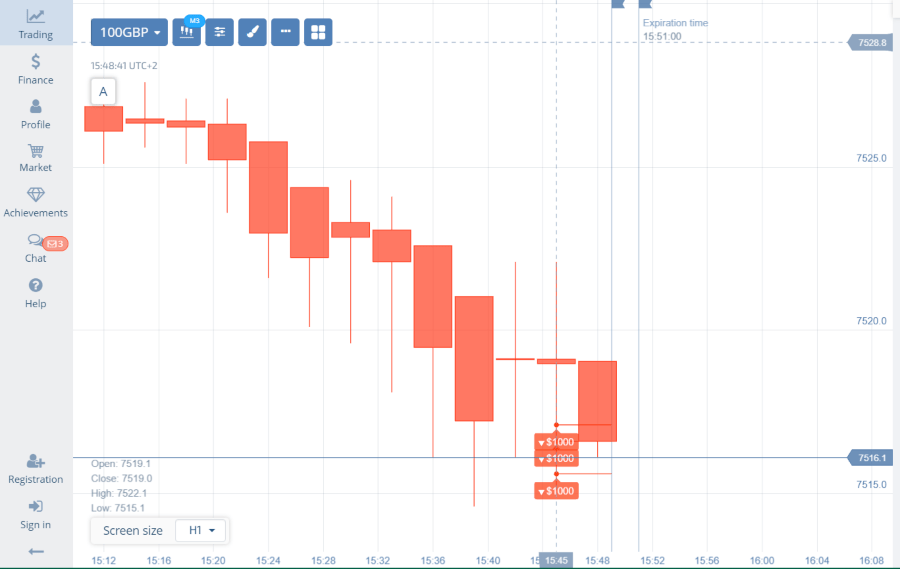

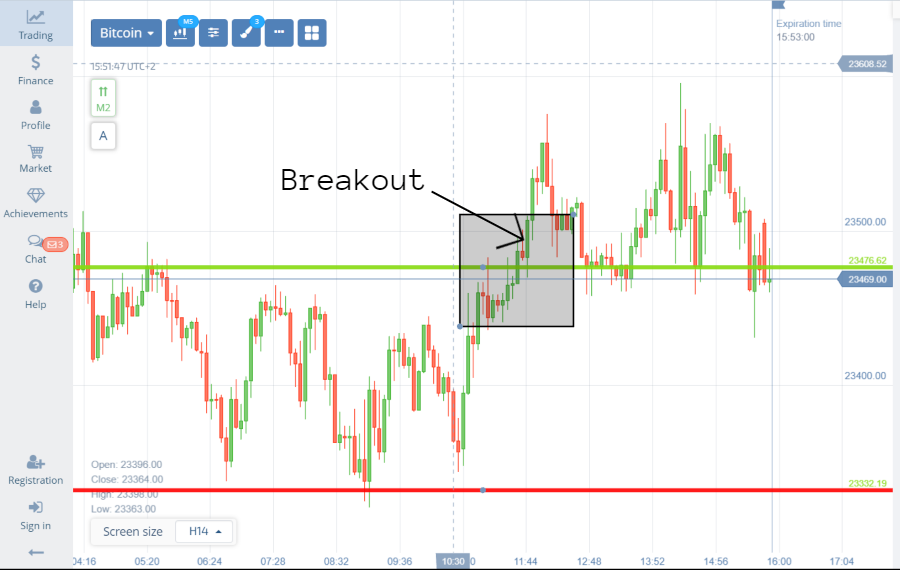

2. Breakouts

Breakout binary options strategies use short-term stability characteristics to define criteria for the next major price jump. The first step in this approach is to identify support and resistance lines, which act as boundaries within which the asset’s value should remain stable. Price charts will often oscillate several times between these two limits before any major change.

Breakouts

Once the price chart has rebounded from a similar value twice on each side, the support and resistance lines are consolidated, providing the first two criteria for your next contract. If the asset’s value breaks out of the consolidated channel in either direction (above a resistance or below a support line), it suggests a breakout and a period of growth or contraction upon which you can capitalise with a binary option.

However, you should also keep an eye on market volume statistics during this period. A breakout that is backed by a large jump in active trading volume reinforces the likelihood that the market will shift and increases the expected size of the change. Sometimes, though, the price may break through for a limited time before retreating within range, usually when the volume is low.

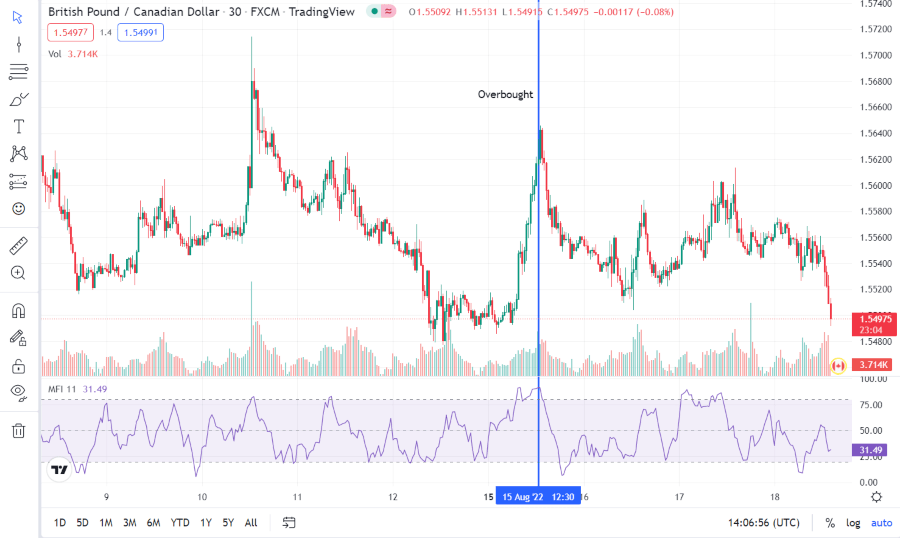

3. Money Flow Index

The money flow index (MFI) is a useful graphical indicator that comes as standard with most major binary options trading platforms that have a focus on technical analysis. The MFI provides insight into the supply and demand of the market, providing a metric for the proportion of investor positions that are buying vs selling.

The MFI will return a value between 0 and 100 for each period, with 0 denoting an entirely selling market and 100 meaning that all investors are buying. This information is plotted as a line beneath or superimposed upon your price chart and can be a helpful tool for identifying overbought or oversold markets.

MFI

Generally, an MFI score of more than 80 suggests the market is overbought and will soon contract. This can be applied to binary options trading, taking this opportunity to purchase a put option that will profit from a falling market. Conversely, a score beneath 20 suggests an oversold asset and an imminent bullish movement.

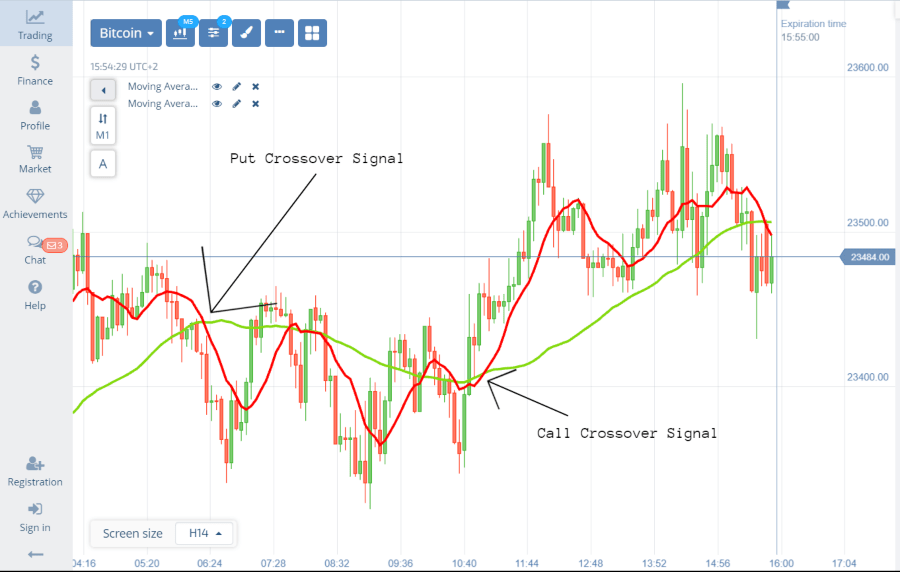

4. Moving Average Crossover

Moving averages are some of the most popular graphical indicators for all kinds of approaches, whether that be a 30-day change tracker or a 2-minute direct binary options trading strategy. Moving averages smooth out shorter-term volatility by averaging the latest close price over a set number of preceding timeframes.

The moving average crossover strategy for binary options combines two or more averages of varying fidelity to look at the interaction between short-term and mid-term trends. Typically, the approach involves superimposing a 10-period and 50-period moving average onto the price chart, visualising short and mid-term trends, respectively.

Moving Averages

The signal for a contract purchase here is the crossing of these two lines. For example, the shorter-period average crossing the longer-period one from below suggests that a bullish trend is developing and you should purchase a call option, and vice versa.

Moving averages come in several forms, the most commonly used being simple moving averages (SMAs) and exponential moving averages (EMAs). The latter adjusts the weighting of the averaging algorithm, giving added focus to more recent time periods. Combining a short-term EMA and a long-term SMA can result in quicker identification of opportunities. However, this also increases the likelihood of a false signal.

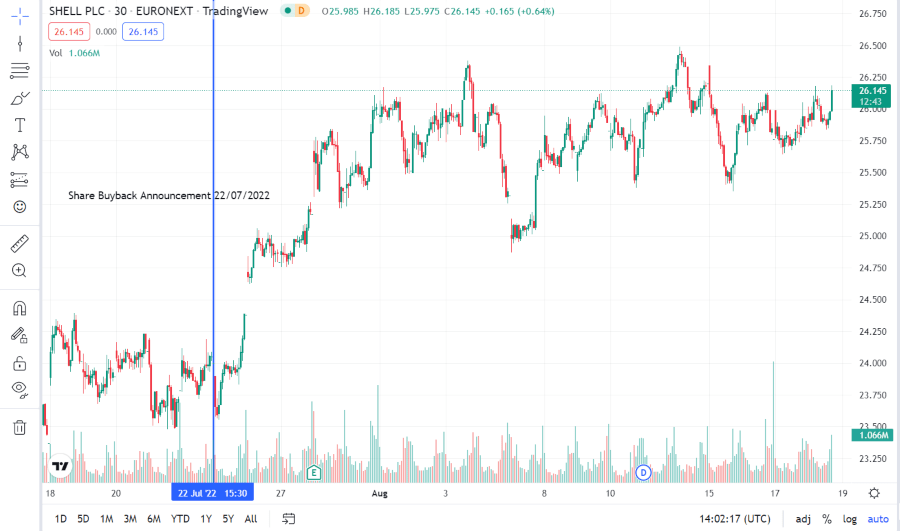

5. Momentum

Momentum trading shifts away from technical analysis toward a fundamental analysis approach to produce a less mathematical binary options trading strategy. This system involves acting upon news sources and using real-world stimuli to inform market predictions. Often used for BOs on stocks, indices and forex, though equally applicable to all other markets when looking in the right places, momentum trading is popular amongst those that don’t have time to comb through price charts and graphical patterns.

Put simply, if you spot a piece of news that should result in a price jump, purchase a call option on the asset and rake in the profits. For example, a shift in monetary policy within the US might cause a sharp incline in its strength against the GBP, so you could purchase a put option to benefit from the bearish sentiment. Alternatively, a company might announce a share buyback scheme like Shell did in July 2022, leading to a sharp rise in stock price valuation, as shown below.

Momentum

While this strategy can be effective, significant news events are not very frequent so proponents tend to combine it with technical strategies during less active periods or comb through the news for a wide range of assets and markets.

Binary Options Strategies For Those With No Time

If you are struggling for time in your life but do not want to miss out on the possibilities explored by complex binary options trading strategies or cannot get your head around advanced technical analysis, all is not lost. There are several ways for you to take some of the manual effort out of the experience.

However, you should never completely hand over control of your finances, whether it be to a robot of your own design or an expert account manager. Always keep an eye on the performance of your portfolio and look for ways to improve your output or adapt to the changing markets.

Automated Binary Options Strategies

The use of mathematical robot programs and algorithms to make trades is continually increasing not just in the UK and for good reason. Once you have honed a strategy, or simply struggle to effectively and efficiently carry out technical analysis, you can create a robot to do it all for you. Not only can an algorithmic strategy carry out complex analysis in a heartbeat, but it can do so 24 hours a day, 7 days a week (24/7). This means that automation techniques can not only increase the success rate of individual positions by acting more quickly but also increase the total volume of trades, running while you are otherwise engaged.

Automated trading strategies involve the use of algorithms and signals to identify optimal binary options trading opportunities and carry them out. While these are often created manually using a suitable programming language, there are plenty of software packages out there that simplify the process and even provide a graphical creation interface.

While robot-based approaches are becoming commonplace, these are not guaranteed hacks even with a winning formula their use is not always a good idea. Automation can greatly increase your efficiency but you must always keep an eye out as even those bot strategies with the best settings, greatest results and reviews will not be perfectly robust. Beware of unique external events that could impact the markets in a way that your algorithm does not account for.

While there is no way to remove this chance, your best bet for compounding a decent wage over time is to check daily review and forum sites for any third-party robots you intend to use for any complaints or warnings. Beware of any dodgy sites that claim to have the top 5 robot downloads or use complicated techniques like neural network systems or machine learning without backing up their claims.

You should also develop a solid grasp of how it works and, if possible, use virtual trading within a demo account to continually test and improve it. Work out when best to have the bot active. For some, this may be constantly, while others may lose money over the weekend or have specific trading hours where they demonstrate the best results.

Managed Binary Options Trading Accounts

Managed trading accounts require even less effort than automated strategies, without the need to set up the algorithm yourself. Managed accounts involve handing over the reins to a successful portfolio manager of your choice. This manager will then use as much of your capital as you allow to place trades for you and facilitate often very complex large-scale strategies. You will then receive a portion of any money the manager makes, proportional to your capital investment in them.

Copy Trading

Copy trading can be thought of as a slightly simpler version of multi-account management. However, social trading platforms do not give control of your capital over to another trader. Instead, you can select an experienced and successful investor from the rankings to perfectly imitate in your own account.

With this approach, any move made by the expert will be reflected in your own account, whatever the option type, expiry, instrument or payout. The only difference lies in the absolute value of the stake. Rather than investing the same amount of capital in each contract, your account reviews the proportion of the expert’s account that is used for the trade and mimics this.

Signals & Alerts

Binary options trading signals are a service provided by a wide range of online providers, aiming to remove your need for manual technical analysis. Signals services send you alerts via your preferred medium, be it text, email or in-app notification, of a position that their algorithm has identified to have potential. Once you have received a signal, you can decide whether to follow through and place the trade or not.

As with all approaches, signals within BO trading can be applied to a range of assets, timeframes and strategies. Bear in mind though that the best live signals in the UK, whether offered for free or not, will often specialise in a specific market or instrument. The more markets or strategies that a service tries to cover, the less time and effort it can put into its analysis.

You should also ensure you do your due diligence when it comes to signals, especially free ones. Whether you are looking for alerts over a 60-second, 1-minute, 5-minute or 4-hour period, there will be some sites out there looking to take advantage. Check signal providers against forum websites, reviews and even analysis videos to best understand if they are legitimate or not. There are also no guaranteed binary options trading signals and any top 5 or 10 signal provider articles or PDFs should be taken with a pinch of salt.

Binary Options Taxes In The UK

It is always a good idea to do your due diligence regarding taxing early on in your binary options trading career. For those in the UK, the taxation stance taken by the HMRC is one that most benefits those that are successful with their investments and do not have massive portfolios that contain a huge number of assets, speculative vehicles and complex hedging strategies.

For UK taxes, binary options trading is treated as a form of gambling as it is a purely speculative activity using a contract that, in itself, holds no inherent value. This means that any earnings gained from all-or-nothing trading are likely to be tax-free, providing no contribution to income or capital gains tax. While this will be of benefit to the vast majority engaged in the activity, this does mean that losses cannot be leveraged for tax relief, as can be the case with other financial speculation.

If you are also concerned regarding the likelihood of HMRC considering binary options trading activities as an official “trade” once you have a rigorous system in place and are receiving most, if not all, of your income from BO speculation, you will likely be fine. There have been several notable cases that have gone before the UK courts that took the stance of gambling activities remaining just that, gambling, regardless of how consistently successful one may become at them.

This being said, we only aim to provide guidance and a base understanding to those unclear on the topic and do not provide any financial advice. Always consult a professional accountant or lawyer, preferably with a specialism in financial trading and gambling activities, for advice tailored to your unique situation and to reduce the possibility of a lawsuit.

Binary Options vs CFD

Binary options trading is often compared to contracts for difference (CFDs), the most popular asset class in online retail investing. Both are derivative contracts, paying out based on a product’s price movements without transferring ownership of the underlying asset. However, there are some key differences between the derivatives types when it comes to risk exposure and complexity.

Binary options are simple to understand and clearly show all possible outcomes of the position before the contract is ever bought. CFDs, on the other hand, open you up to an infinite number of outcomes. CFDs require you to also select when to close the position, usually at a planned price level. However, the asset’s value may never reach this level, so your stake could be lost for a significant period. Moreover, significant price fluctuations can completely wipe your entire net worth when using leverage.

While the open-ended nature of CFDs can sometimes lead to massive profits, the risk taken on each position is often poorly understood and can be devastating. Moreover, without good mental maths and a solid understanding of the markets, the possible outcomes of each trade are not always clear.

Binary options trading reverses much of this, with a predetermined, clear and fixed profit or loss potential. With these contracts, it makes no difference to what extent you win or lose, simply that you have either won or lost. If the price of the asset falls to zero, you will still only lose your original stake. On the flip side, if the asset skyrockets, you have no opportunity to stay in for the ride.

Binary Options vs Regular Options

Vanilla (regular) options contracts give the purchaser the right to buy or sell the underlying asset at a predetermined price within a given timeframe or upon expiry (depending on the type). However, there is no obligation to settle the option. Similarly to binary options trading, this means that an option that is settling out of the money will simply lose the purchaser the price of the contract.

The key difference between the alternatives is what happens if successful. When a vanilla option settles in the money, the purchaser can then take delivery of the underlying asset, such as barrels of oil, at the strike price. After that, they will often quickly sell it off for a profit on the difference, though this is not always the case.

With binary options, there is no settlement of the asset and the profit of the contract is determined by the chosen payout. Therefore, these are a simpler form of option contract, with known profit potential and automatic payouts.

Binary Options vs Spread Betting

While binary options trading and spread betting both provide vehicles for financial speculation without purchasing the assets in question, they differ in terms of risk and payout system. Spread bettors place a bet on whether they think the market will rise or fall within a given timeframe. The size of the position taken out is purely up to the investor and the payout comes from how much the market moves or does not move in the predicted direction.

Two prices are provided by agencies in spread betting, the bid and ask prices. The difference between these is called the spread and is where the bettor makes money. For a long position, if the market moves enough, the existing ask price will overtake the initial bid price and the difference between these two is the profit. In theory, this means that there is no limit to the sizes of profits or losses that you could take when spread betting, effectively showing an infinite risk.

Binary options cap this risk with a fixed outcome that is determined before contract purchase and cannot change. However, this also caps the potential payout to a predetermined value, not allowing for significant market changes to result in life-changing profits.

Broker Regulation & Legality

You may have heard that, in 2019, the FCA followed the ESMA’s lead in banning the sale of binary options contracts to retail traders within the UK. However, this does not mean that the activity itself is illegal. The concerns of the financial watchdog stemmed from the pricing model’s similarities to fixed-odds betting, requiring investors to “beat the odds” in a house edge-type situation to achieve success. Moreover, the London-based FCA claims that the short duration of most BOs can cultivate an addictive relationship.

However, binary options trading remains legal for retail traders within the UK. The ban has simply restricted FCA-regulated firms from selling the contracts within the UK. This means that you must find an offshore binary options broker that accepts UK traders.

Beware, though, as some online firms have been set up to scam traders without proper oversight. One easy way to spot a scam is to check if a brokerage claims to be based or regulated within a country whose regulations have banned the sale of binary options contracts, such as the UK or any country served by the ESMA.

Islamic Law

With the increased popularity of all-or-nothing trades, the question of the impacts of Sharia law on binary options trading is becoming all the more pertinent. Islamic economic jurisprudence forbids interest, or “Riba”, to be charged. Investing using BO contracts over timeframes that roll over to the next working day carries with it an overnight interest charge.

However, this does not make all BO trading haram. Many online brokerages recognise the importance of this concept within the Islamic religion and offer special Muslim-friendly account types. These avoid “swap” charges by imposing an end-of-day expiry point and reopening the positions the next morning, keeping the activity halal. However, there is some discrepancy in various fatwa outcomes, so it is always safest to consult your religious leader when in doubt.

Binary Options Trading Education

One of the biggest mistakes you can make is to dive into financial speculation and jeopardise hard-earned capital without first developing a solid understanding of the markets, binary options trading and the associated risks. While many firms that sell BO contracts will have their own education sections, we recommend exploring dedicated websites with no direct stake in your performance.

There are many education providers, academy sites and university-style online courses that specialise in binary options or have webinar series and 101-style video tutorials devoted to the subject. Many of these workshops and course sites are free, though some of the more rigorous choices will charge a fee for access to their services. These lessons are worth exploring if you want to lay a solid foundation of knowledge upon which to build a successful investing career, often also answering any questions you may have. However, effective UK online education is not limited to such websites.

There is a wealth of other open-source (free) binary options trading information available on the internet, from short binary options strategy articles, videos, webinars, newsletters and blogs outlining the fundamentals, to 101 tutorial ebooks for beginners, PDFs and even a popular unmasked documentary that dives deep into the world of derivatives speculation. A quick search engine query will return thousands of items, listing guides to binary options trading for beginners and dummies, top 5 BO strategies for 1-minute options, ebook PDFs with guide sections on how to develop your own strategy, helpful articles exploring the latest market news and economic statistics, predicting their effects on various binary options instruments.

You may also find claims of zero-risk strategy definitions, unbelievable success stories, counter-intuitive tactics, dodgy live stream sites claiming to have cheat codes for making money or tutorial starter kit PDFs with heavy price tags. Be cautious of any pages or sites offering you a get-rich-quick approach or a strategy with a too-good-to-be-true success rate like 90%+ accuracy.

Forums

Online public forum sites can also be a useful tool if approached with caution. These pages, whether they be UK live binary options trading chat rooms, social network pages, daily analysis clubs or group opinion community sites, attract a wide variety of people. These can range from experienced, qualified coaches, mentors, helpers and tipsters to less knowledgeable enthusiasts that simply like to make comments and review other opinions. If you can learn to sift through the comments, examples and other content, avoiding the dangers of public advice, you may find some nuggets of gold.

Binary Trading Tips

- Practice Accounts: Demo trading is an important tool that you should use as much as possible. Beyond simply providing a risk-free opportunity to try out speculation, paper trading can make a huge difference throughout your journey. Demo accounts can be great for exploring new assets, markets and contract types, allowing you to get to grips with them before risking money. Moreover, they are handy for real-time strategy testing and refinement. The financial markets never stop evolving, so make use of practice accounts and ensure that you keep up.

- Patience: Binary options trading is not a quick cash system, there are no simple, zero-risk strategies that work immediately and earn you enough to live off. Every trading day and every instrument are different, with financial markets inherently unpredictable. You must keep emotions out of it and avoid frustration if you are not seeing huge results as quickly as expected. On the other hand, if your strategy is consistently underperforming over an extended period, you should try to work out why this is the case and fix the root cause.

- Keep Learning: The saying “every day is a school day” may not have been first intended to be taken literally. However, when it comes to binary options trading, you will benefit from embedding this mindset into your approach. The markets are constantly changing, as are their influencing factors like interest rates and geopolitical environments, so you should change too. Keep up to date with financial news relevant to the markets you speculate upon, as well as major events that happen elsewhere that may have trickle-down effects. If you keep refining your strategies and stay up-to-date with the industry, you should be best placed to achieve consistent success.

- Automate: Once you have established a binary options trading strategy that performs with some level of consistency that you are happy with, you should look into automating it. Manually inputting trades introduces a lag that can eat into the potential profits of each contract, while the rest of your life will stop you from maintaining 24/7 activity in the markets. Automation via robot and expert advisor tools can remove these limitations, running on autopilot immediately capitalising on opportunities that your strategy identifies and acting during periods that you are away from your computer or phone.

- Blacklists: While the word “scam” can get thrown around fairly easily these days, safety should be a primary concern in this industry because your money and capital are at risk. Do not be enticed by binary options trading offers that seem too good to be true, especially when you are just starting. Many community sites and customer reviews will list companies and software that have lots of complaints, behaved unfairly or scammed their clients. These should be taken with absolute sincerity and avoided to keep your money as safe from scams and fraud as possible.

Bottom Line On Binary Options Trading

Binary options trading is derivatives speculation made easy. With a simple, two-outcome premise, completely transparent, fixed risks, a huge range of supported assets and boundless automation potential, BO contracts can be a stepping stone to making a living from the financial markets. Despite some poor press and sale restrictions within the UK and Europe, the derivatives are still available to clients within Britain via offshore regulated brokers. Check out our guide above to creating your own strategy, setting up an account with the right firm and getting started with binary options trading.

The History of Binary Options

Perhaps surprisingly, binary options trading has been going on for decades, though restricted to large institutions and the very wealthy. However, The US Securities and Exchange Commission (SEC) changed the retail trading world, for better or worse, in 2008. By allowing the contracts to be traded through exchanges, the general public gained access to uncomplicated all-or-nothing investing.

The rapid growth of the online world and digitisation of retail foreign exchange and CFD trading sparked a surge in retail binary options trading that is still growing today.

FAQ

Can Binary Options Trading Make You Rich?

Binary options trading marries simple derivatives contracts with volatile markets for a wide number of ways to make money. There are successful investors out there that make a living solely through this form of financial speculation. However, this neither means it is easy nor guaranteed. Success requires a good deal of patience, dedication, skill and growth.

There is no single master strategy that will always win you money and can be left alone for long periods to accumulate immense wealth. You must always push yourself to improve upon your current approach, learn new concepts and develop a better understanding of the financial markets if you dream of triumph.

Are Binary Options Legal In The UK?

Trading binary options as a retail investor in the UK is perfectly legal and legit using brokerage firms based outside of the UK and EEA. While no companies within these territories can legally sell the contracts to you, companies based elsewhere have no such restrictions and many maintain reputable licences and operate under regulatory oversight from other watchdog agencies.

Where Can I Trade Binary Options in the UK?

There are plenty of brokers to choose from for binary traders in the UK. Brokers based in the UK can not legally offer binary options here, but nothing prevents a UK-based trader to sign up with a broker based elsewhere. To find one, please see the list of the best binary options brokers for UK traders with full reviews and ratings.

Is Binary Options Trading Halal Or Haram?

Intraday binary options trading is halal if approached with an analytical mindset and strategy. However, basic BO contracts violate Sharia law when held open overnight. Investors can get around this by opening specialist Islamic accounts, which are available from most major firms. These account variants close positions overnight and reopen them in the morning, avoiding swap interest charges.

What Is The Best Binary Options Trading Strategy For Beginners?

Every beginner or self-proclaimed dummy will be better suited to a different strategy than the one before them. This is because each will have unique goals, capital, knowledge, skills, interests and capabilities. Moreover, no strategy is completely effective at all times for all people. The best you can do is to learn about the financial markets and binary options trading, practice with a free demo account and develop your own system.

Some of the most commonly used strategies amongst beginners, newbies and pros alike are 4-hour forex fractals, one-minute rainbow binary options strategies, 30-second compounding candlestick, the ultimatum trading system for hourly directional and volatility prediction strategy, extreme arbitrage variants, the 5-point decimal OTC system and the turbo 5-minute BO historical data RSI strategy. Many of these can be found in online PDF documents, tutorial videos and even dedicated podcasts, usually alongside returns monitor data and average win rates.

What Is The Best Binary Options Trading Broker?

Much like strategies, different brokerages will be able to serve different clients better than others. This will come down to their unique asset ranges, platform offerings, payout schemes and other features. However, we have collated a list of the top 5 recommended sites after lots of research and in-depth reviews, see the list of UK binary options brokers.

What Is A Binary Options Indicator?

Binary options indicators are statistical and graphical tools that can be used alone or together for the analysis of recent price movements and to make a prediction regarding likely market trend shifts. Indicators can range from simple moving averages (SMAs) and Fibonacci retracements to complex, multi-variate algorithms.

Some of the most popular indicators with investors are 60-seconds/1-minute Bollinger Bands, the 5-minute holy grail, average true range (ATR), one-hour stochastic oscillator and relative strength index (RSI). However, while you may be on the hunt for a binary options trading strategy indicator that works close to 95% of the time, bear in mind that none will be consistently that accurate, given the unpredictable nature of the financial markets.

What Is A Binary Options Trading Robot?

Binary options robots and other forms of automated trading can be an important tool in any trader’s arsenal. Removing the inefficiencies brought on by analysing markets and opening positions manually while balancing basic human survival needs. There are several levels of automation, from binary options signals to autonomous algorithmic robots held on a cloud server and operating 24/7.

Is Binary Options Trading Genuine?

Binary options trading has been criticised in blog posts and the press. However, the reality and truth is that, approached correctly, binary options trading is a legitimate activity. See our making money with binary options trading starter kit above for more information. We cover the advantages and disadvantages of the popular financial product, extreme hourly trading systems and plans, social trading networks, plus a glossary of key terms. We have also decoded graphic trend analysis, binary options versus forex trading, and more.

Which Binary Options Trading Firms Offer Low Minimum Deposits?

Binary traders who want to get involved for less can check out our list of binary options brokers with low minimum deposit. We rank binary brokers with the lowest minimum deposit requirement, all the way from 5, 10 and 20 GBP.